-

Through fever waves of populist anger including the Occupy Wall Street protests, there has been no sign that disgusted customers are draining the giant banks of their deposits.

November 10 -

There's bad news for those who withdrew funds on Bank Transfer Day to punish the targets of their ire. Most banks don't really need their money at least not right now.

November 9 -

Community banks and credit unions plan to keep pushing promotions in coming weeks as a way of maintaining momentum after Bank Transfer Day.

November 4

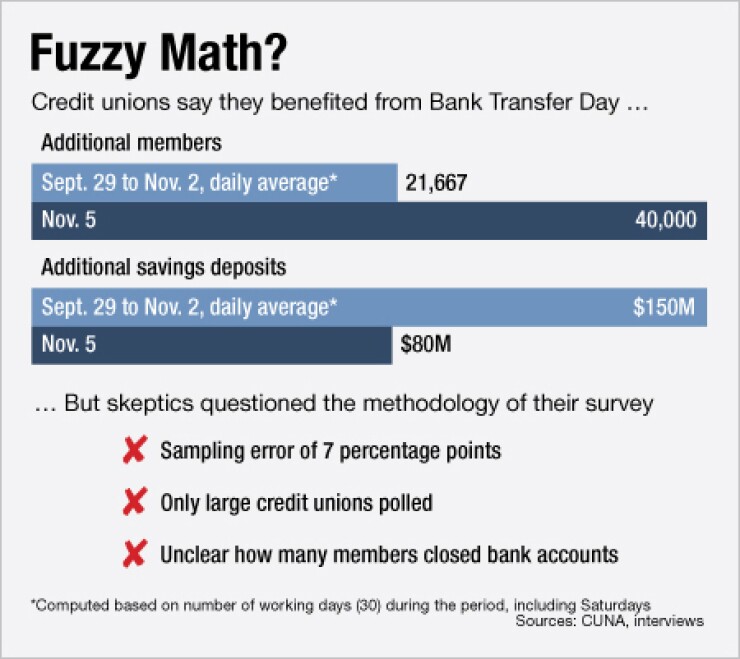

Credit unions attracted hordes of new members on Bank Transfer Day, thanks to public anger at big banks over bailouts, mortgage missteps and debit fee blunders, right?

That's what countless media outlets reported, citing survey data from the Credit Union National Association. Hundreds of thousands of consumers have joined credit unions since late September, the numbers showed.

Surely credit unions gained at the expense of banks, but several skeptics — some with axes to grind, and others who are presumably more objective — say the numbers may have been inflated.

"For any number that you see from the credit union trade association, you have to look beyond the numbers," said Alan Theriault, the president of CU Financial Services, a consulting firm for credit unions. "I'm not saying the bank associations are any better, but clearly CUNA and others have skillful ways to spin stories to get the impact they want."

In a survey released on Nov. 3, CUNA said credit unions added 650,000 members and about $4.5 billion of savings deposits in the weeks following Bank of America Corp.'s Sept. 29 announcement of plans to

Theriault and Keith Leggett, a senior economist at the American Bankers Association, questioned aspects of the survey interviews. Theriault wondered what the net gain was for credit unions during the period covered by the surveys, as there is a natural ebb and flow of people joining and leaving financial institutions. Reviewing quarterly data on membership would be a good indicator, he said.

There might be a bias in who responded to the survey, Leggett said.

"Maybe if you didn't have an increase, you didn't respond, so there was self selection," Leggett said. "Those that reported are the ones who saw an increase, and this was used to extrapolate. Based on that, that leads to an overestimation."

Leggett, who also runs the blog Credit Union Watch, argued that the publicity surrounding Bank Transfer Day accelerated the timeline for people who were already planning on joining credit unions. Long-term data will be more telling, he said.

It is unclear how many people opened credit union accounts without transferring their balances from their bank accounts. Weekly data from the Federal Reserve has not shown a deposit outflow from banks, he said.

"It basically indicates that we are not seeing deposits fleeing banks," Leggett said. "This doesn't refute what the credit unions are saying. This just means balances have not been transferred."

Mike Schenk, a vice president of economics and statistics at CUNA, acknowledged that many people may have joined credit unions without transferring all of their business. The survey did not ask for account size or average balance of accounts opened.

The rate of increase of savings deposits went from an annual rate of 4% before September to an annual rate of 6% during September. Schenk said this was a healthy increase but not huge given the high volume of new members. The estimated 650,000 that joined from Sept. 29 to Nov. 2 exceeded all new members in 2010, Schenk said. The overall increase in savings deposits in each survey was a fraction of 1%, Schenk said.

"This suggests to me that a lot of people are joining credit unions, but at this point they are not transferring a huge book of business over," Schenk said. "All it takes to join some credit unions is a $5 deposit."

Schenk defended the accuracy of the data, stating that a selection bias is a potential problem in any survey. The first survey had a sampling error of plus or minus 4.98 percentage points, and it was 7 percentage points for the second survey, he said.

Gallup polls usually have a margin of error of about 4 or 5 percentage points, said Lee Kidder, a senior consultant at CCG Catalyst, a bank consulting firm. The margin of error in the first survey was typical, but the second survey's was high, Kidder said.

Any return rate higher than 5% is statistically valid, he said. The first survey, sent to 5,000 credit unions, had a response rate of about 7%. The second survey, sent to 1,127 credit unions with at least $100 million of assets, had a response rate of almost 15%.

Since the second survey was only sent to larger credit unions and because of the sampling error size, Kidder said the first was probably more reliable.

"What does it really mean that they only surveyed the largest credit unions?" Kidder asked. "You have to ask where are those largest credit unions located? You can distort the field when you limit your population."

"It's probably a directionally correct survey, but I wouldn't bet the farm on it," he said.