-

Bankers have reservations about building apps for Google's much-hyped wearable device, but they see real promise in adopting technology that would work with wireless beacons in branches and stores.

April 24 -

American Banker's Mobile Banking Intensity Index showed consumers' use of mobile banking apps picked up in December.

February 27

Banks have strongly increased their investment in mobile banking technology this year, according to a recent American Banker poll.

More than two-thirds (68%) of bankers said they're spending more on the channel this year than they did last year; a fifth (20%) say they've increased spending by more than 50%. One third (33%) have increased their mobile banking budget by 11% to 50%.

The added investment is no surprise. Banks are under tremendous pressure to keep their mobile banking apps up to date. The pressure emanates from consumers, whose expectations for phone and tablet banking rise constantly; from large-bank competitors with the deep pockets and in-house programming expertise to create state-of-the-art apps; and from smaller direct-bank competitors that move nimbly and tout their ability to remove "friction" from banking.

Unless they create state of the art mobile banking technology, banks, especially small and midsize ones, risk losing customers.

By contrast, there's far less urgency around the more mature online banking channel. In the same survey, which polled 262 bank executives in April, bankers reported smaller increases in their online banking budgets. Only 2% of bankers increased their PC banking budget more than 50% this year. Just under a third (31%) upped their spending on online banking tech by 11% to 50%.

American Banker's monthly survey of mobile banking activity, the Mobile Banking Intensity Index, also found that customers did more banking on smartphones and tablets in April than they did in March.

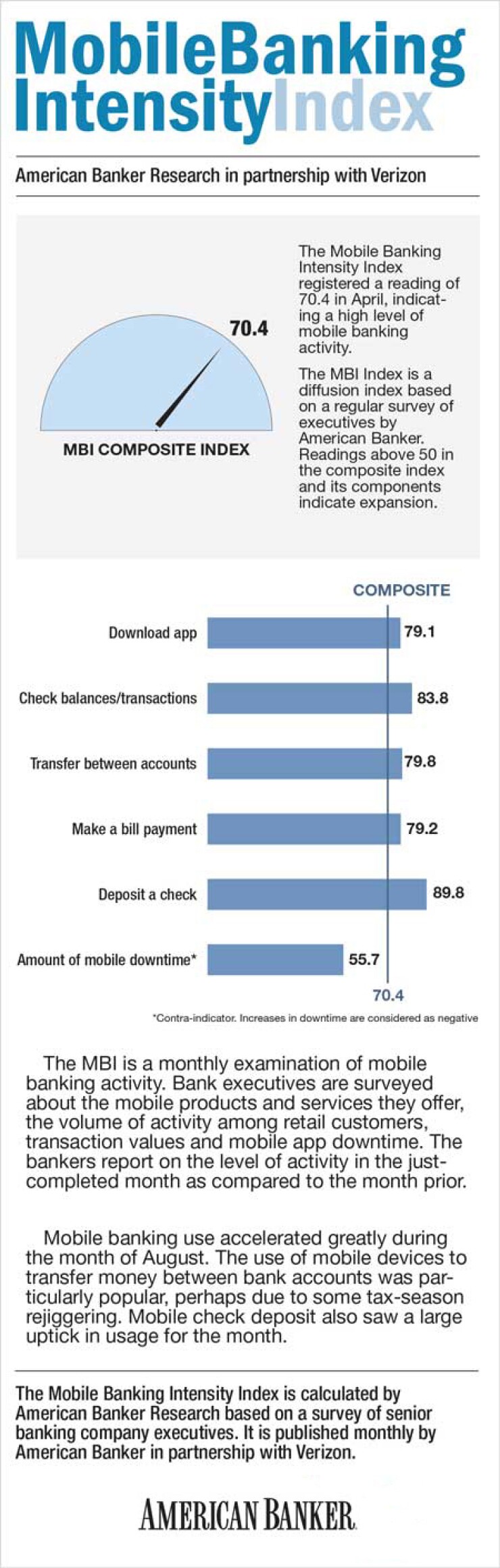

The overall index value, which tracks growth in use of various mobile banking activities (such as mobile check deposit) adjusted for contra-indicators (such as mobile app downtime), had an overall value of 70.4, a modest rise from the previous month's 69.8. Any value over 50 indicates strong growth.

Mobile check deposit was particularly popular in April: 80% of bankers said the volume of activity from retail customers using a mobile device to deposit a check was higher in April than in March; 20% said the rate of activity was the same as the preceding month.

Mobile funds transfer was also well used. About 62% of surveyed bankers said their customers conducted more funds transfers on their devices in April than in March, while 36% saw a steady level of activity.

The latest survey asked bankers if they were trying to achieve an "omnichannel," a state of consistency such that a bank's different channels (mobile banking, online banking and branches) offer similar products and provide a comparable experience. About 28% said they are trying to create such consistency, about 41% said they didn't know, 16% said they were not, and 15% were on the fence. There's been a bit of a debate about the omnichannel concept in the industry. Some say it's important to give consumers the same access to products no matter what channel they use. Others say it's impossible to provide the same experience on all channels.

"A symmetrical user experience makes it easier to transition customers from deposit only to various loan products, and helps us manage them throughout their life cycle. It also makes support by staff easier, since the products all work in a similar manner," one survey respondent wrote.

Another scoffed, "Omnichannel is an industry and consultant buzzword we have always been committed to providing a seamless, positive customer experience."

A few respondents noted the technical challenges of integrating channels.

"With all our different platforms, cross-channel is proving difficult maybe we are a 'modified omnichannel'?" one banker said.