-

Executives at the super-regional bank told investors that years of investments are poised to start paying off in rising profits, but the market seemed skeptical about the company's plan forward.

September 12 -

Profits at Cleveland-based KeyCorp have suffered due to bonds it bought when interest rates were low. But a recent investment by Canada's Scotiabank gave Key more wiggle room — an early benefit of a deal that both companies hope to build on.

September 9 -

The Dallas company, which has been in transformation mode for three years, recently took a series of actions to try to meet the profitability targets it set for itself.

September 6 -

The third-largest Canadian bank's proposed minority stake in KeyCorp is an unconventional way to generate more U.S. revenue. Analysts say it's a less risky approach than buying an American bank outright.

August 23 -

Industry Bancshares got into a deep hole after rising interest rates tanked the value of its sizable bond portfolio. Now the Texas community bank is expecting a $195 million capital infusion and taking steps to start relying more on revenue from loans.

August 21 -

Though it hasn't set a timeline, Oxford Bank, based north of the Motor City, is weighing a southward expansion that would add all the Detroit metropolitan area to its footprint.

August 13 -

The embattled Long Island-based bank announced the hiring of nine new senior executives. Most of them have ties to CEO Joseph Otting, who previously held the top job at the OCC and OneWest Bank.

July 24 -

When the superregional bank sold its insurance business for $10.1 billion, it laid out three ways to use the proceeds: buybacks, a balance sheet repositioning and loan growth. The latter plan is so far proving to be elusive.

July 22 -

The Alabama-based bank also said that its outlook for net interest income is brightening. Several other regional banks have offered similarly upbeat guidance in recent days.

July 19 -

The Dallas-based company, whose earnings per share fell short of consensus by 6 cents, lowered its revenue forecast and raised its expense outlook. Its stock price fell more than 8% on Thursday.

July 18 -

The Minneapolis-based company reported an 18% increase in quarterly net income thanks largely to slimmed-down operating expenses. It also notched modest increases in loans and deposits, while asset quality issues remained manageable.

July 17 -

After its planned sale to a larger competitor fell through, the renamed bank plans to expand into new markets, starting with St. Louis.

July 12 -

Two days after the megabank was hit with $136 million of fines, Citi executives said they aren't changing the company's full-year expense guidance. Citi has 30 days to submit a plan to regulators showing that the bank has allocated enough resources to achieve compliance in a timely and sustainable manner.

July 12 -

In this month's roundup of top banking news: a cease-and-desist issued by the Federal Reserve, high CFO turnover, the end of Chevron deference and more.

July 3 -

Investors are keeping a close eye on recent banking news, including Mastercard's latest plan for crypto, Comerica's proposed settlement of a class action, employment gains and skeptical shareholders.

June 25 -

The Honolulu bank is raising $165 million through depositary shares, a move that two observers said would help boost its below-average leverage ratio.

June 20 -

As high interest rates continue weighing on banks' balance sheets, some are selling branches to real estate firms and leasing them back. The strategy is helping lenders that want to restructure their underwater bond portfolios.

June 13 -

During New York Community Bancorp's annual shareholder meeting, executives reiterated their mission to restore value in the beleaguered Long Island-based company. Questions from shareholders suggested at least some discontent following a capital influx that significantly diluted their position in the company.

June 7 -

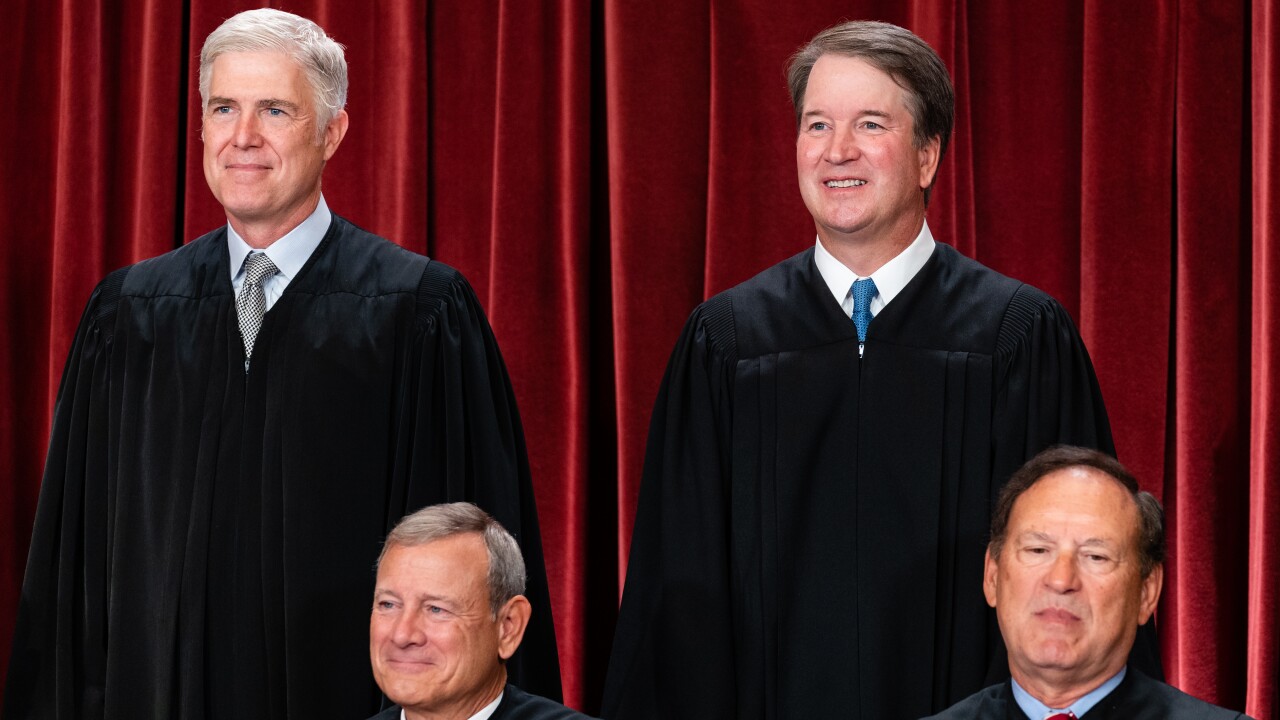

In this month's roundup of top banking news: a Supreme Court ruling on CFPB funding, TD Bank's money laundering woes, an FDIC workplace probe reveals a culture of misconduct and more.

June 3 -

The beleaguered Los Angeles-based bank reported its strongest quarterly results in more than a year, but executives at its Canadian parent company cautioned that improvements may not be linear.

May 30