It became clearer than ever Monday that 2019 is going to be a

It all points to the fact that Corbat must rely heavily on the banking side of the house in 2019 to meet revenue and profit goals, said Lisa Kwasnowski, an analyst at the debt-rating agency DBRS. The fourth-quarter results showed that such a strategy can work, she said.

“Their more stable businesses have performed quite well, which is why we have a positive outlook on Citi,” Kwasnowski said. “The diversity of their franchise allows them to offset weaknesses when they appear in other parts of the company.”

Corbat will have at it with a new leadership team at his side — most notably, longtime Chief Financial Officer John Gerspach is retiring in March — and a new chairman (ex-Comptroller of the Currency John Dugan) looking over his shoulder. Also hovering over the management team will be the activist investor ValueAct Capital Management, which Citi

Even with fixed-income and capital markets businesses struggling in the fourth quarter, there were signs this month that the trading environment has improved, Gerspach said during a conference call Monday. Shares of Citi were up about 4.3% to $59.15 in afternoon trading.

“Volatility has somewhat moderated,” Gerspach said.

Nevertheless, Gerspach warned that it is early and that market conditions have not fully recovered from the wild swings of December.

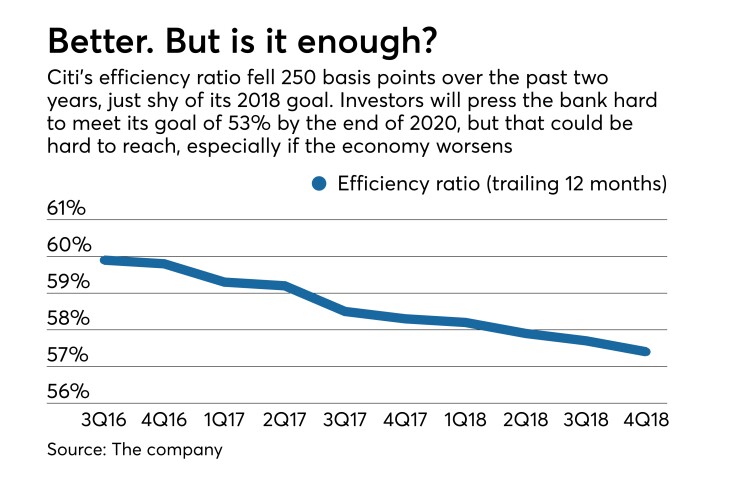

Perhaps that is why analysts were so focused on Citi’s expense control during the call. Citi’s efficiency ratio improved to 57.4% for the full year,

Some observers are still not sold that Citi’s cost-cutting regimen will achieve the 53% target that it has set for the end of 2020, especially if the economy struggles. Mike Mayo, an analyst at Wells Fargo Securities, asked if Citi could accelerate cost-cutting.

“When we look at your efficiency, business line by business line, it looks worse than your peers,” Mayo said. “What else can you do to improve the intensity of expense control? What are you doing for travel, entertainment, bank cards, Ubers, the size of coffee cups, paper clips?”

Corbat responded that plenty of costs can still be removed from Citi’s consumer business (though not from its credit card operations).

“We need to improve the efficiency in our retail business, and that’s what a lot of the investments are focused on,” Corbat said.

Ultimately, Corbat’s message echoed that of many other bankers over the past year — economic fundamentals are sound, especially in the U.S., such as “strong, tight labor markets [and] reasonable wage increases,” he said. Those should fuel optimism for the banking sector, but they are overshadowed by worries about a potential recession, global trade wars and other geopolitical concerns.

“Right now, we see the biggest risk in the global economy is one of talking ourselves into the next recession, as opposed to the underlying fundamentals taking us there,” Corbat said.