-

Three and a half years after selling Harbor Florida Bancshares Inc. at the top of the market, the company's former executives have decided it's time to buy.

June 8 - Florida

Two years ago David A. Daberko, National City Corp.'s chief executive and chairman, said "you must reinvent the company in major ways every couple of years to stay competitive."

July 12

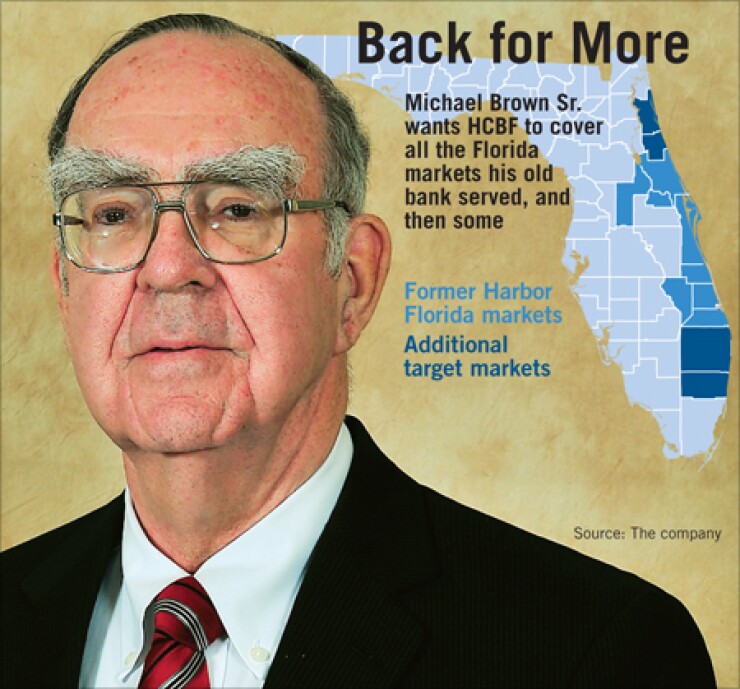

In the last year, Michael Brown Sr. raised nearly $330 million, bought a small Florida bank, converted it to a thrift, struck a deal for a weaker competitor, bought a branch from the Federal Deposit Insurance Corp. — and turned 70 years old.

The chairman and chief executive officer of HCBF Holding Co. in Palm City says he's just getting started.

"With our deals so far, we will have a nice, concise footprint in contiguous markets we know," Brown said in an interview this week. "We want to grow from there. We're looking at opportunities farther south and farther north than where we were before. We are looking at much of the east coast of Florida."

Brown knows a thing or two about consolidation in the Sunshine State, having sold Harbor Florida Bancshares Inc. to National City Corp. in 2006 for 3.24 times its book value.

Based in Fort Pierce, Harbor operated in eight counties, largely in central Florida with a concentration along the so-called Treasure Coast. Before selling itself to National City, Harbor had expanded north and west into the Orlando area. Brown said he is looking to expand his latest venture from Broward County to just south of Jacksonville, a roughly 300-mile stretch.

(National City, meanwhile, was a casualty of the financial crisis. The Cleveland company sold itself at a steep discount to PNC Financial Services Group Inc. of Pittsburgh in 2008.)

HCBF is already plunging into new territory with its pending acquisition of the $452 million-asset Grand Bank & Trust of Florida in West Palm Beach.

Harbor never operated in Palm Beach County, the northern tip of what is traditionally considered south Florida.

While its first acquisition involved a healthy bank — the $97 million-asset First Bank and Trust Co. of Indiantown — Grand has struggled.

At March 31, nonperforming assets made up about 7.5% of its total assets, though the bank was adequately capitalized.

Karen Dorway, the president of BauerFinancial Inc. in Coral Gables, Fla., estimated that Grand needs about $4 million of equity to return to well capitalized status.

"Grand was doing what was typical of Florida institutions during the boom years," Brown said. "They were taking advantage of opportunities. But they did build a terrific franchise."

With the Grand purchase, which should close in the third quarter or early fourth quarter, along with the branch acquisition from the FDIC, HCBF will have $600 million in assets and 12 branches.

Ken Thomas, an economist and bank location consultant at BranchLocation.com, said HCBF is "being smart" by expanding to the south.

"They were always comfortable on the Treasure Coast, but the money is in south Florida. It holds 40% of the state's deposits," he said.

Thomas was, however, less enthused about the idea of taking on nearly the entire eastern seaboard of the Sunshine State.

"Florida banks make the mistake of doing that so they can have beautiful branch maps," Thomas said.

"I think they should focus on the Treasure Coast and south of there. There is not a lot of money for them up the coast."

Richard Bove, an analyst at Rochdale Securities, said that while Brown might be casting a wide net, he doesn't see the "brilliant" veteran building a disjointed franchise.

"I really don't see him stringing a whole bunch of banks here and there," Bove said.

Analysts said HCBF might have the home field advantage compared to other private equity-backed groups.

Brown said that would-be sellers have taken notice. "Once we announced the Grand transaction and we were no longer just an idea, we started getting phone calls," he said.

HCBF is backed by a mixture of local money, pension funds and private-equity firms, including Stone Point Capital and Kelso & Co.

Brown said the group decided to go the thrift route because Harbor was regulated by the Office of Thrift Supervision. HCBF began that process before the Dodd-Frank Act abolished the OTS, which is now bracing to merge into the Office of the Comptroller of the Currency in July.

"We are anxious to see how that transition goes," Brown said.

Bove said he believes that Brown will focus on building critical mass through acquisitions and then shift to organic growth.

The $3.2 billion-asset Harbor was built almost exclusively through organic growth over roughly 30 years.

Bove said that is where Brown and his team will have the greatest advantage.

HCBF is not ignoring organic growth while it acquires, though, Brown said.

"We obviously have a lot of prior relationships coming to us, but there are also new opportunities out there because there are not a lot of banks that are lending," he said. "But it is a great time to find new customers because you get to see how these businesses are operating in stressed times."