-

Mortgage servicers tied to the independent foreclosure review settlement will begin sending the first wave of $1.2 billion in checks to troubled borrowers on Friday, federal regulators said.

April 9 -

The public and bankers need to know that the OCC is making sound decisions and doing the right thing. But when it comes to the multi-billion foreclosure settlement, the agency's actions are a failure on both fronts.

March 6 -

Thirteen mortgage servicers will begin compensating more than 4 million borrowers beginning in April as part of the amended consent orders released by regulators on Thursday.

February 28

WASHINGTON — Most of the checks that borrowers will receive from mortgage servicers as a result of an independent foreclosure settlement will be small and likely to disappear quickly.

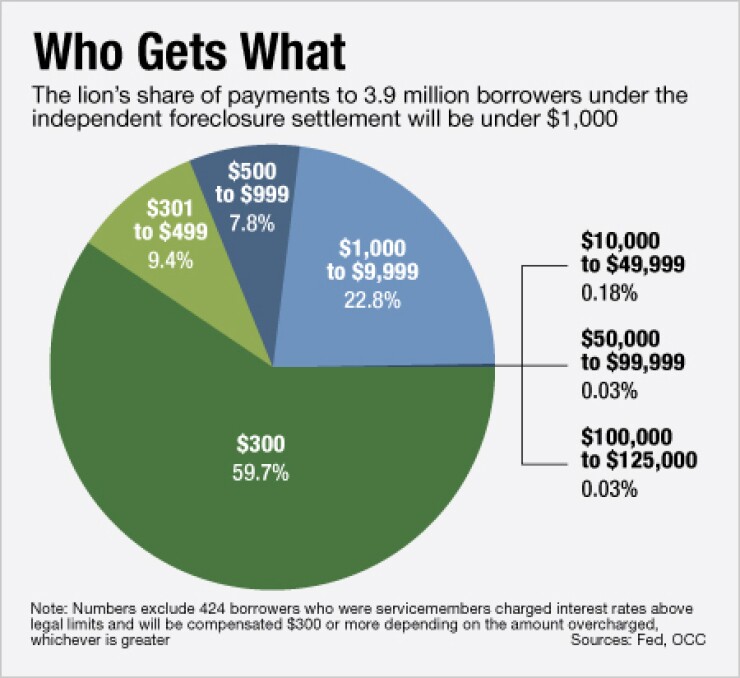

More than half of the roughly 4 million borrowers affected by the settlement will receive a mere $300. Overall, three-quarters of those borrowers who were in the foreclosure process between 2009 and 2010 will receive less than $1,000.

The $9.3 billion settlement with the 13 large mortgage servicers has been heavily criticized by lawmakers and consumer advocates after the Office of the Comptroller of the Currency and the Federal Reserve Board called off an independent foreclosure review process in January to get faster payouts to borrowers.

The payout details released Tuesday are likely to add more fuel to that fire.

"To me, it's a disappointing moment in an otherwise very disappointing process," said Debby Goldberg, special project director at the National Fair Housing Alliance. The categories "make it unnecessarily complicated and it creates a big spread between folks at the top and folks at bottom with no basis for doing that."

Regulators determined how much each borrower would receive based on their status of foreclosure or modification as well as whether the borrower filed a request for review before a regulatory deadline.

While affected borrowers will receive at least some money, the amounts do not take into account whether there was actual harm, critics say.

The cash compensation spans from $300 to $125,000 per person, most of which will go out this month with the final round sent out by mid-July.

A majority of the borrowers who are receiving the lowest amount had either been approved for modification, or the servicer did not engage a modification or loss mitigation as of the end of 2011. The 1,135 borrowers receiving the highest amount of $125,000 went through full foreclosure and were either service members who did not get appropriate legal protection or were not actually in default.

Yet some borrowers still in the foreclosure process — who were not actually in default — will receive far less. Such borrowers will receive $5,000 instead of the full $125,000 if their foreclosures were not completed by late 2011.

"It's just too little, much too late given the magnitude of the problem," said John Taylor, the head of the National Community Reinvestment Coalition. "It's a dismal part of history when it comes to mortgage finance."

According to statistics provided by regulators, there were more than 600 cases where borrowers were in the foreclosure process despite never being in default. At a minimum, that statistic is likely to be used to combat claims by banks that they did not foreclose on borrowers who were on-time with their payments.

Yet the lack of details on the statistics leave open the possibility that there were other legitimate reasons behind the foreclosure, even if critics are likely to be skeptical.

Some borrowers will also receive less if they failed to file for remediation.

Nearly 90% of the borrowers identified as part of the settlement will receive a smaller amount because they did not file a request for review with regulators by the deadline. Those who did file a request received almost twice as much in cash for the same categories. For example, the 763 borrowers who filed a review request after being foreclosed on while under bankruptcy protection will receive $62,500. But borrowers in a similar situation who did not file a request — a total estimated as 5,075 people -- will receive $31,250.

"The outreach process that was conducted was very flawed … there were a lot of people who never knew this process was going on," Goldberg said. "And they certainly never knew filing would make a big difference in how much money they would get."

Regulators at least identified a large number of borrowers that will receive some kind of compensation quickly. The first wave of more than one million checks totaling $1.2 billion in checks will be sent out Friday. Had the regulators proceeded with the costly and prolonged independent foreclosure review, it's unclear whether the same amount of people would have received something similar and when.

"Under Comptroller [Thomas] Curry, there has been a real effort to get money to people as quickly as possible and that has been a sea change" at the agency, said Ruth Susswein, deputy director of national priorities for Consumer Action. "However, the fact that some people who have been egregiously harmed may end up with a few hundred dollars is, at a minimum, inadequate."

There is no appeals process if a borrower disputes the payout amount or category they've been placed under. But regulators said Tuesday that borrowers who receive a check can also take other legal action with their servicer. Servicers are not allowed to ask these borrowers to waive legal action in relation to the payments.

"The OCC says it's committed to helping people here," Susswein said. "So I hope that ends up being exactly what happens."

The other $5.7 billion from the settlement will be credits to the servicers for offering foreclosure prevention assistance to affected borrowers based on the full unpaid balance of the mortgage. That, too, has created concerns for consumer advocates who argue servicers will be more likely to help borrowers with larger mortgage amounts to get a larger credit than the low-to-middle income borrowers.

"It's going to be hard to use the provisions as they've been written to steer servicers to actions that would save" more people, Goldberg said. "There is some renewed attention to issues, both at the Fed and OCC, and a desire to help save homes but whether they put it into practice is a question."