This article is from the annual

The high-tech branch upgrade is no longer a luxury project for the deep-pocketed.

Futuristic concepts, talked about for upwards of a decade, are becoming reality as financial institutions give their bricks and mortar digital makeovers. The overhauled designs often include: smaller square footage; tablet devices; free wi-fi for guests; the striking absence of a teller line; and concierges who will direct visitors to an appointment with a banker booked online.

True, financial institutions are also closing branches as consumers increasingly transact through digital alternatives. However, branches still generate more sales than any other channel. And the new breed of branches is expected to gain steam well into 2015 and beyond.

"It's not that the branch is dead," said Bob Meara, a senior analyst in Celent's banking group. "[But] we have to do something and it's rather urgent this time when consumers are changing so significantly."

What that "something" should be is an open question, however.

"We know what the consumer is doing. They have made it clear," said Debra Stewart, a financial services consultant. "Now the question is: 'What is the right response?' There are so many different approaches to solving the same problem."

Bank of America has been testing the use of video tellers who work from a centralized place and communicate with customers over video streamed to select Teller Assist devices throughout the country. UMB Bank, in Kansas City, Mo., appoints in-branch tech support specialists who teach customers how to use, say, online bill pay. Wells Fargo has debuted a tiny branch with ATMs that interact with employees' tablets and spit out a variety of bills.

These enhancements come on top of investments banks have been making for years to automate mundane tasks. Budgets have been allocated for cash recyclers, teller image capture software, and image-enabled ATMs -- all technologies meant to help automate what had been manual teller work.

"They have to bring down the cost to service," said Kevin Travis, managing director at the consulting firm Novantas. "The question is, 'How do I have to spend to get to these cost savings?'"

In to a recent SourceMedia survey, 17.8% of bankers said they are considering investing in branch sales support in 2015 or 2016.

If that pans out, the investments are likely aimed at shifting the purpose of the branch's existence to a sales and service hub from a transaction center.

Scaling the makeover work, however, will take time.

"Making sweeping changes in the branch network is a very difficult chess game," said Meara. "Ripping and replacing everything in one fell swoop is not going to happen."

THE LATEST CROP

This fall, Eastern Bank, Regions Bank and Rivermark Community Credit Union were among the financial institutions that debuted branch designs with new technologies baked into the experience, including video teller machines instead of traditional teller lines.

Rivermark said it is trying video because of the acceptance the technology has gained, even in recent months.

"We just think the timing is right," said David Noble, vice president of marketing for the Beaverton, Ore., credit union. "Be it Skype or a Google Hangout, people are more familiar with [video]."

Typically, financial institutions turn to video tellers to save on operational costs, allowing them to keep their branches open longer. Video tellers can also perform tasks old-fashioned ATMs can't, such as let people identify themselves with a driver's license instead of a debit card.

Regions Bank views video machines as but one element of a broader menu of branch design options. Like other financial institutions, Regions envisions an assisted self-service approach where employees are free to advise customers about more complicated transactions while customers get to choose between self-service or full service.

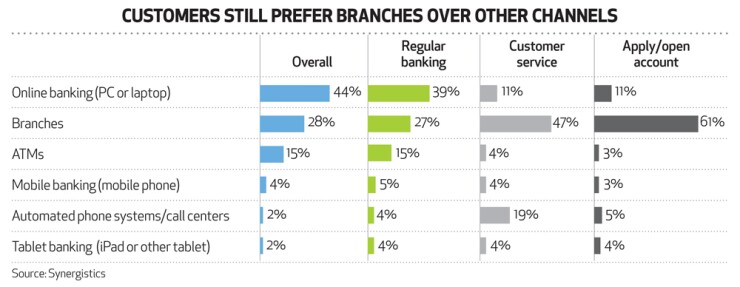

Sixty percent of Regions' customers report using a branch once a month while 80% of all sales take place in the channel. "We still think the branch has a critical and important role going forward," said Shawn Bradley, head of customer insights and analysis at the Birmingham, Ala. bank.

Eastern Bank shares this opinion but is taking a somewhat different approach. In September, the Boston lender opened a 350-square-foot branch on the campus of a community college a short jaunt away from a traditional branch. The tiny branch has a defined mission: sign up new customers in an area that is heavily trafficked. It also signals the bank's future approach to branches.

"Any branch we open will be a smaller footprint," said Robert (Bob) DiGiovanni, director of retail banking and senior vice president of Eastern Bank.

The mini-branch model includes an area where people can use tablets to test new products and a conference room encased in glass, which can be frosted with a flip of the switch for privacy.

The $8.8 billion-asset mutual thrift has more branch investments planned.

"Next year will probably be the busiest year in terms of projects and tech and branch renovation," DiGiovanni said.

Eastern is upgrading its ATMs for deposit automation in addition to testing NCR video technology and replacing teller lines with pods. Its broader, ongoing goal is to convert the vast majority of its tellers into universal employees, who can just as easily demonstrate online bill pay as sign up a new account.

This reflects a broad trend: tellers are turning into experts on everything.

Financial institutions are "moving aggressively toward universal employees," said Novantas' Travis. "That will continue."