(Image: Thinkstock)

William Demchak, PNC Financial

Ray Davis, Umpqua Financial

Ryan McInerney, Visa

Cece Stewart, Citigroup

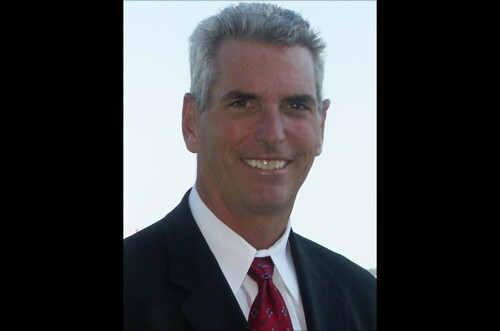

Steve Gardner, Pacific Premier

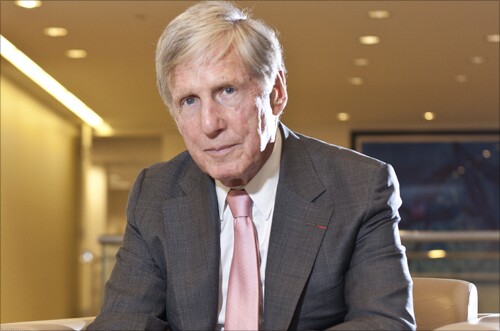

Robert Wilmers, M&T Bank

Carl Chaney/John Hairston, Hancock Holding

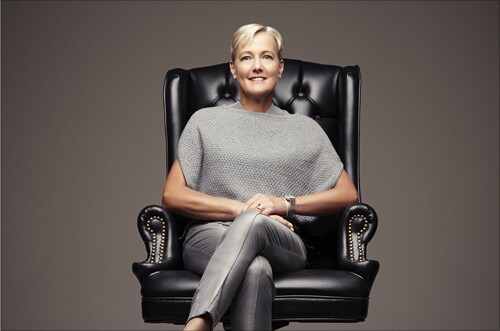

Arkadi Kuhlmann, ZenBanx

Bryan Jordan, First Horizon

Everyone at JPMorgan Chase

(Image: Bloomberg News)