-

More community banks are establishing credit card loyalty programs in their quest for revenue growth. The programs can work provided they are easy to understand, pay a lot of cash and tie rewards points to local services.

September 12

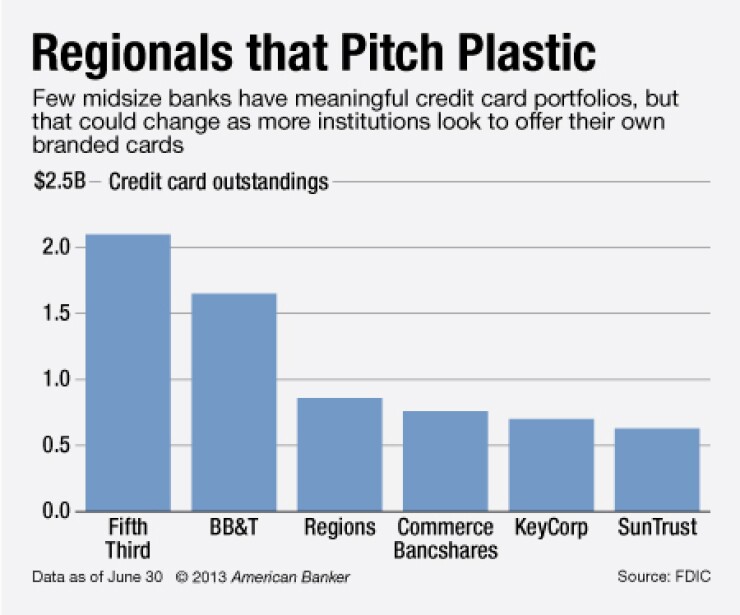

There's a new normal for regionals that aim to be full service institutions customers' wallets must include plastic emblazoned with the bank's logo.

Not too long ago, regional banks were eager to get out of the credit card business. A number of those institutions are returning to the business, while others are seriously considering it.

Huntington Bancshares (HBAN) in Columbus, Ohio, and KeyCorp (KEY) in Cleveland have

"Credit cards allow for a much more interactive relationship with the consumer," says Odysseas Papadimitriou, chief executive of CardHub.com. "It's making these banks realize they made a mistake" by avoiding the business.

KeyCorp sold its credit card portfolio in 1998, limiting itself to offering cards through partners such as U.S. Bancorp (USB) unit Elan Financial Services. But KeyCorp's executives decided that it needed its own platform, so they

"I want you to make your payments the way you want to, just do it all with Key," says David Bowen, KeyCorp's senior vice president of product development. "If you create the ecosystem that allows customers their own choice and control, you're going to win all day long."

Key and Huntington have no plans to become major credit card players on a national scale. Executives at the banks say that they will only offer cards to existing customers.

"I don't have any intention of competing against Capital One Financial (COF)," Bowen says, referring to the McLean, Va., company that held roughly $79 billion in credit card outstandings at June 30.

The $56 billion-asset Huntington has no plans to market its card outside its six-state operations, or to non-customers, says Mark Sheehan, the company's payments and channels director.

"It's really about servicing our own customers," Sheehan says. "We believe when you deepen the relationship with your customers, you will have an increase in retention."

The allure of credit cards, as a contributor to the bottom line, is easy to see, industry observers say. Cards produce better returns on assets than other types of loans, says Bob Hammer, a consultant in Thousand Oaks, Calif., who advises banks on credit cards.

The risk profile of credit cards has improved; chargeoffs have returned to pre-crisis levels, Hammer says. "It is the best business in banking," he says.

Regional banks can work with larger firms on credit cards, but the best way to fully benefit involves handling all issuance and servicing, Papadimitriou says. That also means spending what it takes to build sufficient infrastructure, he says.

"You can't just spend $2 million and get into the credit card business," Papadimitriou says.

For instance, the former Wachovia spent about $50 million in its first year after reentering the cards business. Wells Fargo (WFC) bought the Charlotte, N.C., company in 2008.

Throw in the Durbin Amendment, and its cap on interchange fees for debit cards, and bigger banks that lacked a credit card were put in a vise. KeyCorp realized that it could not regain lost interchange income by directing debit card users to credit cards.

"When the Durbin tide went out, you saw who was swimming naked without their own credit card," Bowen says.

Several banks with $20 billion or more in assets could consider issuing their own cards, industry observers say. They include Associated Banc-Corp (ASBC), Cullen/Frost Bankers (CFR) and People's United Financial (PBCT). Additionally, East West Bancorp (EWBC) and TCF Financial (TCB) could have an interest expanding beyond the less than $5 million in card outstandings on their books.

Cullen/Frost, a $23 billion-asset company in San Antonio, sold its credit card portfolio in 1986 and has not looked at getting back into the business, a spokeswoman says.

Huntington began the full rollout of its new card on Sept. 3, offering it through the MasterCard network.

Bankers told Huntington's executives that customers repeatedly asked why the company lacked a card. After researching the issue, Huntington realized its clients use credit cards more than debit cards, and that Huntington was missing out on the action, Sheehan says. "We realized we only had half the story," he says.