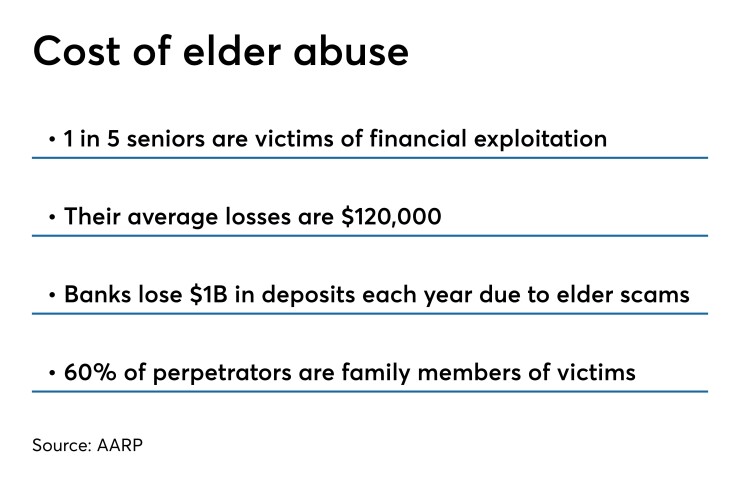

It’s a $1 billion problem for financial institutions each year: people who con older customers out of their deposits.

“Elder financial exploitation can destroy the lives of members and their families,” Jilenne Gunther, national director of AARP's new BankSafe program, said at a press conference Wednesday. “One in five older Americans are victims of financial exploitation, and each victim loses an average of $120,000.”

Chillingly, 60% of the time family members are the perpetrators of elder abuse. This can make it hard for bank employees to detect, as family members sometimes legitimately need to help older relatives as they age and lose cognitive function.

To help banks protect older customers, AARP started BankSafe — a free online training program for bank and credit union employees. The Independent Community Bankers of America and Credit Union National Association have signed on to distribute the training. Banks can also register directly at Aarp.org/banksafe.

Two-thirds of all deposits are held by people over 50, AARP said.

The group enlisted 200 bank employees to help develop and review the training content, then tested it with more than 2,000 bankers in an 11-state pilot.

One component of the training is a video game called Trust Your Instincts that is loosely based on the 1984 game Duck Hunt. Employees are fed scenarios and have to decide which ones are potential elder abuse.

A classic red flag is when a customer comes in with a second person who is speaking for that customer, Gunther said. Another is when someone wants to obtain power of attorney for a customer. A third is when an older person asks to buy large quantities of gift cards. A fourth is when a customer who has had an account for many years suddenly moves money into another account with a second person on it.

BankSafe also provides role-playing videos. One shows a son and father who have come into a bank. The son wants to start a landscaping business using the father’s house as collateral. Players choose what steps the employee should take to protect the customer.

In addition to the training, BankSafe provides information about state laws, adult protective services agencies, employee tipsheets and resources for customers.