-

Rising tariffs are rapidly increasing the cost of building materials, putting banks at risk.

September 10 Contract Simply

Contract Simply -

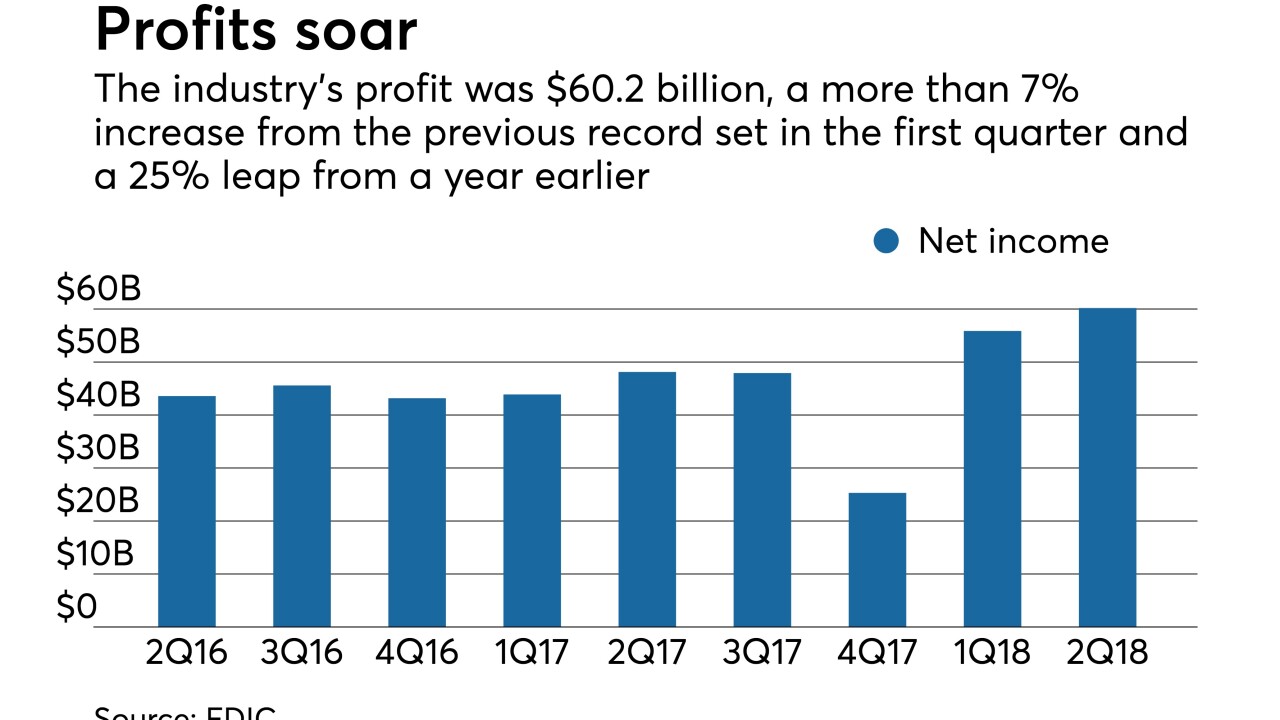

A huge chunk of the profit increase in the second quarter was due to a lower tax rate, but rising net interest margins and loan growth signal that institutions continue to derive revenue from their loan book.

August 23 -

The industry’s profit was $60.2 billion, a more than 7% increase from the previous record set in the first quarter and a 25% leap from a year earlier, the agency said in its quarterly report on the industry's health.

August 23 -

What are community banks doing with savings from the corporate tax cut? Several CEOs share how they've put that money to use.

August 23 -

The Treasury Department and the Internal Revenue Service issued a proposal that would allow pass-through businesses like Subchapter S banks to deduct 20% of their business income as part of the new tax law President Trump signed last year.

August 9 -

Multiple agencies are looking into its purchase of certain credits tied to low-income housing developments, the bank said in a securities filing Friday.

August 3 -

Depending on the asset class, about 11%-18% of earnings per share came from tax savings. The looming question is how do they top themselves in 2019 when tax rates don’t change like they did this year.

July 31 -

The recent decision involved sales taxes, but Wells Fargo recorded a net expense of $481 million under the assumption that it will also lead to higher state income taxes. Other banks may have to follow suit.

July 18 -

From medical expenses to home improvements, here's a look at some of the most frequently cited reasons homeowners are borrowing against their home equity.

June 26 -

Bankers would be better off cleaning their own houses and focusing on deregulation efforts, instead of going after credit unions, suggests NAFCU's Carrie Hunt.

June 20