-

The central bank issued a proposal aligning recent stress testing changes with supervisory standards that are tailored to an institution's size and complexity.

September 30 -

The Federal Reserve will continue its ban on share repurchases for banks with more than $100 billion of assets into the fourth quarter and will cap dividend payments using a formula based on recent income.

September 30 -

Lenders should be subjected to tough reviews of their readiness for economic threats posed by severe weather, required to disclose risks lurking in their portfolios and perhaps forced to set aside extra capital, a government study recently recommended.

September 20 -

The agency has scheduled an extra assessment of institutions' strength to incorporate more recent economic data during the pandemic.

September 17 -

Lenders press Congress to restart — and revamp — the Paycheck Protection Program; Fed corrects stress test error for Morgan Stanley, Goldman Sachs; M&T's new fintech unit rolls out first product; and more from this week's most-read stories.

September 11 -

The central bank said it had miscalculated the loss rates for certain public welfare investments, which led to incorrect capital requirements for the two companies.

September 4 -

Under a rule issued in March, banks will build an additional capital cushion that is determined by their performance in the annual tests.

August 10 -

Policymakers have eased some rules and the Supreme Court recently dealt a blow to the Consumer Financial Protection Bureau. But as the landmark legislation approaches its 10th anniversary, the post-crisis regulatory regime has stayed largely intact.

July 13 -

Randal Quarles, who is also chairman of the Financial Stability Board, said FSB members must do more to prepare for bank failures.

July 7 -

Deutsche Bank says it’s on track to meet its financial targets while Commerzbank's top two executives resign; recent Fed stress test results show European banks' poor performance in U.S. continues.

July 6 -

Six of the eight regional banks that announced their stress capital buffers on Tuesday said they will need just a 2.5% cushion to weather an economic downturn. All eight said they’ll keep their dividends steady.

June 30 -

In response to the Federal Reserve's stress tests, Wells said it will lower its third-quarter distribution to shareholders. Meanwhile, JPMorgan Chase, Goldman Sachs and five other companies announced stress test capital buffers that exceed the minimum requirement.

June 29 -

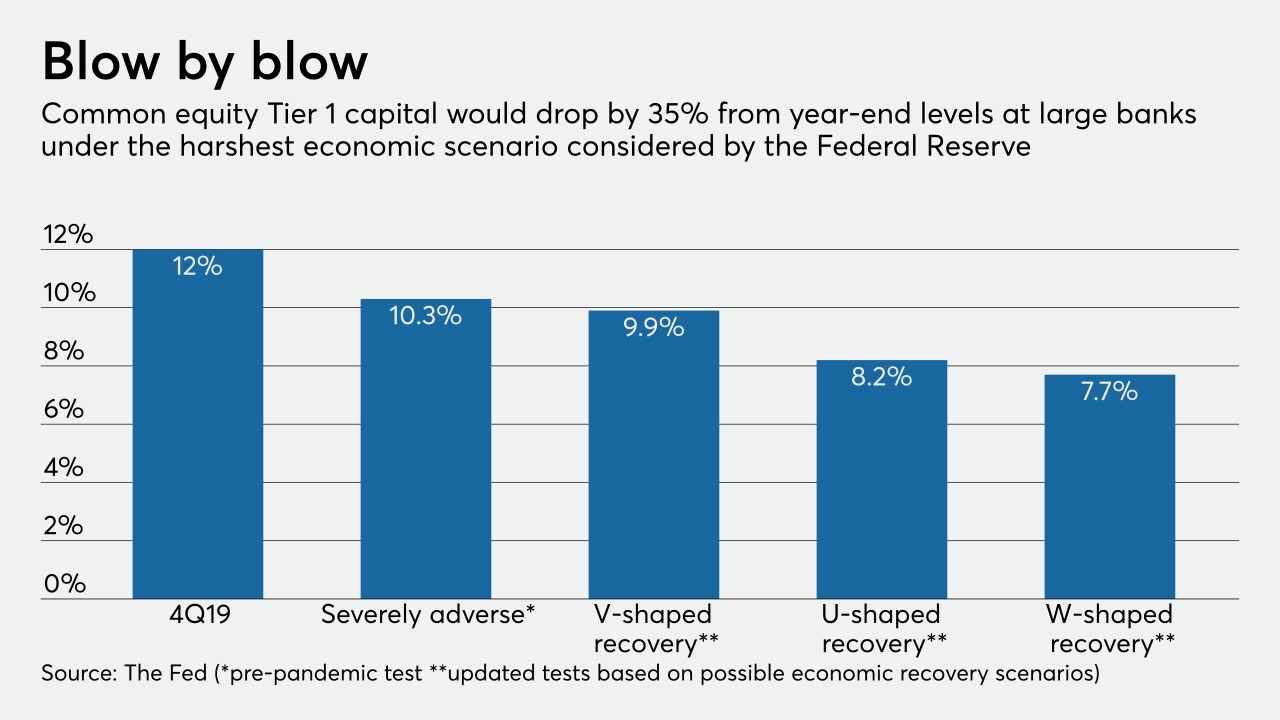

Some observers said the central bank should have suspended dividends entirely in response to an unprecedented economic emergency caused by the pandemic. Others said its more cautious moves were appropriate because big banks' capital is strong and the economy could bounce back.

June 26 -

The Fed stopped short of banning payouts entirely following bank stress tests; banks get greater freedom to invest in venture capital funds and reduced collateral on swap trades.

June 26 -

In the most sweeping capital distribution order since the financial crisis, the Federal Reserve says it will prohibit big banks from buying back their stock in the third quarter and limit dividend payments to second-quarter levels.

June 25 -

Borrower relief is necessary in a national emergency, but if the exclusion of the deferred loans from troubled-debt restructurings is extended past the end of the year, safety and soundness could be compromised.

June 25

-

The embattled German payments company filed for insolvency, while its former COO is either on the run or looking for the missing $2 billion; the giant asset manager is looking to hire more college graduates rather than poach junior bankers.

June 25 -

The lawmakers argued in a letter to the Federal Reserve that suspending dividend payouts would be the "prudent course of action," allowing banks to build their capital cushions and continue lending during the coronavirus pandemic.

June 24 -

Business continuity plans should be used constantly, not just when the crisis is at its peak, says the New York Fed’s head of financial services.

June 24 The Federal Reserve Bank of New York

The Federal Reserve Bank of New York -

Big banks will need to show how well they can withstand three different scenarios before they can pay dividends; the German payments company is still looking for $2 billion of missing funds.

June 22