-

This year, bankers seemed to remember in a big way that first-class technology is critical to their competitiveness and relevance.

November 12 -

More banks are deciding to invest millions in mobile banking, video tellers and core-processing upgrades after avoiding capital spending for a long time. They says it's a good move for the long term, but some will take heat from investors and other critics in the short run.

March 26 -

Digital banking, marketing analytics and the 'omnichannel' top bankers' technology shopping lists for the coming year.

December 18

Optimism about business growth and a rising sense of alarm at security breaches are shaping U.S. banks' tech spending plans for 2015.

Top spending initiatives are planned in the areas of security, analytics and digital banking (an umbrella term for online and mobile), according to research and anecdotal evidence. Meanwhile, the basic costs of keeping the lights on and running the IT infrastructure are dropping, thanks to hardware and software commoditization.

"We're being laser-focused on areas where we're willing to invest and holding off on other areas," said Bruce Livesay, the chief information officer and executive vice president for technology and operations at First Horizon in Memphis. Compliance, digital banking and analytics are the bank's top three IT spending categories for the coming year.

Overall, research firm Ovum expects U.S. banks to spend 4.3% more on IT in 2015 than they did in 2014.

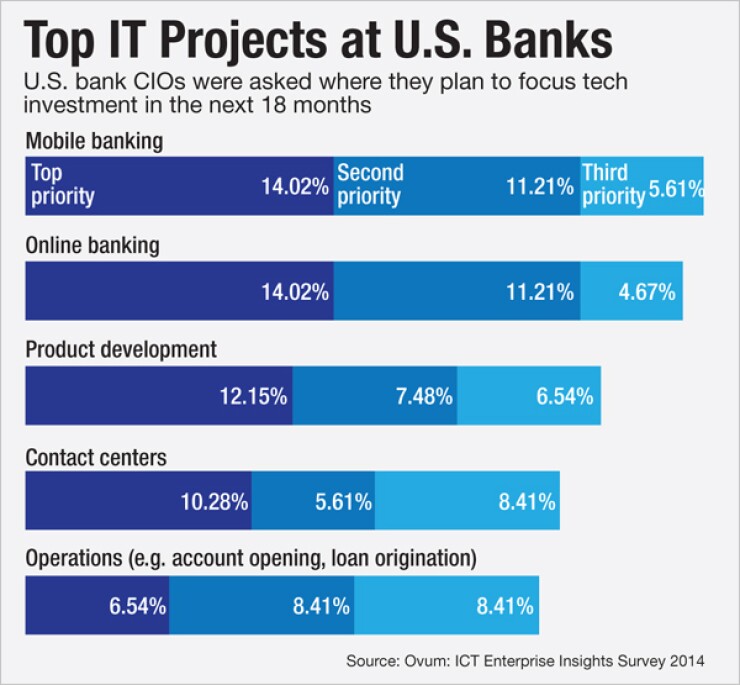

The firm recently surveyed 500 CIOs and IT decisionmakers in the U.S. banking industry about their budgets and project priorities. The research has not yet been published, but Kieran Hines, practice leader of the financial services technology practice at Ovum, shared some findings with American Banker.

"We see a big uptick in investment in the retail banking side. That's partly due to the economic picture, which looked rosy in the middle of the year; it looks less positive now," Hines said. "What we're hearing from vendors and banks is there's more optimism about the immediate future and there's a shift from compliance-based spending to projects that will drive growth." Projects to simplify and streamline processes in the front and back ends of banking are becoming a high priority.

However, at some banks, compliance still consumes a large chunk of the tech budget. At First Horizon, for instance, "the amount of time being spent on regulatory/compliance changes is increasing," said Livesay. "It is eating into our capacity to do other business changes." This year, compliance grew to 25% of the bank's tech investment.

Overall, IT spending as a percentage of assets decreased in 2014, according to a report from the consulting firm Cornerstone Advisors that benchmarked 80 mid-size U.S. banks. This mainly reflects the fact that hardware costs have dropped and cloud services are cheaper.

"Banks have done a good job taking advantage of commoditized pricing, things like cloud services that have a cheaper cost," said Terry Roche, a partner at the Scottsdale, Ariz., consulting firm. "When you're in a mature, commoditized business, that's what you have to do."

This leaves some funds for more strategic IT spending.

DIGITAL BANKING

The two biggest centers of IT spending growth among North American banks for the coming year, according to Ovum, are mobile banking, which is expected to grow 7.5% next year, and online banking, which expected to rise 7%.

"Digital is an ever-important channel," said Livesay. "This includes retail and commercial online banking, mobile banking, ATM banking, and new payments capabilities such as Apple Pay. As banks work to provide a differentiated customer experience, we are working hard on omnichannel solutions and consistent experiences across platforms."

Jacob Jegher, a research director at Celent, is seeing many banks build responsive design websites, develop tablet apps and enhance their online banking systems. "That's consistent with what we've seen in past years and there's no sign of a slowdown."

He cites Capital One's recent purchase of the digital marketing firm Adaptive Path and BBVA's purchase of the "neobank" Simple and its partnership with OnDeck (in which it will refer small-business customers who might not qualify for a bank loan to the online lender) as examples of banks making radical changes to their digital channels. Banks will continue to seek new partners and acquire and create venture arms, accelerators and innovation labs in 2015, Jegher said.

"These alternative methods of doing business change the way dollars are spent on IT," he said.

Wealth management is an area of interest for digital banking initiatives. "Increasingly in the wealth space, the younger affluent customer tends to be more interested in self directing their investments," Hines said. "That industry is moving from the traditional pinstripe suit, braces, country club kind of thing to high-net-worth individuals becoming more interested in being involved, in being given a range of options" for digital self-service, he said.

ANALYTICS

The next-highest area of bank's tech spending for the coming year is expected to be customer analytics. Ovum's researchers expect U.S. banks to spend 5.8% more on analytics in 2015 than they did this year. "There's a lot of interest in solutions that can help banks drive up cross-selling and the average product holdings per customer," Hines said.

"If you know what a customer is doing in real time, you can be quite precise about knowing the next product that customer is likely to be interested in," he said. "The challenge a lot of banks have at the moment is getting that single view of the customer. To do that in real time or near real time is the next level beyond that." The next challenge is turning that information into product improvements.

At First Horizon, "we are very focused on using information for business insight," Livesay said. "This is another area of ongoing technology investment. We want to provide our bankers with useful insights about their customer relationships and economic profitability. We also want to provide our customers with better information via self-service."

Cornerstone saw a 27% increase in spending on data warehouses this year among the midsize banks it monitors. "The data warehouse is an investment that's probably been delayed a couple of years," Roche said. "A lot of people wanted to invest in a data warehouse in the past and they got trumped by other initiatives.... No one is bringing banks a turnkey data warehouse strategy, so they're having to invest to do it themselves and they have so many disparate systems, so many different sources of information, so many data points coming from different systems and vendors, that management is demanding they be turned into business intelligence."

The money to spend on such Big Data projects has been freed up by the commoditization of pricing in core systems, data communications, infrastructure and remote delivery, Roche said.

SECURITY

Jegher is seeing "massive" increases in spending on security and fraud technology initiatives among U.S. banks.

"Financial institutions continue to fight the war against the fraudsters and it's on all fronts, across all channels," he said. "That's why it's getting interesting. You've got everything from sophisticated [distributed denial of service attacks] to phishing and

Digital initiatives provide a new frontier for fraud, he said. "If a bank decides it's going to introduce a brand new mobile banking app, you'd better believe there's somebody out there that's going to figuring out how they can break it and transfer money out."

Banks in Cornerstone's benchmark study spent 29% more on fraud detection in 2014 than they did the previous year; this was the biggest jump in spending.

"Fraud is so front-and-center in people's minds, both from a loss and an audit and compliance regulatory standpoint," Roche said. "I'm not surprised that went up. Particularly in things like payment fraud where you've got card-not-present fraud jumping heavily."

PAYMENT HUBS

Ovum's analysts expect to see a lot of activity around

"You can't provide visibility to corporate treasury clients until you have a more streamlined approach," Hines said. Big banks also can't contemplate offering real-time payments unless they modernize their software. (Earthport and Ripple Labs, for instance,

"A lot of it comes back to the fact that a lot of banks still have legacy and siloed infrastructure, which makes it difficult to provide clean servicing and data," Hines noted.

WHEN 'CORE' ISN'T CORE

Core banking is not a big growth area of tech spending, observers say. Ovum analysts predict that operations IT spending, which includes core systems, will rise 5% next year, partly for account opening improvements and back-office streamlining.

Spending on core processing software was at 0.05% of assets this year (remote delivery was 0.06%, strategic systems was at 0.048%), according to Cornerstone's study.

"Core spending has been easing down over the years," said Kilmer. "You now see multiple categories that are vying for the spending." Core banking is increasingly seen as a commodity.

For all the drawbacks of running fairly old, legacy core systems, as many of the banks Cornerstone studied do, they are cost effective in a way, he said.

"After five years, all you're paying is maintenance," Roche said. "You're no longer depreciating what could be a multi-million dollar investment."

OUTSOURCING AND THE CLOUD

The Cornerstone consultants see an increase in outsourcing, especially for online banking. The challenge of hiring top tech talent is one driver of the trend.

"If I'm in Kalamazoo or Wichita, how am I going to draw the talent I want?" Kilmer said.

The ongoing shift to cloud computing will continue to drive IT costs down but also bring new security risks, some say.

"I think you'll see slow movement to cloud computing, I don't think you'll see breakout movement," Roche said. "It's too early to tell whether cloud computing is going to be that much cheaper. We don't have enough history of cloud based costs."