-

The payments associations proposal comes amid regulatory scrutiny of bank relationships with online lenders, and could affect financial institutions' dealings with a range of other industries.

November 12 -

As the world accelerates toward faster and contactless payments, the U.S. has been reinforcing checks, avoiding global payments standards and pursuing closed-loop innovations that further isolate it.

October 10 -

Widespread adoption of same-day settlement will level the competitive playing field for all financial institutions and allow all account holders to benefit from expedited settlement.

September 17 -

Wal-Mart is agitating for nonbanks to have more say in how the automated clearing house network is run, saying foot-dragging by banks has stifled new payment products.

April 5 -

The digital payments initiative clearXchange is run by three banks that make up more than 50% of the online banking market in the U.S., but it still has a lot of work cut out for it.

September 10

First of two parts.

In the United Kingdom, you can send money to someone else's bank account within a couple of hours. In Mexico, the process takes no more than a minute or two. In Sweden, it happens even faster, via mobile phones.

Here in the United States, electronic payments move at a snail's pace by comparison. Times vary by bank, but it's common for three, four or five days to elapse before the cash arrives in the recipient's account.

Remarkably, it's often speedier to pay someone by scribbling out a paper check than it is by transferring funds electronically, thanks to check imaging technology.

"The check system can clear items same-day. So we're a little bit behind the check world even," says Norman Robinson, president of EastPay, an organization that represents Southeast U.S. banks on payments issues.

If checks, a payment method that's hundreds of years old, can be updated for the Internet age, why can't America's four-decade-old electronic payments system? Blame the big banks.

More than two years ago, the staff of Nacha, the industry-owned group that sets the rules for the automated clearing house network, decided it was time to modernize the system. The group's proposal was far more modest than the near-real-time systems that now exist in numerous other countries. If a U.S. bank submitted a payment before 2 p.m. Eastern time on a weekday, it would be settled around 5 p.m., rather than waiting until the following weekday, or perhaps the day after that.

The plan, known as Expedited Processing and Settlement, may not have been a step into 21st Century, but at least it would remodel a system built in the 1970s and 1980s.

But even this incremental move was too much change for a bloc of big banks that played a decisive role in torpedoing the proposal in a vote in August of last year.

The episode, which happened mostly outside of public view, demonstrated the enormous power that a small number of large commercial banks wield over the U.S. payments system. Their interests prevailed over the wishes of many smaller banks, corporations, and consumers, all of whom would benefit from a faster, broadly accessible way to make electronic payments. And because Nacha's balloting process is shrouded in secrecy, these large banks didn't leave any fingerprints.

"In this space, a relatively small number of banks decide whether progress happens," says Jason Marshall, a former payments executive at Wal-Mart who now works at the payments technology firm InComm. "And with a lack of transparency, the small number of banks that hold back the payments system don't even have to show their face."

A Bid to Stay Relevant

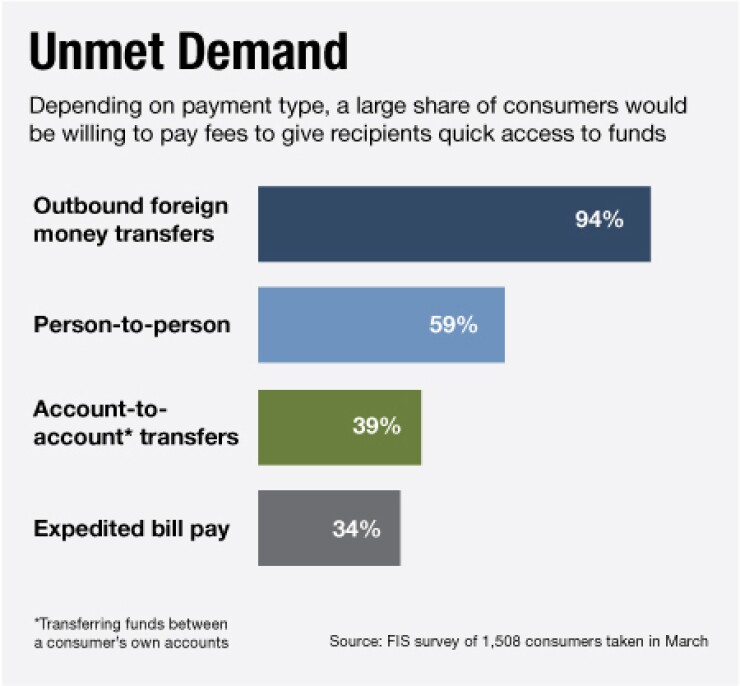

A faster ACH network would unquestionably be a boon for many consumers and for businesses that rely on the payments system.

Families on the verge of missing the deadline for a utility bill payment would benefit. So would companies that must pay vendors right away. In a situation where a worker fails to submit a timesheet on time, the employer could make a speedier direct deposit.

"I think there is a definitely a need in the business community," says Anita Patterson, director of treasury services at Cox Enterprises, one of the country's largest privately held companies.

"I've never met a knowledgeable corporate finance professional who's against it," adds Marshall, the former Wal-Mart executive.

In all, the individuals and businesses involved in about 25% of all ACH payments would benefit from same-day settlement, estimates Steven Cordray, project director at the Federal Reserve Bank of Atlanta's Retail Payments Office.

Community banks also have a powerful incentive to support the faster movement of payments within the ACH network because small banks can't build proprietary payments systems like some of their bigger competitors can.

"I feel that about 70% of the banks in the United States are very supportive of it," says the Atlanta Fed's Cordray.

In April, the Independent Community Bankers of America

"From a community bank standpoint, we absolutely feel that same-day needs to happen," says Cary Whaley, ICBA's vice president of payments and technology policy.

The biggest advantage that the ACH network has over other payment systems is its ubiquity. Every one of the country's 6,940 banks and 6,681 credit unions is connected.

"Unless you have the surety of reaching all end points, the value for anyone is diminished," says Jan Estep, president of Nacha. "So we're really trying to maintain ubiquity."

But some observers worry the network's value is eroding as faster payment technologies emerge.

"There are initiatives that could compete and establish a more dominant role," says Beth Robertson, a payments industry analyst. "If existing networks want to play, as things evolve, they have to be willing to innovate."

Setting the Bar High

When the vote was held last summer, Nacha had 48 members, including 31 financial institutions. That list includes many of the nation's largest banks: JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (NYSE: C), Wells Fargo (WFC), and Bank of New York Mellon (BK), among others.

Twenty-two of the 31 financial institutions on the Nacha membership list have more than $50 billion in assets, and only five of them have less than $15 billion in assets. For a small bank, joining Nacha is costly. The group would not disclose its exact membership dues, but says the figure is less than $40,000 annually.

In addition to the 31 financial institutions, Nacha has 17 members known as regional payment associations; they represent the views of financial institutions in specific geographic areas, including both small banks and large ones.

Under the rules, banks that are direct members of Nacha can also be members of regional payment associations. This system has prompted grumbling by some community bankers that the voice of the big banks is given too much weight.

"Ultimately, it's way skewed toward them," says Sam Vallandingham, president of First State Bank in Barboursville, W.Va.

There are two ways for a Nacha ballot proposal to pass. Both require a supermajority of the vote.

The first method of passing a measure is straightforward: 75% of the group's 48 members must vote in favor.

Under the second method, the votes of member financial institutions are weighted according to the volume of payments they process, and the votes of regional payments associations are weighted by the number of institutions they represent. Nacha would not disclose the weighting formulas that are used under the second method, but says that in order for a measure to pass this way, it needs to garner two-thirds of the weighted vote.

And there's one more hurdle a ballot measure has to clear: if one of those first two thresholds is met, but two-thirds of either the financial institution members or the regional payment associations vote no, the proposal fails.

Nacha sent out a request for comment on the Expedited Processing and Settlement plan in September 2011. Comments the association received influenced the language of the eventual ballot proposal.

That five-page ballot proposal was sent to Nacha's 48 members in July 2012. Voters had roughly a month to cast their confidential votes electronically.

Ultimately, a majority of Nacha's members voted yes, according to the organization. But the proposal fell short of the supermajority needed under both voting methods.

"We set a pretty high bar with how rules get passed," Nacha's Estep acknowledges. "When 75% have to be there, you know, that is a really high bar."

Combined with the rule that gives more say to banks depending on their transaction volume, the 75% threshold effectively gives the biggest banks veto power. And by all accounts, they used it in this case.

Litany of Objections

Banks that opposed Nacha's ballot measure registered a number of objections.

They raised concerns about the price tag of implementing the changes, especially at a time when the industry was adjusting to a wave of new regulatory costs. They voiced fears that fraud losses would increase as the time provided to settle a transaction got smaller, since there would be fewer hours to detect malfeasance before the payment was finalized.

Opponents questioned whether the plan's upside would accrue only to those banks whose customers initiate electronic payments. And they expressed doubts about whether the proposal would yield sufficient benefits for West Coast banks, which would need to submit their transactions by 11 a.m. Pacific time to squeeze into the same-day window.

The proposal's supporters contend that some of those worries are overblown. For example, faster processing would allow banks to spot suspicious activity sooner, and could actually reduce overall fraud, they argue.

"I think the industry is much more ready for this than the industry understands," says Bob Steen, chief executive officer of Bridge Community Bank in Mechanicsville, Iowa, who has been a vocal advocate of speeding up the payments process.

But the big banks had other reasons to resist the Nacha plan.

The plan's most visible foe turned out to be The Clearing House, which acts as the trade group for the nation's largest commercial banks.

The Clearing House's list of owners overlaps heavily with membership in Nacha. In fact, the ten biggest financial institutions in Nacha JPMorgan, Bank of America, Citi, Wells Fargo, Bank of New York Mellon, U.S. Bank, PNC Financial, Capital One Financial, TD Bank and BB&T

A Clearing House official acknowledged that fewer than half of its bank owners supported the Nacha proposal, without naming specific banks.

"There were more that did not than did," says Dave Fortney, senior vice president for product development and strategy at The Clearing House. "But it wasn't overwhelming."

Nacha did not release any of the comment letters it received, so individual banks never had to take a public stand on the issue of faster electronic payments. But various industry groups, including The Clearing House and the American Bankers Association, have made their comments public.

The trade groups' letters don't say this explicitly, but many observers believe that some big banks were worried a faster ACH service would hurt their revenue from wire transfers.

"I do think it is one of the more significant factors," says Robertson, the payments industry analyst. "It's not one that everyone is going to readily admit."

Steve Keneally, a vice president at the ABA, acknowledges that some banks worried their wire transfer revenue might be cannibalized by a faster ACH service. Nacha's plan would have allowed same-day payments of up to $25,000, so banks might have lost certain wire transfers below that threshold.

"That's an issue that I'm sure all the banks that do have active wire rooms considered," Keneally says.

Backers of a faster ACH network also suspect that some big banks opposed the measure because they are looking to build their own proprietary electronic payment systems, which could give them a leg up over smaller banks.

Bank of America, JPMorgan and Wells Fargo are currently building one such system known as

American Banker asked representatives of the nation's four largest commercial banks about how they voted on last year's faster payments proposal. JPMorgan, Bank of America and Wells Fargo all refused to discuss the matter.

Citigroup, however, confirmed that it voted no. Changes to the payment system require "broad industry consensus," along with "a relatively simple path for financial institutions to adapt" and "a reasonable cost," says Citi spokeswoman Nina Das.

What Next?

One question raised by the episode is why a minority of Nacha's megabank-heavy membership should be able to kill a proposal that carries major consequences for the entire industry.

Nacha officials argue the 75% voting threshold is set appropriately high. "We want rules to have broad-based industry support," says Michael Herd, the group's managing director for ACH network rules.

The speed of the payments system is also vitally important to U.S. consumers and businesses. And while these parties can submit comments on Nacha proposals, they don't get a vote.

In Nacha's view, it's appropriate that only banks and credit unions decide the group's rules. "Because they are the institutions where the buck stops," Estep says. "They need to warranty the funds behind those transactions."

But if the banking industry can't agree on relatively small improvements to a creaky old payments system, how can it possibly find common ground on more sweeping changes? Is the ACH network doomed to be surpassed by faster-moving proprietary networks like clearXchange and PayNet, a service developed by the bank technology vendor FIS?

If the industry cannot act on its own, the Federal Reserve Board could, eventually, mandate improvements. So far the Fed is moving slowly, but it's showing signs of dissatisfaction with the status quo. The Fed, which has

"When it made its appearance in 1974, the automated clearing house was, at best, a next-day batch clearing and settlement system," Sandra Pianalto, president of the Federal Reserve Bank of Cleveland, said in a

Dave Birch, an electronic payments consultant in the United Kingdom, notes that his country's Faster Payments system was not the result of a collective push by the nation's banks.

"They were made to do it by the regulators," he says. "And I think in time that's what will have to happen in the U.S."

Next: Is the banking industry capable of modernizing electronic payments on its own, or is a push from the Fed necessary?