-

JPMorgan Chase & Co. (JPM), the lender whose legal and regulatory battles led to more than $23 billion in settlements in 2013, said Chief Compliance Officer Cindy Armine left to join another firm after a year on the job.

February 25 -

The company is "committed to the mortgage business for the long run" despite current challenges facing the industry, mortgage banking chief executive Kevin Watters says.

February 25 -

JPMorgan Chase said it would eliminate about 8,000 jobs in the consumer and mortgage banking units this year as demand for refinancings declines.

February 25 -

JPMorgan Chase plans to develop a one-click checkout option for its customers when shopping online or through mobile devices.

February 25

JPMorgan Chase (JPM) laid out a careful plan for a better 2014 on Tuesday, announcing both expense cuts and plans for growth as the country's biggest bank tries to recover from a year spent paying for past mistakes.

Chief Executive Jamie Dimon, Chief Financial Officer Marianne Lake and other senior executives presided over JP Morgan's annual investor day in New York, sketching out a strategy that involves more job cuts among its mortgages and consumer banking staff; rethinking the size and features of its branches; and relying even more heavily on its blockbuster asset-management business for growth across the bank.

The daylong presentations came after a profitable but bruising reputational year for JPMorgan, which saw the bank agreeing to pay more than $20 billion to settle regulatory and legal complaints over a variety of its operations. Like other big banks, it is also still adapting to changing regulatory standards over operations including trading and investment banking.

"We see 2014 as a transition year," Lake said several times during her opening presentation, using a phrase that other executives echoed throughout the day. Here are three parts of that planned transition:

1) No more fines? Changing regulations are still weighing on the bank, but executives seemed optimistic that the worst of their regulatory run-ins are over. In the last few months alone, JPMorgan agreed to pay the government $13 billion over the mortgage-backed securities it sold before the financial crisis, and made a $2.6 billion deal in January to settle charges over its involvement in Bernard Madoff's Ponzi scheme.

"Obviously we had a little bit of a tough time last year," but "I'm particularly happy with the resolve and resilience of our people," Dimon told the audience towards the end of the day.

He would not comment much on the past settlements or potential future ones, aside from saying: "We've gotten some behind us. We'd like to get more."

2) Trimming rather than slashing: The bank announced several thousand more job cuts, amplifying and accelerating plans laid out a year ago. In early 2013, JPMorgan said it would cut up to 15,000 jobs in mortgages and up to 4,000 jobs in the rest of its consumer operations by the end of 2014. On Tuesday, the bank revised those numbers: it now plans a total of 17,000 mortgages job cuts, 11,000 of which have already happened; and it now plans 7,500 cuts in its card and consumer banking businesses, 5,500 of which have already happened.

Many of those non-mortgages staff reductions are coming from JPMorgan's branch network, which is still growing but in a different form than the bank had apparently intended even a year ago, when executives

JPMorgan is now moving "from a branch-build strategy to an optimization strategy," Barry Sommers, the bank's consumer bank CEO, told investors.

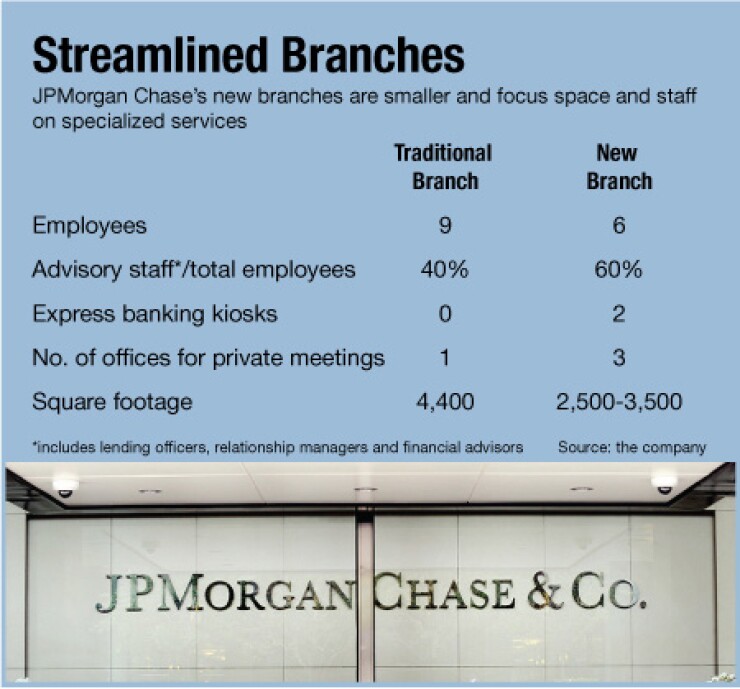

What that "optimization" means is that JPMorgan is now planning to shrink the size and staffing of its physical locations, turning them into high-tech automated offices with an average of two tellers per branch, rather than four. At the same time, the bank is increasing the number of meeting rooms it will have on hand at its branches, so that the wealthy customers it most wants can meet with financial planners and buy more of the asset-management services that JPMorgan is increasingly relying on for revenue growth. The bank built a model "Branch of the Future" in a lobby next to the conference rooms, so that investors could examine its new design during the breaks.

JPMorgan Chase is also heavily relying on technology to offset its shrinking branch size and consumer bank manpower. Its new branches will have automated "express banking kiosks," and the bank announced a series of online payment developments, including a one-click "

3) A wealth of wealth management: A main bright spot for JPMorgan Chase in 2013 was its

Mary Callahan Erdoes, who runs JPMorgan Asset Management, called her unit's coordination with other businesses one of "the most important" parts of her future strategy.

"All of the people in our private bank are partners with all of Mike and Daniel's people and all of Doug's people," she said, referring to Mike Cavanagh and Daniel Pinto, the co-heads of the corporate and investment bank, and Doug Petno, the commercial banking CEO.

She also mentioned her coordination with JPMorgan Chase's retail bank and its (relatively-speaking) less wealthy customers. That involves "being able to take what we have done for billionaires, and package it for people who walk into the branches," Erdoes said.