-

The large custody bank was one of the first U.S. banking firms to embrace robotic process automation. Here's why a 232-year-old institution took a pioneering stance on a new technology.

August 25 -

The fifth-biggest bank in the U.S. strikes a deal with BlackRock's FutureAdvisor to offer automated investing service.

August 24 -

Screen scraping is an out-of-date way to share transaction data with mobile apps and services. It's high time for banks to invest in OAuth, a protocol that lets customers access their financial data in a portal of their choosing and is secure.

August 24 Wallaby Financial

Wallaby Financial -

Royal Bank of Canada beat analysts' estimates for the fiscal third quarter as its City National purchase in the U.S. bolstered wealth management and capital markets earnings surged. Canada's largest lender raised its dividend 2.5% to 83 cents a share.

August 24 -

Sure, there is an inherent business tension between banks' digital offerings and personal financial management software. However, the ground rules for making account data available to consumers for use in external software products and apps are in place and the so-called rivalry is overblown.

August 23 Quicken Inc.

Quicken Inc. -

Nonbanking fees are also allowing Community Bank System in New York to be a patient acquirer even though it is creeping up on $10 billion in assets.

August 4 -

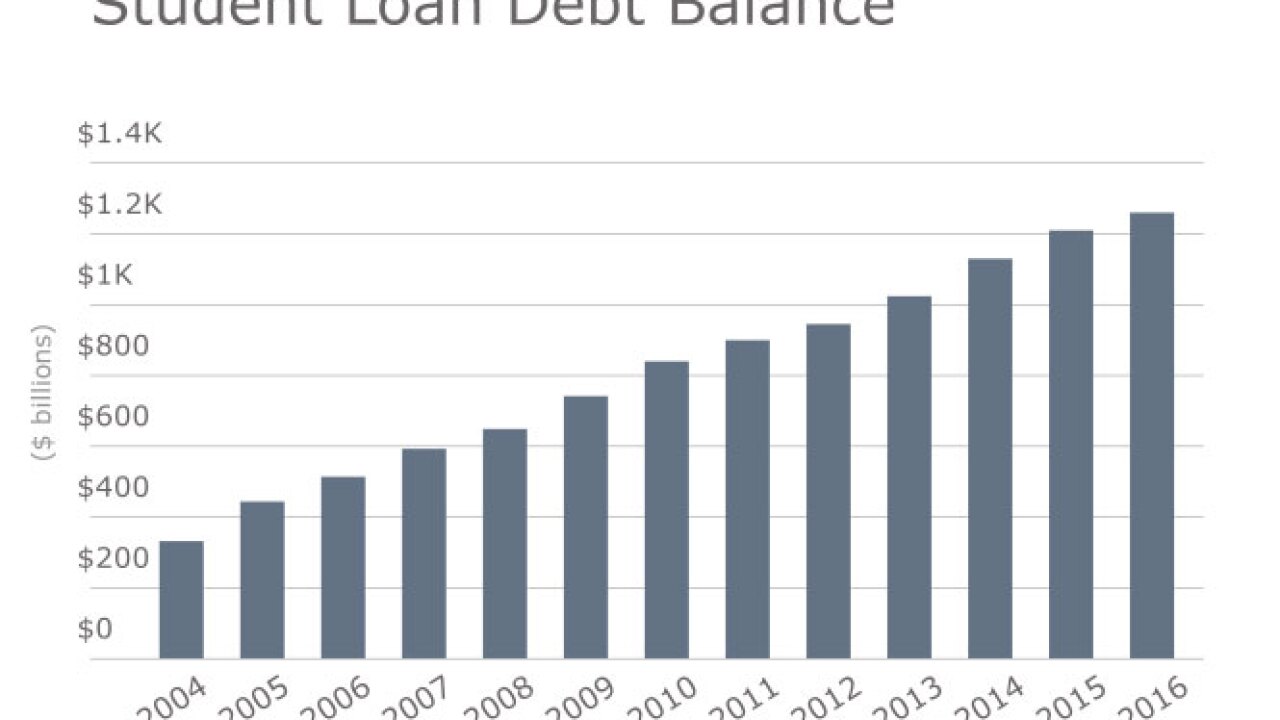

Fintech firms and millennial-focused advisers are providing advice on student loan refinancing, with the expectation that over time it will eventually lead to new business, in the form of brokerage and retirement accounts.

August 4 -

A handful of banks and fintech companies are letting bank customers connect via chat bots on platforms like Slack of Facebook messenger. Some say this is the next big thing, while others say the technology still has a ways to go.

August 1 -

Changes in consumer behavior including a growing distrust of financial advisers are driving the rise of robo advisers, says Gauthier Vincent, a consultant with Deloitte.

August 1 -

Hedgeable sees the peer-to-peer business and personal loans as an alternative to fixed-income investments that are traditionally offered through exchange-traded funds.

July 27 -

State Street's cost-cutting plan began to pay dividends, as the Boston company's second-quarter profit rose sharply on lower expenses.

July 27 -

Though several banks have begun automating financial advice for smaller investors, some are also providing more personalized services such as counseling family members who have suddenly inherited a fortune.

July 25 - New York

People's United Financial in Bridgeport, Conn., has agreed to buy a New York wealth-management firm.

July 21 -

Morgan Stanley outlined its plans for deploying automated advice tools, with executives emphasizing that it was only a part of its digital strategy.

July 21 - Illinois

Costs from a lawsuit settlement, the modification of some customers' contracts and employee severance costs combined to push down second-quarter profit at Northern Trust in Chicago.

July 20 -

Propel Venture Partners, the venture capital firm backed by BBVA, led a $7 million investment round in Guideline, a fintech startup focused on 401(k)s.

July 19 -

The investment banking firm's GS Bank unit has added a large number of consumer deposits since spring, but its success hasn't been cheap.

July 19 -

The three custody banks had been projected to post weak second-quarter results because of a lull in foreign exchange trading. Then Brexit happened, and everything changed.

July 19 -

Wells Fargo plans to pilot a digital advice platform in early 2017, according to a high-ranking executive at the wirehouse.

July 19 -

Bank of America, the second-biggest U.S. bank by assets, said second-quarter profit fell 21% as it took an accounting charge and posted a decline in wealth management revenue.

July 18