-

The Los Angeles company said earnings fell 2% in the quarter as strong loan growth was offset by costs tied to its acquisition of CU Bancorp as well as a loss on the sale of a securities portfolio.

January 18 -

The Arkansas company's earnings fell 52% from a year earlier, reflecting a higher provision, a revaluation of its deferred tax asset and higher costs following a series of bank acquisitions.

January 18 -

BNY Mellon plowed some of its tax law savings into restructuring efforts.

January 18 -

Highlights at the North Carolina bank included deposit service charges, CRE lending and wider margins, which all offset one-time costs related to tax reform.

January 18 -

Merger- and tax-related charges took a bite out of fourth-quarter profits at the Cleveland company, but its CEO emphasized that a recent deal and tax reform are promising for growth.

January 18 -

Executives at U.S. Bancorp and Bank of America plan to use their tax savings to ramp up spending on new technology to stay competitive — but they sought to reassure investors that they would not abandon cost control.

January 17 -

Total loans rose 3% at the Minneapolis bank, but its net interest margin climbed 10 basis points. It also booked a one-time accounting gain of $910 million related to tax reform.

January 17 -

Write-down clears the decks for better times ahead; the agency’s acting head is looking to revamp strict rule that went into effect on Tuesday.

January 17 -

Tax reform and other regulatory factors could allow Citigroup — and other banks — to maintain high capital levels and strong rewards for shareholders.

January 16 -

Though business owners are more optimistic about the direction of the economy since the tax law was passed, it's doubtful their borrowing will increase meaningfully until they see more signs of more robust growth, bankers say.

January 16 -

The Arkansas company's net income topped $100 million for the first time, though it largely reflected the revaluation of its deferred tax liability.

January 16 -

The bank plans to stick to its multiyear plan to pay out at least $60 billion in capital to shareholders even after booking a larger-than-forecast charge of $22 billion to adjust to the new tax regime

January 16 -

Executives of large banks told investors and analysts what they wanted to hear Friday when they said they plan to increase returns to shareholders.

January 12 -

The Pittsburgh company got the tax-related boost from an increase in the valuation of its deferred tax liabilities. It was partly offset by several charges.

January 12 -

The company expects to report a $15 million gain in the fourth quarter from the stock sales, which will more than offset any deferred-tax impairment tied to recently passed tax reform.

January 11 -

The elimination of a key deduction that had worked as a cap on CEO salaries, combined with investor pressure to maintain performance incentives, could lead to an upward drift in compensation for top executives of many banks.

January 9 -

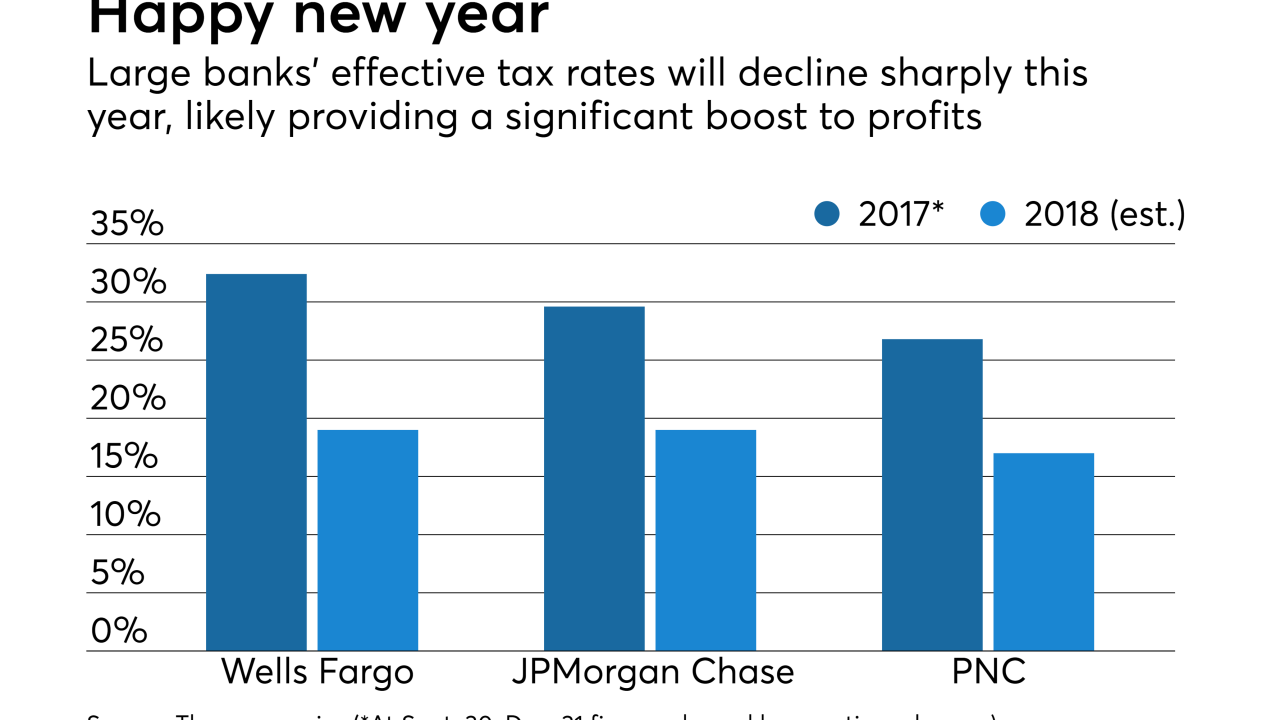

Banks have been in full cost-cutting mode in recent years, but with profits expected to increase substantially as a result of tax reform, all analysts and investors want to know is how they plan to spend their tax savings.

January 5 -

Beyond just maintaining the tax exemption, a look at how the recently signed Tax Cuts and Jobs Act might affect the credit union landscape.

January 4 -

Changing political and economic forces are raising new questions about deployment of tax savings and the cost of deposits, while old concerns about cost-cutting, credit quality and risk-taking persist or return.

January 3 -

About a third of U.S. banks are S corporations, and many are rushing to determine whether the new tax law has robbed them of their appeal and if they should convert to traditional corporations by the March 15 deadline.

January 3