The critically undercapitalized Peoples Community Bancorp Inc. of West Chester, Ohio, might stave off failure with the deal it announced Monday to sell nearly all of its branches.

But it has a struggle ahead before it is free of danger, observers said.

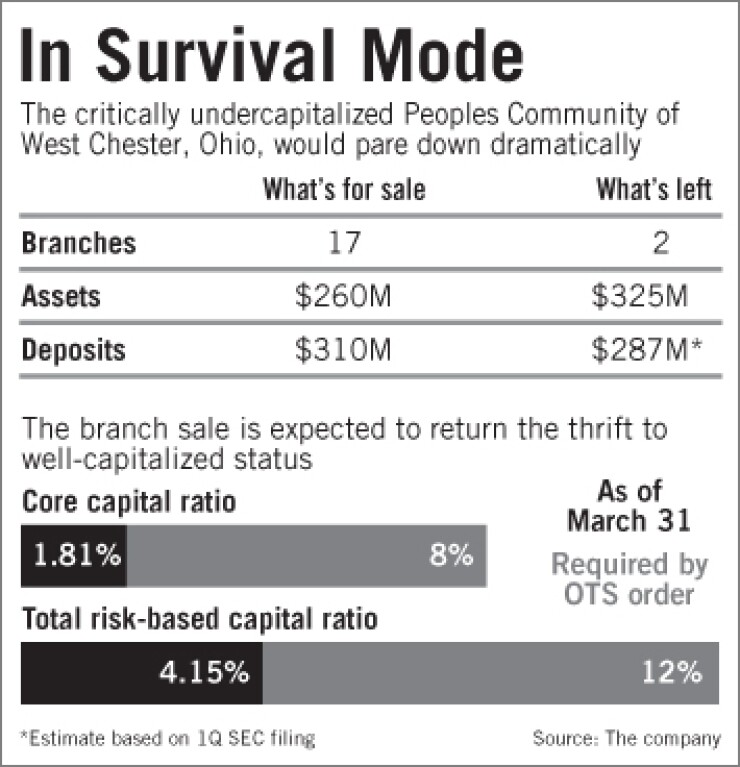

Peoples, which previously had no luck in efforts to sell itself, would part with 17 of its 19 branches in the deal, which it said should get it to well-capitalized status.

The $3.8 billion-asset First Financial Bancorp in Cincinnati said it would pay $12 million for the branches, along with $260 million of performing assets and $310 million of deposits.

The price works out to a 4% deposit premium.

But that still leaves Peoples with its mounting troubled loans, which have contributed to its 11 quarters of losses totaling $110.2 million.

"I think you have to look at two points of view. From a capital perspective it reduces the assets and gets them a deposit premium, both good things," said Michael Iannaccone, the president of MDI Investments Inc. in Chicago. "From a risk perspective, now you have the same amount of nonperforming assets on a smaller balance sheet. In that regard, it just buys you time."

Still, Iannaccone said the deal is likely the best possible move for Peoples, whose two deals to sell itself outright in the last year and a half both fell through.

Nonperforming loans had climbed to 9.41% of its total at the end of the first quarter, and without the branch sale, Peoples had said it would likely face seizure of its thrift unit.

An order from the Office of Thrift Supervision requires the thrift to achieve elevated capital levels by July 14 and, if it becomes critically undercapitalized before then, to liquidate or sell itself.

Executives there did not return a call for comment, but Jerry D. Williams, Peoples' president and chief executive officer, said in a press release that paring down to two branches should enable the company to get healthy again.

"We believe that this transaction will generate the necessary capital to return the bank to a well-capitalized status," he said. "It is our intention to return to our banking roots in Lebanon, Ohio, and the additional capital will allow us to focus both on offering traditional banking products from our two offices in Lebanon and reducing our levels of criticized and classified assets."

But observers disagreed over its chances.

Though they said that divesting branches is a fast way to raise capital, it is sometimes not enough.

The $3.5 billion-asset First State Bancorp. in Albuquerque announced in March that it had agreed to sell its 20 Colorado branches to the $4.3 billion-asset Great Western Bank in Watertown, S.D.

First State expected to boost the total risk-based capital ratio at its bank to 12% to comply with a regulatory order.

However, a first-quarter loss of $24.4 million derailed those plans, leaving it only adequately capitalized.

Mike Heller, the president of the bank rating firm Veribanc Inc. in Woonsocket, R.I., said the Peoples deal would plug a capital hole for the company but do little else.

"This puts them over the deficiency they have," Heller said. "But what about the rest of the portfolio? What is changing that is going to allow them to return to profitability?"

But Geri Forehand, the director of strategic services at the consulting firm Brintech Inc., a unit of United Community Banks Inc. of Blairsville, Ga., said the deal could position Peoples to thrive, because the company would be able to concentrate on working through the problem assets.

"This could allow them to refocus their energy," Forehand said. "The premium gives them some flexibility and they are left with a smaller institution and hopefully a much more manageable institution."

For First Financial, the deal would accelerate its plans to expand in the Cincinnati market.

"This fits in perfectly with our footprint," Claude Davis, First Financial's president and CEO, said in an interview. "We think this really elevates our status by several years in terms of where we want our branch network to be."

The deal would increase the company's branch count in Cincinnati by half, to 51.

In all, it has 82 branches in three states.

Davis declined to say if regulators were involved in structuring the deal, but he called the pricing attractive.

In terms of the asset mix, Davis said 70% of the assets it plans to acquire are one-to-four-family mortgages.

"We are not purchasing any land acquisition or development, construction, commercial builder or residential lot loans," he said.

The deal is expected to close in the third quarter, and First Financial said it should boost earnings by 6 cents per share next year.