-

JPMorgan posted strong gains in consumer deposits and mobile users, and other big banks are expected to do the same. It could be a sign that megabanks are indeed stealing market share from regional and community banks.

July 14 -

U.S. Bancorp could see a slight uptick in revenue in its payments business after the U.K.'s decision to leave the European Union, Chief Executive Richard Davis said on a conference call Friday.

July 15 -

The San Francisco bank reported a 17% drop in mortgage fee income during the second quarter as other lenders made inroads by refinancing its customers.

July 15

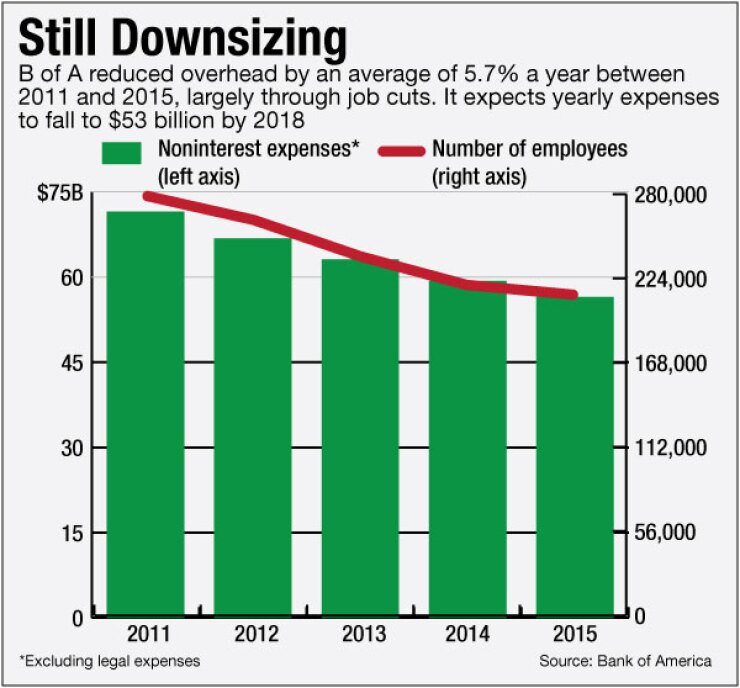

Margins on lending stink and the Brexit vote's impact remains a huge unknown, but Bank of America still believes it can improve its profits by cutting more jobs and expenses.

The nation's second-largest bank has reduced overhead by nearly 6% a year since 2011 and said Monday that it is on pace to lower annual expenses to $53 billion by the end of 2018. The $2.2 trillion-asset bank plans to hit that target by cutting even more jobs, closing data centers, automating branches and other back-office functions, and encouraging more customers to use mobile banking.

While executives are hopeful that the Federal Reserve will raise interest rates and give margins a much-needed boost, Chief Financial Officer Paul Donofrio said Monday that the bank can improve results "even in a flat interest rate environment" by managing overhead.

Marty Mosby, an analyst at Vining Sparks, agreed, saying in a research note Monday that B of A could boost annual earnings by 10 cents per share if it is able to hit its $53 billion target.

Results for the quarter that ended June 30 were a mixed bag.

The good news is that net income from consumer banking — B of A's largest business segment — rose 3% to $1.7 billion from a year earlier, thanks largely to an increase in credit and debit card income. Total loans rose 2.5% to $903 billion, on increases in auto lending, commercial-and-industrial loans in the U.S., and commercial real estate.

However, net interest income fell 12% to $9.2 billion as low rates continued to squeeze margins. Meanwhile, noninterest income fell 3% to $11.2 billion on declines in fees from investment and brokerage services, as well as investment banking. Global wealth management revenue fell 2.4% to $4.5 billion, on lower client balances at Merrill Lynch.

Overall, net income fell 19% to $3.9 billion. Earnings per share fell 16% to 36 cents. The efficiency ratio, which had been improving, rose by 250 points to 65.43%.

B of A's wide range of revenue sources is one reason to believe the bank can improve on its results, despite the rate environment and economic uncertainties surrounding Great Britain's decision to exit the European Union, said Lisa Kwasnowski, an analyst at DBRS.

The Charlotte, N.C., company did hit a key milestone in the quarter by removing the Legacy Assets & Servicing category from its list of business segments. It was that unit where B of A housed most of the problem mortgages it inherited from its acquisition of Countrywide and, until now, it had cost the bank roughly $2 billion a year.

Further savings will come from eliminating jobs that don't generate revenue, Chairman and Chief Executive Brian Moynihan said on a conference call with analysts Monday.

"It's a constant reduction in personnel through hard work and automation, while we're continuing to increase the investment in salespeople," Moynihan said.

B of A has eliminated nearly 65.000 jobs — or almost one-fourth of its workforce — since 2011. The company did not provide an estimated number of jobs on the chopping block through 2018.

Staff cuts are only part of the equation. B of A has

Moving customers from the teller line to smartphone apps has also helped cut costs. B of A increased its total number of mobile banking users 15% to 20.2 million from a year earlier.

"As we continue to bring down people, we have less occupancy, less telecommunications and everything else," Moynihan said.

B of A also plans to generate savings through the automation of virtually all facets of its business, Donofrio said.

"I do want to emphasize that it is about making progress across the entire company," Donofrio said. "We're simplifying our legal entities structure and business model. We're integrating wholesale credit origination and processing across the lines of businesses."

"There's a lot going on and we're going to need all of it to get to our goals," he said.