-

The Fed is seeking feedback on a "Building Block Approach" to risk-based capital standards for firms heavily engaged in insurance activities.

September 6 -

With no fintech applicant officially seeking the agency’s specialized charter, Judge Dabney Friedrich said claims by the Conference of State Bank Supervisors still were not ripe.

September 4 -

Under a state proposal, annual percentage rates would have to be disclosed on nonbank commercial loans of $500,000 or less. Lenders' responses have been mixed depending on their business model.

August 18 -

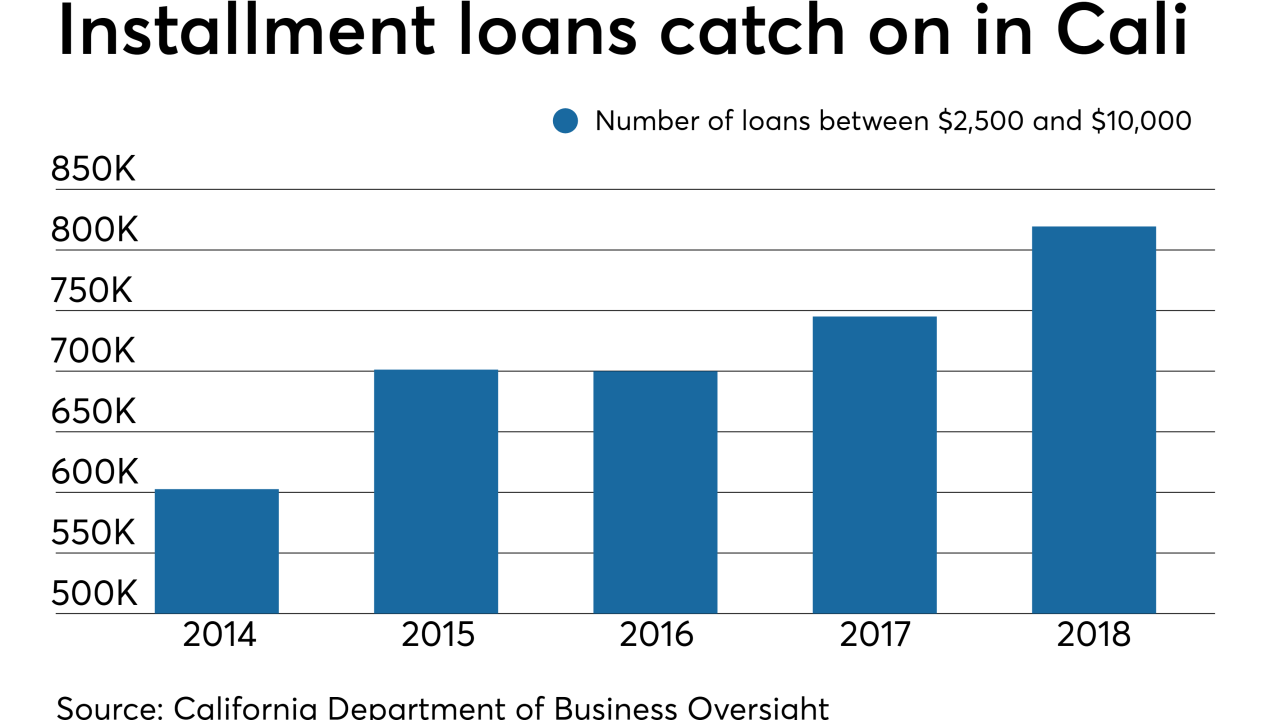

New data from the state shows that payday loans fell to a 12-year low in 2018. But the trend does not necessarily mean that consumers are paying less to borrow.

August 8 -

New York and 10 other states are looking into whether companies in the fast-growing sector are violating payday lending laws.

August 7 -

State regulator Ron Rubin had been asked to resign in May over a sexual harassment complaint, but he attempted to fight the allegations.

July 25 -

“Limited” digital-asset broker spots may be approved; Linda Lacewell’s plans for the New York State Department of Financial Services.

July 9 -

Former Trump campaign chairman Paul Manafort pleaded not guilty in a New York mortgage fraud case — state charges that are beyond the reach of a presidential pardon.

June 27 -

The Citigroup mortgage unit is not the first lender to be tripped up by California law requiring the interest payments on escrow impound accounts.

June 18 -

Regulators closed The Enloe State Bank in Texas late Friday, marking the first failure in 17 months and the first in the Lone Star State in over five years.

May 31