-

The Pittsburgh company got the tax-related boost from an increase in the valuation of its deferred tax liabilities. It was partly offset by several charges.

January 12 -

The company expects to report a $15 million gain in the fourth quarter from the stock sales, which will more than offset any deferred-tax impairment tied to recently passed tax reform.

January 11 -

The elimination of a key deduction that had worked as a cap on CEO salaries, combined with investor pressure to maintain performance incentives, could lead to an upward drift in compensation for top executives of many banks.

January 9 -

Banks have been in full cost-cutting mode in recent years, but with profits expected to increase substantially as a result of tax reform, all analysts and investors want to know is how they plan to spend their tax savings.

January 5 -

Beyond just maintaining the tax exemption, a look at how the recently signed Tax Cuts and Jobs Act might affect the credit union landscape.

January 4 -

Changing political and economic forces are raising new questions about deployment of tax savings and the cost of deposits, while old concerns about cost-cutting, credit quality and risk-taking persist or return.

January 3 -

About a third of U.S. banks are S corporations, and many are rushing to determine whether the new tax law has robbed them of their appeal and if they should convert to traditional corporations by the March 15 deadline.

January 3 -

The banks announced bonuses, wage hikes and charitable contributions resulting from the lower corporate tax rate enacted by Congress.

January 2 -

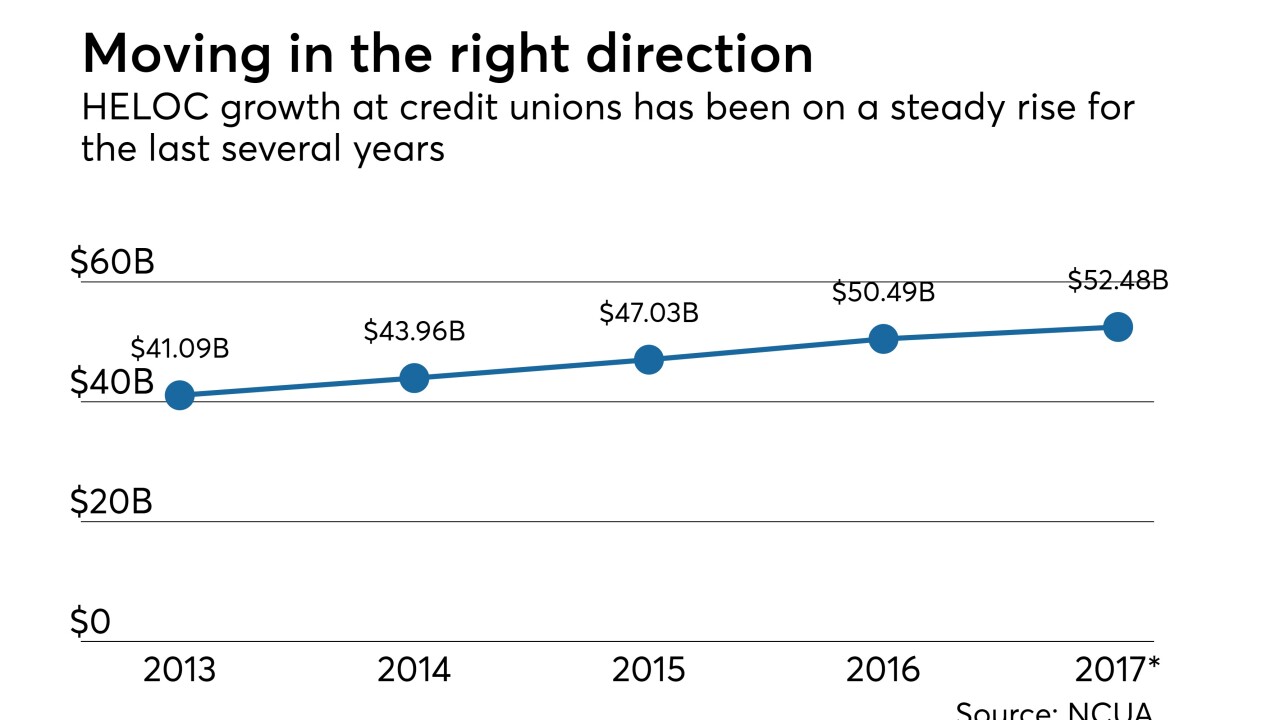

Any decline in home equity balances could be offset by higher demand for other types of consumer loans. The worry is that only borrowers with blemished credit will take out home equity loans, increasing the risk for banks and credit unions.

January 2 -

But bank will benefit long-term from tax reform; judge says accounting firm failed to detect mortgage fraud that did in Colonial Bank.

January 2