-

Student CU Connect CUSO, which had made high-risk loans to students of the now-bankrupt ITT Technical Institute, agreed to a settlement resulting in an estimated $168 million of loan forgiveness.

June 14 -

The U.S. government stepped up collections on delinquent student debt to $2.9 billion last year — or an average of $1,000 from 2.9 million former students and their cosigners, according to the Treasury Department.

May 13 -

The presidential contender’s plan to eliminate more than $1 trillion in student loan debt could have far-reaching implications for credit unions

May 9 -

Earnest hopes offering a streamlined process can help it thrive in a risky niche.

April 25 -

With just $22 million in assets, Manchester Municipal Federal Credit Union has millions in student loans on its books and never recorded a charge-off.

April 22 Manchester Municipal Federal Credit Union

Manchester Municipal Federal Credit Union -

The lawmakers are questioning the agency about its oversight of student loan servicers involved in a federal loan forgiveness program.

April 5 -

The lawmakers are questioning the agency about its oversight of student loan servicers involved in a federal loan forgiveness program.

April 5 -

The 2020 budget would add the Consumer Financial Protection Bureau and FSOC to congressional appropriations, charge lenders for FHA upgrades and require universities to have skin in the game on student loans.

March 11 -

While student, auto and credit card balances are at or near record levels, housing debt is shrinking, credit quality is weakening a bit and lending standards, at least in some sectors, are tightening.

February 19 -

Barclays, BMO, Citibank, Goldman Sachs and ING contributed to the online student lender, which last year made over $1 billion in loans.

February 14 -

Goldman Sachs CEO David Solomon sticks to rogue banker defense in scandal; bank misses earnings, revenue estimates.

January 17 -

American homeownership has been on the decline, and Federal Reserve researchers point to the high cost of college as one culprit.

January 16 -

U.S. student loan debt outstanding reached a record $1.465 trillion last month and one particular set of borrowers is having a hard time paying back their loans.

December 17 -

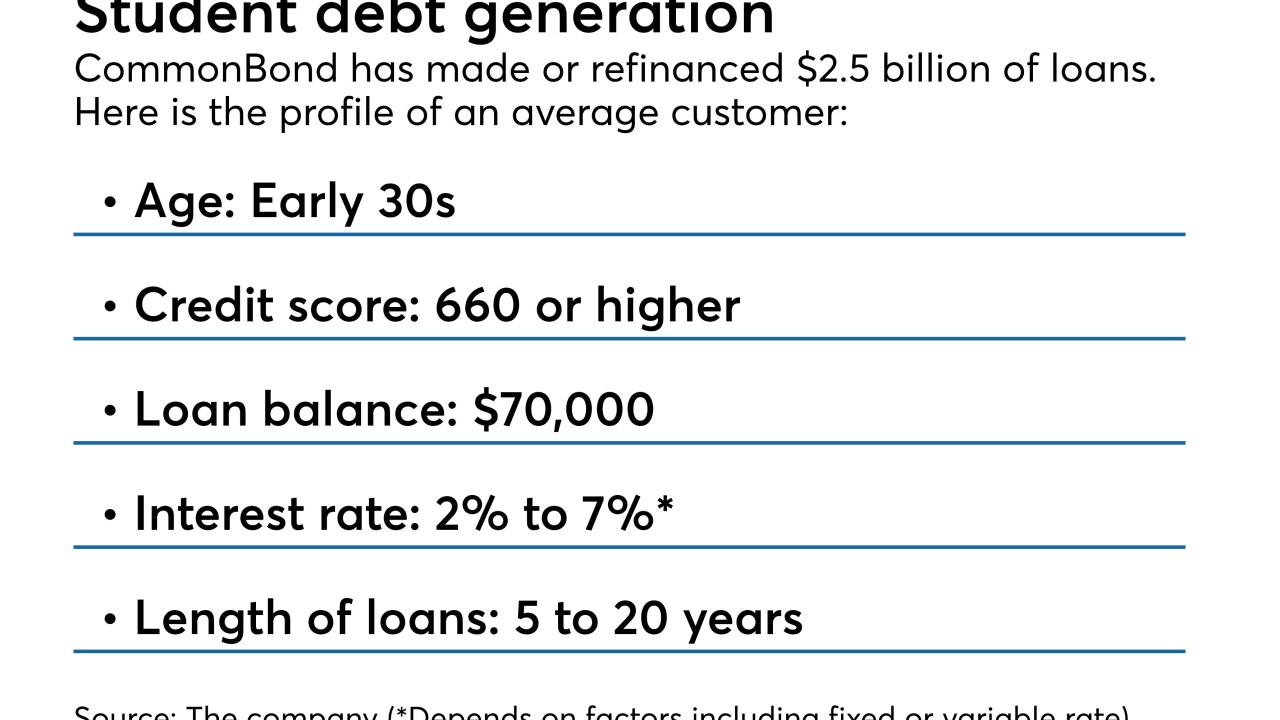

The Midwest regional recently announced a referral partnership with the fintech lender CommonBond. By offering customers an option to refinance student loans at more favorable terms, the bank is hoping to cultivate their loyalty.

November 30 -

Banks and credit unions will have to re-engineer a number of systems to meet the eclectic demands of the generation born roughly in the last 10 to 20 years.

October 11 -

Banks will have to re-engineer a number of systems to meet the eclectic demands of the generation born roughly in the last 10 to 20 years.

October 11 -

Two credit unions are part of a fintech pilot program to help borrowers set aside money to pay down student debt faster.

September 28 -

The report from an advocacy group that focuses on college affordability says schools need to do a better job of educating students about their eligibility for federal loans, which typically carry lower interest rates than loans from private-sector lenders like credit unions.

September 25 -

The report from an advocacy group that focuses on college affordability says that schools need to do a better job of educating students about their eligibility for federal loans, which typically carry lower interest rates than loans from banks and other private-sector lenders.

September 19 -

Seth Frotman, whose student lending unit had been gutted in May, said the bureau's current leadership "has abandoned its duty to fairly and robustly enforce the law.”

August 27