-

The unfortunate reality is that those who most need credit counseling help are also the hardest to reach. In a Q&A, the agency's financial literacy honcho, Gail Hillebrand, talks about efforts to empower the vast swath of American who aren't terribly savvy.

February 24 -

CFPB officials are keeping a close watch on the Qualified Mortgage and ability-to-repay rules to gauge whether further changes should be made. But mortgage numbers don't give a clear picture on what kind of impact they've had.

February 19 -

WASHINGTON The Consumer Financial Protection Bureau will continue its work to ensure credit reports are fair and freely given to consumers, agency director Richard Cordray said Thursday.

February 19 -

WASHINGTON The Consumer Financial Protection Bureau took action Thursday against three mortgage companies that, authorities say, falsely implied affiliation with the U.S. government.

February 12

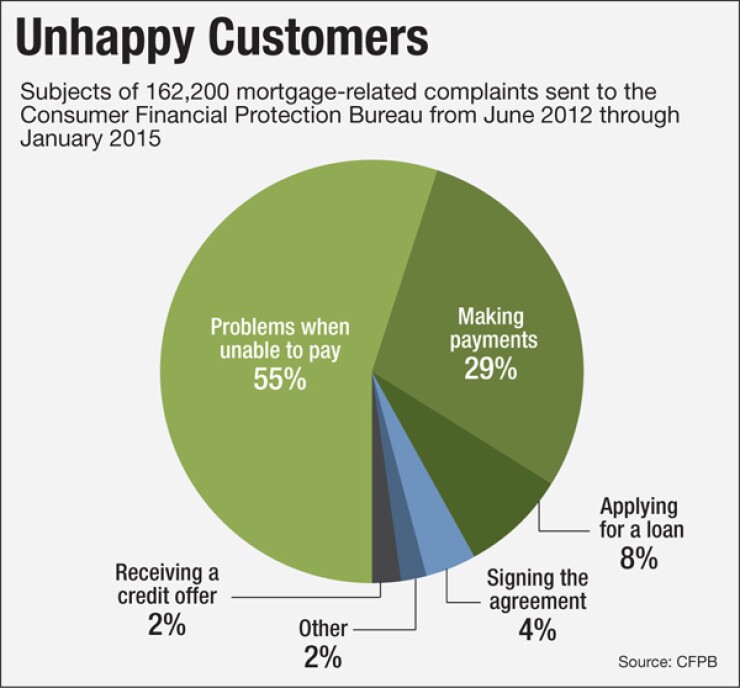

Problems related to loan servicing dominate the consumer complaints about mortgage companies made to the Consumer Financial Protection Bureau, but an agency official expressed optimism about the industry's response to these grievances.

Since its launch in June 2012, mortgage-related complaints account for nearly one-third of the more than 538,000 grievances published in the CFPB's public

Among the roughly 162,000 mortgage-related complaints, 55% were related to problems when consumers are unable to pay, and 29% of complaints involved consumer issues with making a payment (consumers self-identify the nature of their complaints). Meanwhile, consumer issues with applying for a mortgage accounted for 8% of complaints, and 4% are issues with loan closings.

The CFPB weeds out bogus complaints (but does not verify the accuracy of allegations), and forwards legitimate ones to financial institutions for a response. Companies get 15 days to respond before the complaint is published in the online database. About 88% of mortgage complaints have been sent to lenders and servicers for a response. Of those, mortgage companies have responded to 97% of complaints, said Scott Steckel, who oversees stakeholder engagement in the CFPB's Office of Consumer Response.

"Every complaint that we receive gives us and companies insights into the problems that consumers face," Steckel said during a panel at the Mortgage Bankers Association's annual servicing conference, ongoing this week in Dallas.

"We do this to empower consumers...and improve the function of the marketplace," he added.

The CFPB defines complaints as "submissions that express dissatisfaction with, or communicate suspicion of wrongful conduct by, an identifiable entity related to a consumer's personal experience with a financial product or service," and Steckel noted that valid consumer grievances may not be related to a specific regulatory violation.

The top states for mortgage complaints in 2013 were California, Florida, Georgia, New York and Texas. A year later, New Jersey a state notorious for its prolonged judicial foreclosure process replaced Georgia among the top five.

Last year, the CFPB sought public comment on a proposal to expand the complaint database by giving consumers to the option to have the narrative of their complaint made public. Bankers have fiercely opposed the idea, saying that publishing unstructured information would put a

"It's still an open issue. It's still a proposal the bureau is studying and carefully looking at the feedback and comments that were provided," Steckel said. "I don't know which direction that will go."