-

National Bank Holdings in Greenwood, Colo., plans to raise up to $180.9 million after completing an initial public offering.

September 11 -

Capital Bank Financial, a $7.7 billion-asset privately held bank holding company, said Monday it would raise about $250 million via an initial public offering the company first announced in June 2011.

September 10 -

Capital Bank Financial, a Miami company formed two years ago to buy distressed banks in the Southeast, has struck a deal to acquire Southern Community Financial (SCMF) in Winston-Salem, N.C., for $48.4 million.

March 27 -

The Federal Reserve usurps authority usually held by state regulators and fails a Colorado bank.

October 21

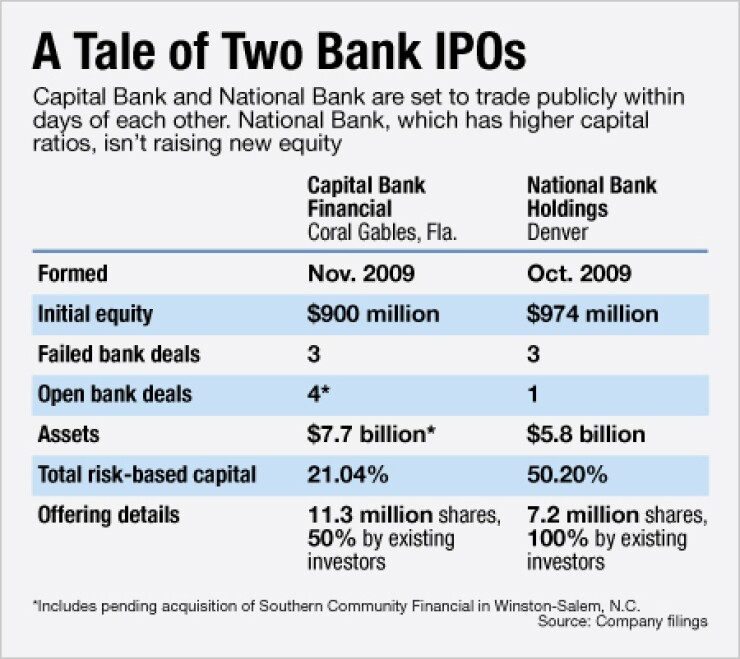

A pair of companies formed after the financial crisis to buy weakened banks will celebrate their three-year anniversaries by going public.

National Bank Holdings in Denver and Capital Bank Financial in Coral Gables, Fla., could become publicly traded as early as next week. The companies, each raising nearly $1 billion in 2009 to become consolidators, have been successful meeting that mandate.

The offerings are a natural evolution, industry experts say. They give investors a way to cash out while positioning the companies to make more traditional acquisitions as failed-bank deals fade.

"Returns for investors haven't been as robust as they thought they were going to be," says Jeff Davis, a veteran bank analyst.

"It does not look like the early 1990s when the banks snapped back strong, but they've made a decent gain and want to take a little money off the table and move on to the next sector," Davis says. "I think [the companies] want a publicly traded currency to acquire because you can't do every deal for all cash, and the failed-bank game is about up."

Such conditions are especially true for National Bank Holdings. The $5.8 billion-asset company is not looking to raise any capital in its public offering. Tim Laney, National Bank's chief executive officer, declined to comment, though sources says the Denver company could officially price its shares on Sept. 19.

When National Bank first filed its registration statement last November, it considered raising up to $250 million. The company amended its statement this week to state that the offering would only include stock held by existing stockholders.

National Bank plans to find buyers for roughly 7 million of its 52 million shares at

None of the sellers are cashing out completely, according to National Bank's registration statement. Fidelity Management, for instance, plans to reduce its ownership to 2.78% from a 4.9%.

The sellers do not include any of the company's executive officers or directors; they have lock-up agreements barring them from selling for 180 days.

It is relatively uncommon to have an initial public offering that excludes new equity for the company.

Adam Fiedor, a vice president at Denver investment bank St. Charles Capital, says National Bank may have scrapped plans to raise more equity because the IPO market has not been kind to banks lately. Another possibility is that the company did not need the capital, which Fiedor says is the most likely scenario.

National Bank's equity stood at $1.1 billion at June 30, and its total risk-based capital ratio surpassed 50%. Through

"They could double the size of the business with no new capital," Fiedor says.

In addition to giving its shareholders some liquidity and making it easier for the company to buy other banks, being public enhances the company's ability to recruit managers. "They create a powerful incentive tool in attracting new talent," Fiedor says.

Investors are likely getting antsy to cash out, says Chris Marinac, an analyst at FIG Partners in Atlanta. He says that the initial investors are also eager to figure out the value of their investments.

"An illiquid stock is a real headache," Marinac says. "We get calls all the time from investors looking for help in valuing stock in privately held banks. Going public is a critical step forward, because now you know what the stock is worth."

Capital Bank Financial, formerly known as North American Financial Holdings, is planning to raise new equity in its initial public offering. The IPO's anticipated pricing date is Sept. 20.

The Coral Gables, Fla., company said in an amended registration statement this week that its offering will include 11.3 million shares, divided evenly between existing shareholders and new stock. The company

Capital Bank Financial had equity of $1.12 billion at June 30, but industry observers say that adding to the coffer makes sense because the company has acquired three distressed banks in traditional deals across the Southeast. It

"It makes some sense for them to raise capital," says Chip MacDonald, a partner at Jones Day in Atlanta. "They are a fine operating team, but they could use a buffer in fixing their banks. "It just gives them more flexibility and more dry powder to buy, too."