-

Across the country, community banks are defying the stereotype of small institutions as technological laggards, sometimes introducing useful digital features well ahead of the better-resourced and purportedly savvier big banks.

February 25 -

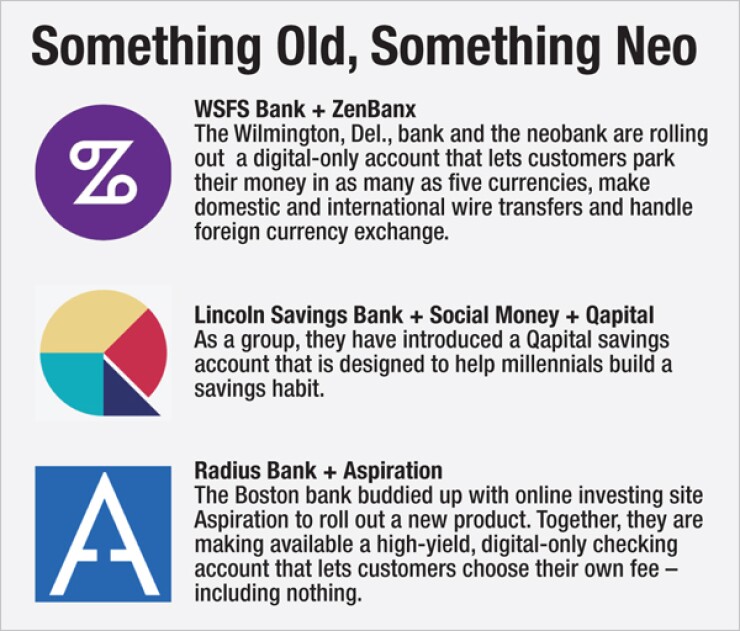

Radius Bank's partnership with online investment firm Aspiration highlights a nascent trend among small banks in the race to win millennial customers: partnering with fintech firms rather than opening branches.

July 20 -

Digital upstarts are out to steal traditional banks' customers by taking the hassle out of everything from account opening to borrowing. Its tough to compete with banks' resources and brand recognition, but these new mobile competitors are adamant that they can win on customer experience.

April 27 -

WSFS Bank has teamed up with ZenBanx, a fintech startup founded by a pioneer of direct banking, Arkadi Kuhlmann. WSFS will be the first in the U.S. to power a mobile account that lets users park money in up to five currencies and send remittances. The partnership is the latest example of a traditional bank trying to inject innovation into its culture.

June 3 -

Qapital, which launched its app in Sweden in 2013, is making its American entrance. It is the latest example of how firms are trying to inspire young consumers to save and mashes personal financial management with money movement.

March 5 -

Several large banks, including Citi and Bank of America, have begun sharing proprietary code with fintech startups and others. The new level of openness brings benefit to both sides.

July 8

As

Aspiration, the institution's neobank partner, was asking about what fonts and pixel sizes to use and where the best place to ask for contact information was detailed design elements the community bank hadn't considered when developing the look and feel of the portion of its own site for

"It's pretty invigorating and fun to collaborate with a group like that," said Chris Tremont, executive vice president of virtual banking at $725 million-asset Radius Bank.

Radius joins a small but growing group of community banks that are buddying up with neobanks to not only expand their depositor base but also to get something akin to an innovation unit. The startups, after all, typically come staffed with experts in design and coding who are hip to the latest technology advancements and hungry to spice up banking traditions.

Institutions typically give up their branding in these arrangements. But they also see their deep relationships with neobanks as influencing the way they think about design, how they pitch products and even what is on their IT wish list.

WSFS Bank in Wilmington, Del., views its partnership with

The ZenBanx account is not yet publically available to consumers in the U.S. Yet Justin Dunn, senior vice president and marketing director of WSFS Bank, said working with ZenBanx "opens our eyes up to technology."

The $4.9 billion-asset bank, which is accountable to the OCC for vendor management, has to approve and sign off on any technology partner the startup wants to work with in the ZenBanx account. But this added work has led to discoveries like Regulated DataCorp., for example. Seeing the value in RDC's database for uncovering anti-money-laundering violations among other things, Dunn said the bank pursued its own agreement with the vendor and expects to layer in the technology by yearend.

Dunn also credits ZenBanx with giving his bank a glimpse of what financial services could look like if bank apps could incorporate social elements. The ZenBanx experience, for example, is already designed to show images of the people the user often sends money to.

"It's been refreshing," said Dunn, who has daily interactions with the ZenBanx team. "It's a nice reminder that banking is a mature space but continues to evolve so quickly."

Design and marketing lessons could be drawn from tech companies regardless of whether or not the firms work with banks directly. But the almost fox-and-hound-like relationships of neobanks and banks underscores a trend spreading across the industry: embracing the startups that are calling the industry into question in the realization that banks is ill-equipped to build everything themselves.

"We don't have capital to grow everything from the ground up," Dunn said.

Mike McCrary, executive vice president of ecommerce and emerging technology at Lincoln Savings Bank, says he has borrowed ideas from visiting incubators (such as for the way the bank pitches new products internally) and taken away lessons in user experience from the Iowa bank's work with startups, including partnering with

The exposure is giving him a new lens to judge digital banking apps. Historically, bankers might check whether they have the right data and meet compliance guidelines. Now, McCrary is noticing the amount of clicks it takes to get something done everywhere even at the gas pump and how it can make the experience feel, well, crappy.

"It starts changing things," he said.

The bank has not yet acted much on its newer lens of design thinking. The institution is reliant on vendors that cater to many institutions, after all. But McCrary says his work with startups like Qapital can help build a case study for pitching more traditional vendors on ideas that have nothing to do with the startup's secret sauce.

"For us, the benefit is that we get to see this stuff early on," he said. "The case study is already there. It's me working with someone and saying this can be done."

Sam Maule, an emerging payments practice lead at Carlisle & Gallagher Consulting Group, views neobanks as sandboxes for their bank partners. The startups, after all, can afford to devote their time to a narrow product and iterate quickly for a small user base, as opposed to a bank that is forced to think across a medley of products and services.

And sure, there are still startups that want to destroy the banks' business lines. But many are coming to find they work best with others.

"They need each other," Maule said. "True disruption is incredibly rare. We are past the point of where this is 'us versus them mentality.' "