-

The Ohio bank has partnered with MorningStar's HelloWallet to offer customers financial health scores and a suite of digital tools meant to provide financial advice at a time when branch transactions are on a decline. The experience will eventually be delivered through the bank's online and mobile banking channels.

March 9 -

USAA's newest app, Savings Coach, analyzes financial data to recommend small amounts of money to save and invites members to take savings challenges, then moves the money upon the member's approval. The app comes at a time when millennials have a negative savings rate.

July 28 -

More credit card companies are offering free credit scores to their customers as they look for ways to distinguish their products from those of their rivals.

March 3

USAA, a banking innovation leader, is using technology to help members to think and act on a topic many ignore: financial planning.

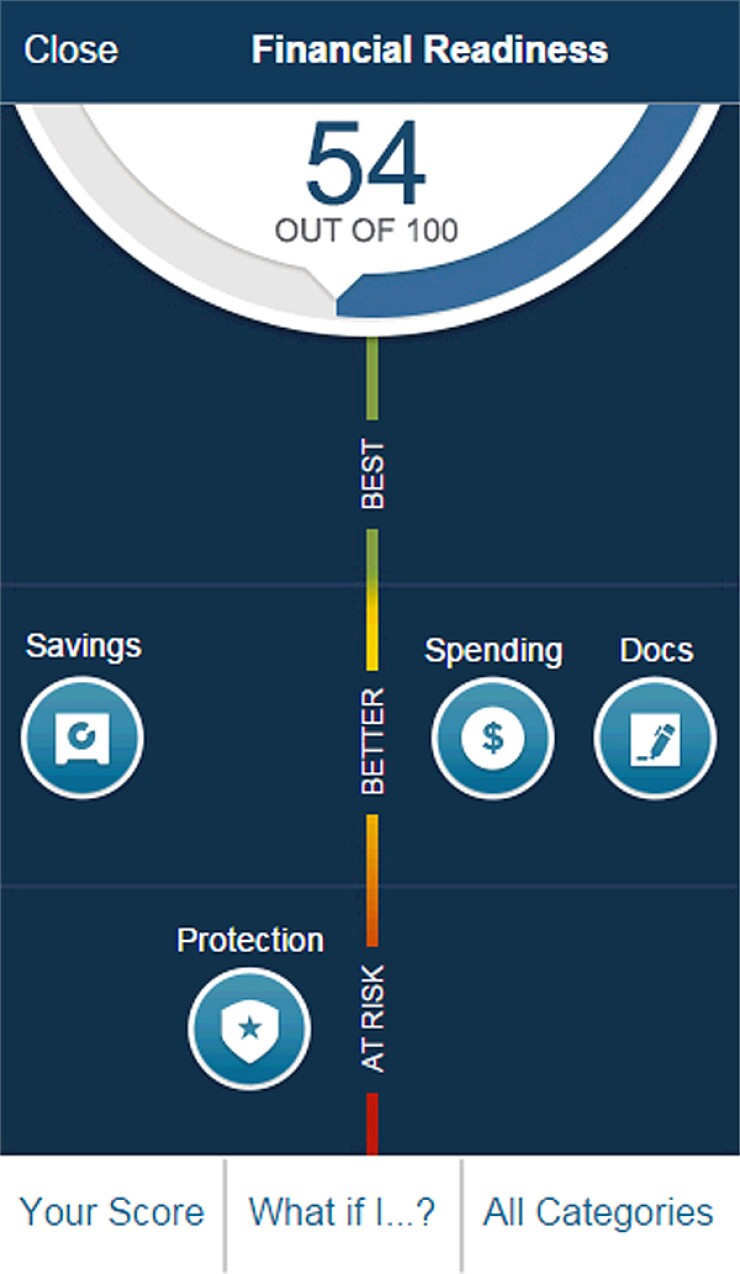

On October 1, the San Antonio financial services firm rolled out financial assessment scores that any member can obtain after they fill out a 10-minute online survey and provide information like income and age. In addition to scores — which range from 0 to 100 points and can change as quickly as daily — members receive advice on how to improve the number. They also receive alerts when their scores change for life events like moving or having a baby.

USAA's initiative comes as ever-more issuers are publishing credit scores — some in online banking. USAA, for instance, lets members with a credit card see their credit scores when they login to their accounts.

But the new consumer metric, called financial readiness scores, is strikingly different and rare in the banking industry.

Credit scores, after all, are a measure of someone's ability to meet financial obligations based on past performance. The new scores are viewed as a way for members to gauge their progress toward financial goals from budgeting to saving for retirement.

Lea Sims, assistant vice president of USAA's enterprise advice group, believes financial readiness scores are even more personal than credit scores. Rather than being used to underwrite a product, they are inward-facing scores that illustrate the member's own risk.

"A financial readiness score is about you and for you only," said Sims.

The latest feature represents part of a trend of a newer digital battlefront and increasingly popular vernacular: financial health.

There are numerous services (think

A startup called

"People love tracking themselves," said Ben Jackson, director of prepaid advisory service at Mercator Advisory Group. "It's why FitBit is such a big deal."

Jackson sees the newer metric as sparking consumers' curiosity about how they are doing financially — with limits. Just as some people don't weigh themselves, the experience won't be for everyone.

And there are hurdles to address. Beyond determining what defines financial health, institutions need to educate consumers on what the new score means, and eventually, deal with issues such as irritated consumers who believe their scores are inaccurate. Keeping consumers engaged in the experience that could feel daunting or depressing is also a major consideration.

"So much depends on execution," said Jackson.

Whether or not scores help motivate people to plan ahead, they are the latest manifestation of firms working to address a societal problem.

"It's not a niche problem anymore," said Jennifer Tescher, president and chief executive of CFSI.

Inside USAA's Financial Readiness Score

USAA has been piloting the metric with members for about a year as it works to get more members — especially younger ones — planning their financial future. Early feedback shows members are reaching out to the institution's advisors (which are free) on how to improve their scores. These advisors have access to the financial readiness score web pages so they can pick up where members left or view the results for continued conversation. And yes, some of the automated suggestions do relate to products USAA sells.

USAA's methodology crunches data like income and life stage to analyze a member's risks in areas like debt, retirement savings and budgeting. The score itself is derived from a survey that a logged-in member fills out. He can also link in outside bank accounts to feed the algorithm, while information the institution already has on a member will be pre-populated.

Whereas FlexScore generates a score of up to 1,000 on a standalone app, KeyBank and USAA are using a scale of 100. There is no peer comparison yet (which KeyBank and FlexScore offer) but USAA includes a social community aspect so members can discuss the score online. It also lets members get their score from inside their online accounts.

The financial services group for military members and their families sees the score as a way to engage millennials and Gen X members on their financial futures and through the channel on which they rely: mobile.

"Not everyone wants to call in or has time to call in," Sims said.

For USAA, the enhancement is just the latest example of its broad mission to deliver financial advice and guidance for members and be on a member's radar when she needs another product or service. Recently, USAA launched

CFSI believes the next basis of competition will be on financial health rather than price or fees.

Just this week, CFSI was pitching industry members on indicators of financial health like whether someone pays their bills on time and if they spend less than or equal to their income.

But definitions are never easy and financial health is no exception.

Tescher says among the challenges in crafting a definition — currently in draft form — is how financial health will vary depending on a person's goals to say, afford a vacation versus afford a house.

"We don't all want the same thing," said Tescher.

And CFSI recognizes that companies may need to customize the metrics.

Scores derived from financial quizzes and transaction data can be a marketing vehicle for firms that really want to gather prize data, like the fact that a customer just got hitched. But the broader idea is to help consumers meet their own goals.

Ultimately, CFSI's vision is to have financial services firms adopt a financial health API. Rather than fees, which often surprise customers, this model would require banks to think about earning revenue in ways that help interested customers.

"It's a complete paradigm shift from how financial institutions think about the business they are in," said Tescher.