-

Social Money announced Thursday an API that lets PFM and prepaid partners introduce savings accounts and goal tools to their digital customers. Already, Social Money partners with The Bancorp to resell its technology to other businesses.

October 3 -

Digit, a startup in San Francisco targeting millennials, has launched a service that crunches checking account data to determine daily amounts to automatically transfer into users' savings accounts. Its debut points to how personal financial management services are growing up to do the work on the consumer's behalf.

February 25 -

Technology reporter Mary Wisniewski muses about the many personal financial management products out there, many of which she has recently tested, and concludes that while they don't fit one definition or set of expectations, that's ok.

January 11 -

It is the season for added expenses and, for many, worrying about cash flows. Financial service providers report holiday products are popular with customers, though not a money-maker. Next-generation financial management software could let people segment their money into goals through one account.

December 18

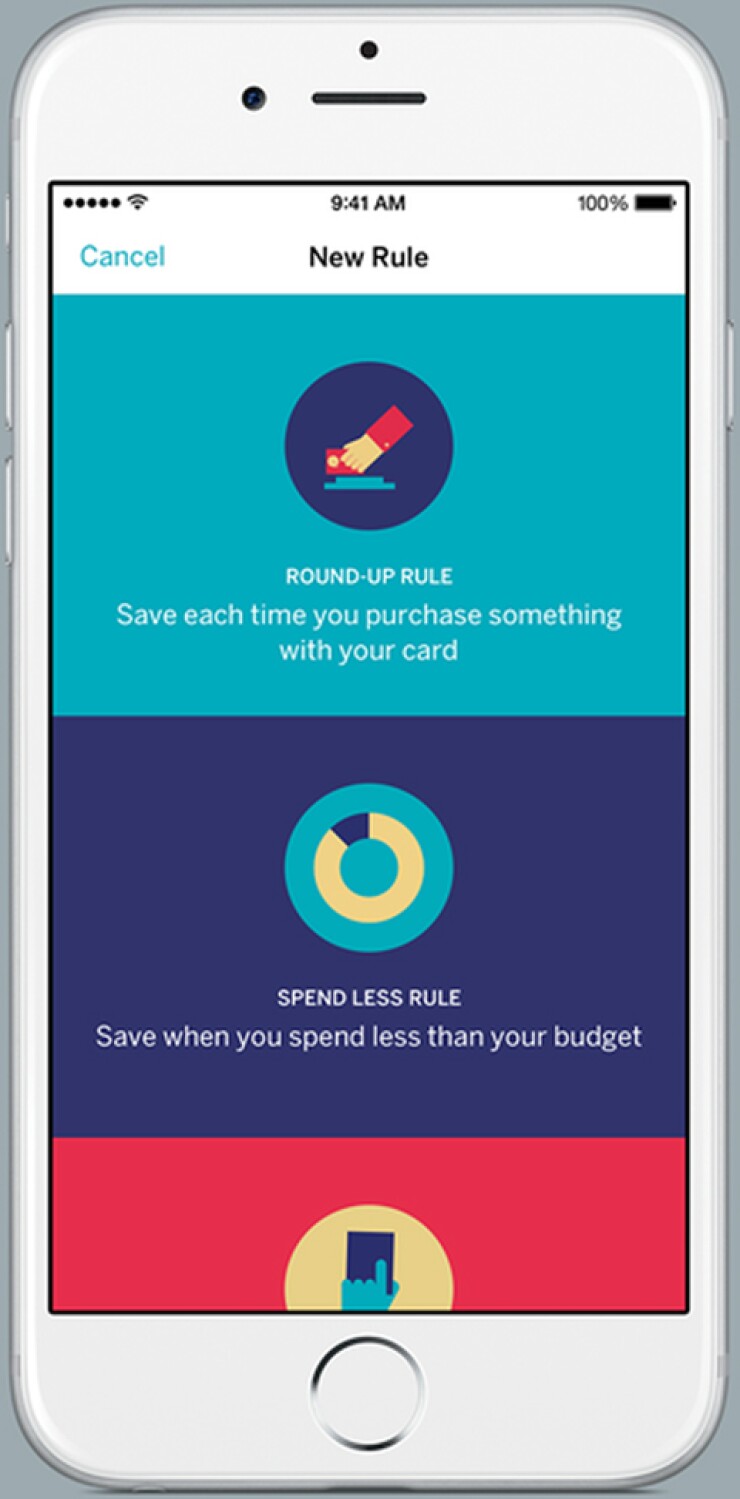

Trending soon on mobile banking (just maybe): automatically paying oneself while buying stuff.

Qapital, which recently raised $1.3 million in seed capital, wants millennials to use its smartphone app to set personal-finance goals and automatically transfer sufficient money into savings accounts in order to meet those goals.

The startup which went live with the app in its home country of Sweden in 2013 is poised to publish its mobile app for iOS in the U.S. in mid-March. It has been quietly testing its technology since late last year with Lincoln Savings Bank in Waterloo, Iowa, which provides the savings accounts.

Qapital's planned entrance will make this the second app aimed at rethinking savings for younger audiences in recent weeks alone. Digit, a

Unlike Qapital (which pays users 0.10 per cent), Digit does not yet pay interest and chose to deliver services by text messages.

Both, however, share a view that small savings deposits add up and they are targeting an audience in desperate need of help. According to data compiled by analysts at Moody's Analytics, adults under 35 had a savings rate of negative 2% in 2014. That's right: negative.

The disrupters are betting consumers just need the right type of experience delivered on their mobile phones to help build their savings slowly but surely.

They, of course, are not alone.

American Express has been studying which technologies influence savings for its reloadable prepaid card Serve. The Center for Financial Services Innovation (CFSI), which works with banks, has long explored technologies designed to improve financial health. And

At Qapital, users will be prompted to establish goals to guide their savings efforts after linking their checking-account data to the app. Users can set up a rule to round up the change on card purchases to the nearest dollar or two dollars, which is reminiscent of Bank of America's "Keep the Change" program. Qapital users could also set rules to spend less: they could tell the app they can spend $400 on Uber per month. Then, if they only spent $300, the "extra" $100 would be routed to Qapital-branded savings accounts.

The idea is to set up a way to save small amounts passively something that increasingly matters as more transactions are card swipes or phone taps.

"It's about tweaking things for everyday growth," said George Friedman, founder and chief executive of Qapital. "It's our approach to savings. People don't save by sheer willpower [of] 'I'll start saving now.' It would have happened."

Broadly speaking, Qapital wants to mimic Pinterest, a photo-sharing site known for its beautiful user interface and for helping visitors visualize their ideal lives. Likewise, Qapital wants to show that users can create a nice life by saving and spending smarter to make their goals into realities without taking on debt.

Stessa Cohen, research director at Gartner, said letting consumers divide savings into buckets that match their goals is more in tune to their behavior. "I want to keep the money I'm saving for a new car separate from the money I'm saving for a refrigerator and separate from the money I'm saving for painting my house," Cohen said in an email.

Its American debut points to the larger story of how personal finance has been evolving. What had been pie charts and read-only insights is turning into ways for people to take action. Simply put: personal financial management and mobile banking are

"We call it mobile banking because it is," said Friedman.

The Bank Angle

The path to its American debut has been one made through partnerships. In addition to the bank, Qapital partnered with Plaid to aggregate financial-account data. It is using core processing technology from Social Money marking the first nonbank in the U.S. to go live with what Social Money calls

The strategy also has implications for Lincoln Savings: the bank is using Social Money's CorePro API for the Qapital accounts it holds in addition to continuing to use its existing core vendor for other accounts.

The decision to use an additional core system for a millennial audience comes down to the math. CorePro's infrastructure is cheaper than if the bank added Qapital accounts onto its existing core which matters when the target audience may not yet be profitable and can open Qapital-branded accounts with as little as a penny.

Scott McCormack, chief executive and president of Social Money, said CorePro costs up to a penny a day per demand deposit account with unlimited sub accounts.

Years ago, Social Money used Microsoft Azure Cloud to build its CorePro processing system for its digital consumer-facing product SmartyPig. In so doing, it created software that is leaner than typical legacy infrastructures, and therefore cheaper. McCormack says the average price on an account running on a typical platform costs $1.50 a month, a price point that would make it difficult to generate profit or break even at a time when institutions' fee revenue is under attack. CorePro, which is available to banks and nonbanks, is meant to help them reach underserved audiences like millennials.

"There is such a large number of individuals who need to be reached with better financial services experiences," McCormack said. "Reaching customers through mobile devices and providing them tremendous value is clearly an opportunity."

Lincoln Savings sees its Qapital partnership as a way to grow deposits, get exposure to new technology, and gain data insights on the mystifying demographic of millennials.

The partnership also speaks to the way some firms are reimagining savings accounts including Lincoln Savings. Indeed, the institution plans to introduce goal-based savings to its customers as it works to know them better in a digital age and at a time when branch transactions are declining.

"Behind every savings account, there is some story," said Mike McCrary, the executive vice president of ecommerce and emerging tech for Lincoln Savings.

The goal-based accounts, if used, will give the bank data to potentially cross-sell customers, but arguably more important, to collect insights into their goals at a time when branch transactions continue to decline.

McCrary views the upcoming bank-branded experience and the Qapital-branded experience as suited for two different audiences.

Qapital's partnership strategy, meanwhile, helps it get to market quicker which it views as critical for a startup seeking to build a brand. "You want to test a hypothesis as soon as possible," Friedman said.

Qapital, which is also open to partnering with other banks, is focused on growing its user base and building daily engagement. "You have to prove the product makes sense," Friedman said.

Soon, the Qapital experience will integrate with a prepaid debit card, which will also let the startup collect on interchange fees.

The longer-term goal, of course, is for Qapital to offer more services. The data it collects, after all, will help the startup understand users' risk levels. Without getting into many specifics, Friedman said Qapital's trajectory is turning everyday use cases into helping users know how to cut down the price of one of their existing financial products.

"It's not hard to imagine it being something about student loans," Friedman said. "It is an unbearable situation for a lot of them."