-

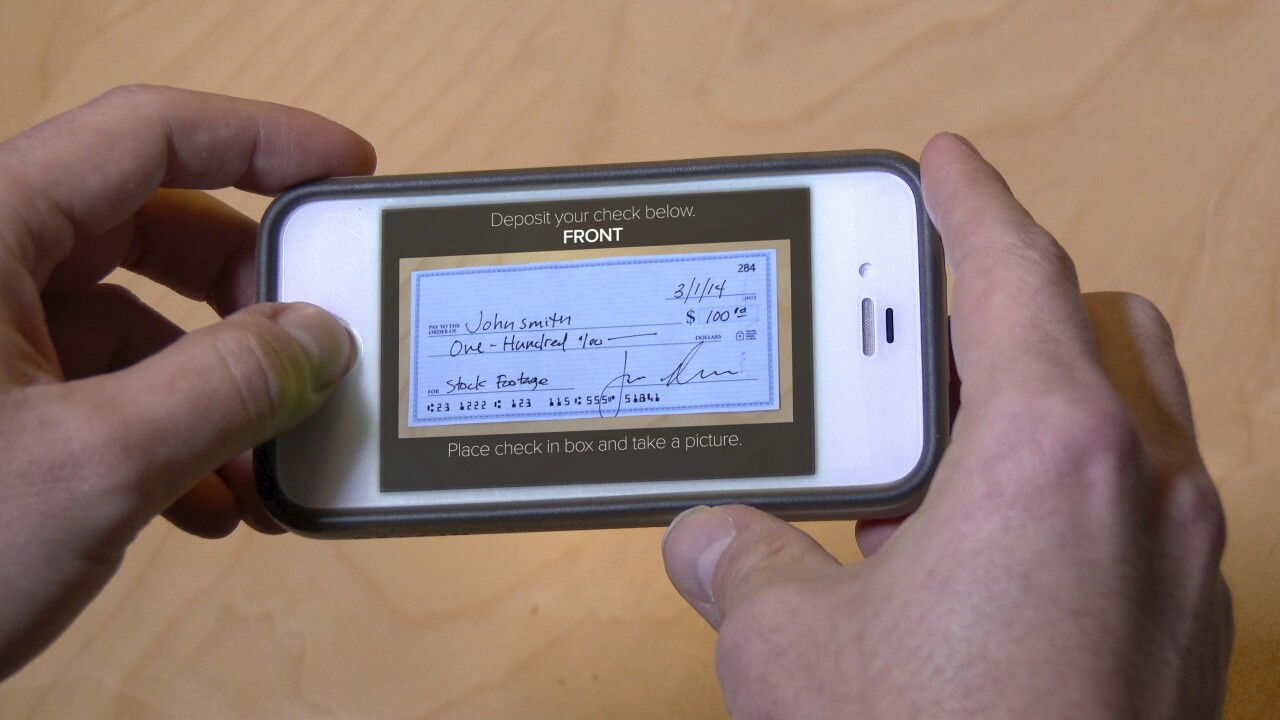

USAA claims to have developed the mobile capture deposit technology and has already successfully sued Discover and Truist, among others.

January 28 -

Neeraj Singh joins the Buffalo, New York-based bank after a four-year stint at USAA, which has seen an exodus of top executives.

January 27 -

The San Antonio-based insurer and bank has named Juan Andrade as its next CEO. The company's bank has suffered a series of regulatory penalties.

January 9 -

For the third time in five years, the Office of the Comptroller of the Currency issued an enforcement action against the beleaguered bank. It bars USAA from adding new products or loosening its membership criteria without evaluating the risks of getting bigger.

December 18 -

Amid steady customer growth, USAA's banking arm failed to make the investments necessary to satisfy either its regulators or some decades-long customers. Changes in the executive suite haven't fixed the problems.

November 21 -

The military-focused company, which operates an insurer and a $111.7 billion-asset bank, has tangled with regulators during Wayne Peacock's tenure. He will retire in the first half of 2025.

August 19 -

The proposed settlement would resolve allegations that USAA violated laws protecting those in the military from excessive interest rates. The bank said it "strongly disagrees" with the allegations.

August 6 -

Ryan Bailey's responsibilities include refreshing Cambridge Savings Bank's digital-only brand Ivy Bank. The institution believes his prior stint at USAA has prepared him for the challenge.

March 1 -

A conversation with USAA's Paul Vincent

-

It is rare for banks, especially large ones, to receive unsatisfactory ratings in their Community Reinvestment Act examinations. The San Antonio bank has now done it twice in a row.

January 26 -

The San Antonio-based company has promoted Paul Vincent to president of its banking unit. Neeraj Singh, previously chief risk officer for Citi’s U.S. consumer bank, has joined the parent company as chief risk officer.

February 3 -

Corporate breaches facilitated by employees — often accidentally — rose significantly this year, and banks have been particularly hard hit. Here's why.

November 16 -

USAA Federal Savings Bank’s downgrade shows how customer mistreatment stemming from flaws in internal controls can hurt Community Reinvestment Act scores. Some want consumer compliance to carry more weight in the CRA calculus.

October 21 -

USAA's regulatory troubles now include OCC fine, CRA downgrade; Citi CEO Michael Corbat and CFO Mark Mason dodged questions on cost of risk overhaul; PNC unlikely to buy a digital bank, CEO Demchak says; and more from this week's most-read stories.

October 16 -

The $85 million penalty and the bank's "needs to improve" rating on its Community Reinvestment Act exam were tied to alleged violations of the Military Lending Act and Servicemembers Civil Relief Act.

October 14 -

The lawsuit follows two successful USAA suits against Wells Fargo that claimed infringement of patents.

October 2 -

Truist emphasizes high-touch, high-tech focus with new logo; Wells Fargo loses another patent lawsuit to USAA; what the Visa-Plaid merger means for banks, fintechs; and more from this week's most-read stories.

January 17 -

Wells was ordered to pay USAA $102.8 million for infringing on its mobile deposit patents. It follows a separate lawsuit loss in November also related to patents.

January 15 -

USAA won $200M from Wells Fargo in patent fight — will others be on the hook?; three takeaways from regulators' approval of the BB&T-SunTrust merger; don't believe the doom and gloom on Fannie, Freddie; and more from this week's most-read stories.

November 27 -

The remote deposit capture tech at the center of the dispute is used by 6,500 institutions. That may mean other institutions will have to pay licensing fees to USAA.

November 18