Lending to developers and builders is community bankers' bailiwick … and sometimes their bane.

In good times construction lending keeps community banks thriving, but the financial crisis of 2008 brought down hundreds of small banks because they were heavily exposed to commercial real estate.

Perhaps there is a tech solution to avoid or soften the bad times, some fintech vendors say. Granted, no software can prevent real estate downturns, but construction lenders' reliance on spreadsheets, file folders and sticky notes is said to add hazards. Their platforms, the vendors say, can streamline the process and make it safer.

Lexie Garrison, senior credit officer at Valliance Bank in Oklahoma City, agrees. Her $366 million-asset bank began using construction loan automation software from Little Rock, Ark.-based BankLabs two years ago. Residential and commercial construction loans make up 15% of the bank's portfolio, and that figure has been as high as 23% this year, she said.

"Construction loans are typically seen as the largest risk to a bank's portfolio," Garrison said. "Anything that makes these loans less risky is a huge benefit."

Since implementing BankLabs' automation software, Garrison said, the bank has sped up the lending process and reduced errors. Previously a draw from a loan involved multiple people, cross-referencing spreadsheets and could take as long as three days.

"Now we have completely eliminated the use of spreadsheets, and the draw process has virtually become instantaneous," Garrison said. "The time spent communicating with borrowers and builders has also been significantly reduced as they can now log on and see all of their respective loans in one spot, be notified of inspections, and request draws from online rather than via the phone or email."

Also, the addition of BankLabs has delivered what automation is supposed to bring: fewer exceptions and problems.

"The margin for error has been nearly eliminated as there is little to no risk of human error or formula error when it comes to calculating percent complete versus percent advanced," she said.

Valliance's old way of doing business is the status quo at many banks, says Chase Gilbert, president and co-founder of

"The way these loans are managed … involves spreadsheets, phone calls, emails, faxes, a lot of back and forth and complex coordination among parties; it's extremely inefficient," he said.

But it's not just about improving the back-end experience; Garrison said the bank's clients like the mobile and digital capabilities.

"A lot of builders have multiple bank relationships," she said. "We weren't their only bank, so if they wanted to check the status of something, they would have to call and figure out: 'Which projects do I have financed with you?' Now they can check on their phone while they're sitting in their office or out at a site to check up on any information they need."

Customers of all ages have embraced the digital options, Garrison said.

"You have your newer owners, maybe sons that have come in and taken over for a retiring father, and they are more tech-savvy," she said. "But also a number of our old-school builders – guys set in their ways and don't want to change – now ask to use this and they like it."

With a higher level of exposure to construction loans, along with an increased regulatory burden, it's important for community banks to improve loan origination and monitoring to minimize loan losses, said Patricia Hines, a senior analyst with Celent. Technology is an ideal way to go about that.

Hines recalled a small bank that several years ago almost failed because it had a large outstanding construction loan no one remembered. During the housing crisis of 2008, tales of forgotten construction loans came up occasionally, especially when failed-bank buyers sorted through the books.

"Historically, smaller banks do not have the kind of monitoring capabilities that larger banks do," she said. "So if they can use technology to help them monitor these loans better, I give them credit."

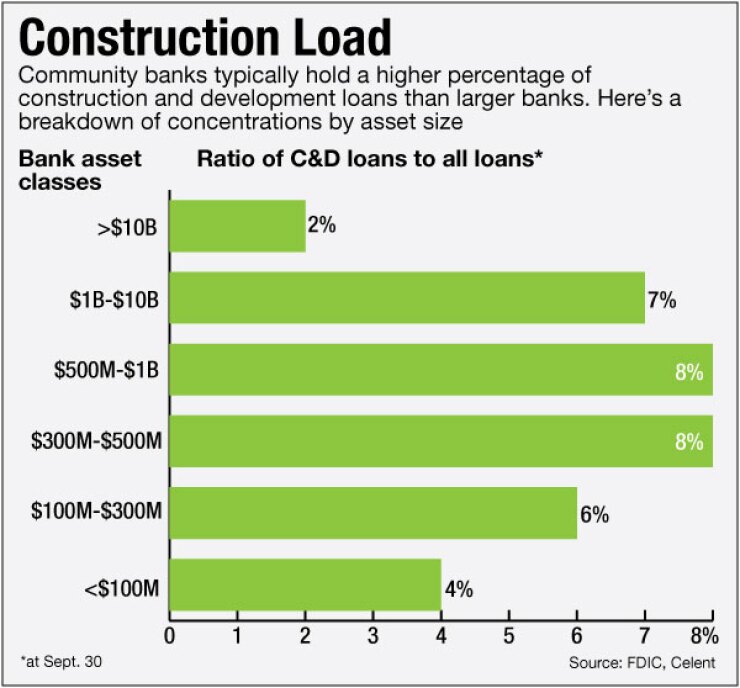

This is especially important for community banks, which tend to hold a higher percentage of construction loans.

"Although banks of all sizes have reduced their exposure to construction loans on a percentage basis, community banks still hold a higher percentage of construction loans on their books as compared to regional and national banks with more than $10 billion in assets," Hines said.

Matt Johnner, president of BankLabs, a division of Radius Group, says banks often need a nudge to try its product.

"We are creating demand," Johnner said. "There aren't many banks sending out RFPs for this; but once we meet and they hear about it, they are interested."

That was the case with Valliance, and Garrison said the technology puts the bank in a position to compete with its larger rivals.

"We don't have a big retail presence," Garrison said. "That can make it difficult to compete with the larger banks, but we are just as tech-savvy as anyone out there."