-

Bank mergers and acquisitions will increase only slightly as capital levels and regulatory limits prompt buyers to choose targets carefully, says Nadine Mirchandani of Ernst & Young.

January 2 -

Park Sterling Corporation in Charlotte, N.C., announced Monday that it is buying Citizens South Bank in Gastonia, N.C., in a deal that would instantly double its size.

May 14

The reasons to avoid acquisitions still outweigh the benefits, particularly in the Southeast.

That was the clear message to bank executives and directors who attended the North Carolina Bankers Association's annual Directors Assembly this week. Deterrents extend far beyond the

"M&A is a lot more complex to do than it is to talk about," Dave Gaines, the chief financial officer of Park Sterling (PSTB) in Charlotte, N.C., said during a discussion of the conditions influencing deal flow. Park Sterling

That sentiment prevailed in a separate presentation from Banks Street Partners. Though Jeff Adams, a managing director at the Atlanta investment bank, was slightly more optimistic than Gaines about the potential for consolidation, he repeatedly encouraged potential sellers to be more realistic.

"The buyers of the past aren't out there buying, and there are not a lot of new buyers," Adams said. "The banking industry needs a new breed of buyers."

Potential buyers are willing to take passes on acquisitions because of the time and expense of conducting due diligence, which can occupy an acquirer for up to six weeks, Gaines said. The exhaustive process includes a tape review of all of a target's loans, file review of up to 70% of credit exposures and a review of all board minutes and audit work from the previous three years.

"Due diligence is wildly different today," Gaines said. "Because it is so complex and so costly … we're out if something goes to a true competitive-bid situation. We'll let the private-equity guys have those. We will not allow ourselves to be the cover bid."

Buyers must be mindful of their institutional investors, who have lofty expectations for acquisitions, Gaines said. Their requirements often include a reduction of the target's costs by 30% or more, immediate accretion to earnings per share and a firm cap on potential loan losses.

"Investors do not want to see buyers incur too much book-value dilution," Adams said, adding the big shareholders are willing to wait three years at most before a deal starts to add value.

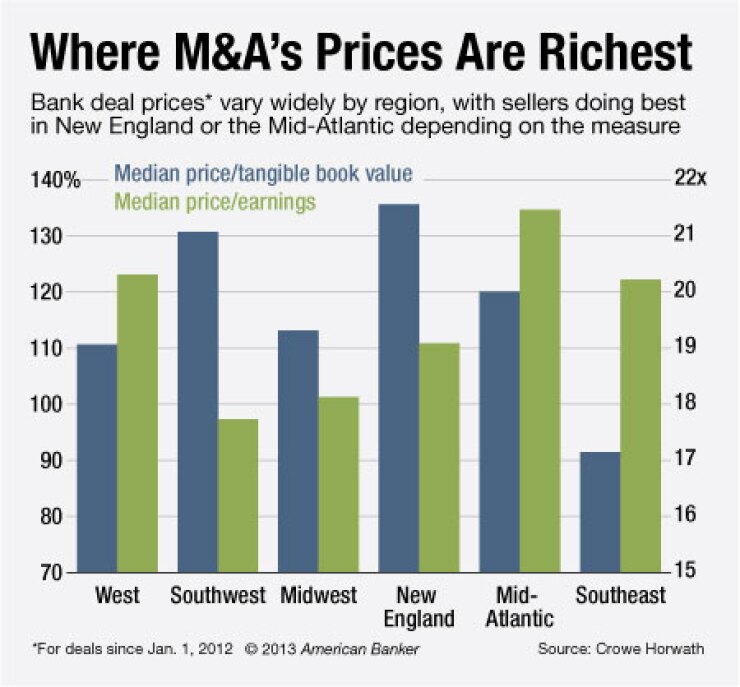

Banks in the Southeast are selling at the lowest price to tangible book ratios in the nation, with a median of 91.5% in the past 14 months. The median deposit premium for branch sales in the Southeast was 1.1% over that time, compared with 3.1% in the Northeast and 3% in the Southwest, according to the Crowe Horwath accounting firm.

"Problems are still running through the balance sheet," said Rick Childs, a director at Crowe Horwath, who spoke in the same session as Gaines. "It is going to continue to be a tough market [for sellers in North Carolina] until nonperforming assets get better."

"The reality is that we have worse asset problems in the Carolinas and Virginia" compared with most other states, Gaines said. "The sooner we realize that the better."

Sellers need to give buyers a compelling reason to do a deal, Gaines said. "If you don't offer a growth market or a product line, then you are just a cost play" where a buyer will gut the expense base to justify a deal, he said. "A buyer is not going to come in and fix your situation."

Accounting rules continue to douse cold water on deals, too. Gaines highlighted the accounting treatment for purchased credit-impaired loans, which "basically treats the loan book as a securitization" by viewing the portfolio as a pool of cash flows.

That treatment distorts credit and yield metrics and can lead to volatility in earnings and the timing of losses, Gaines said.

Moreover, Gaines warned about "hidden surprises." Those include change-in-control agreements, mismatches between the employee benefits packages of buyers and sellers, and vesting for executives' supplemental retirement plans.

"We've been nipped by some of these things," Gaines said, declining to identify the specific areas that have cost Park Sterling money. "And we have been fortunate to discover some of these before we got nipped."