Limits on Debit Swipe Fees Become Law

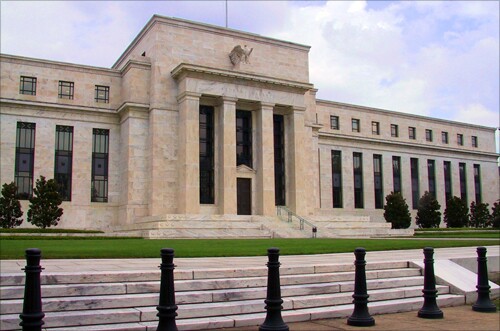

Fed Issues New Interchange Fee Cap

Judge Calls Fed Rule 'Utterly Indefensible'

Appeals Court Sides with Fed

Legal Battle Ends at Steps of Supreme Court

WomenVenture, a Minneapolis-based Community Development Financial Institution, was already under strain from stalled federal CDFI funding. The recent immigration crackdown added significant uncertainty for its customers as well.

The Spanish banking giant, which has been trying to grow its U.S. business, plans to acquire the Connecticut-based parent company of Webster Bank.

The crypto and payment fintechs both debuted on the stock market in late January with strong openings, then traded down ahead of a four-day partial government shutdown.

At a hearing Tuesday, executives at the Swiss banking giant faced tough questions from both Republicans and Democrats. The lawmakers are unhappy with the bank's recent decision to withhold certain documents from a lawyer who's overseeing research regarding Nazi accounts.

Prosecutors claim the Forbes 30 Under 30 honoree maintained two sets of books to hide Kalder's actual revenue of just $60,000.

The buy now, pay later lender is carving out a lane for itself with exclusive deals with Intuit's Quickbooks Payments and Expedia's websites. It also will be the default BNPL provider for Bolt's one-click checkout.