Like other big banks, Bank of America wants to get nimbler and more innovative. But it is weighed down by the same problem they all are: a vast worldwide technological architecture that costs billions of dollars a year to run.

So, in order to bring new technology in, B of A decided to cut some legacy out.

"Innovation is not just about adoption," David Reilly, the bank's chief technology officer, said in an interview last week at the FinTech Innovation Lab Demo Day in New York, which Bank of America co-sponsored. "You've got to retire the old stuff and get rid of the addressable expense."

-

Fintech startups continue to captivate venture capital firms and angel investors, giving a boost to a program in which the operators of startups get advice from mentors and make presentations to hundreds of bankers at an annual event in New York.

June 26 -

So-called containers can lessen the IT workload and help companies bring applications into the cloud. New security and management tools, like automatic patching, are bringing containers into the mainstream.

December 3 -

Catherine Bessant is driving an initiative to centralize and streamline a sprawling technology network at Bank of America. She's got her work cut out for her: the many companies BofA has acquired all came with their own software and hardware, some state-of-the-art and others, not so much. This month, BTN takes an inside look at the challenges facing Bessant and her team, and examines the diffi cult path toward IT modernity at one of the world's largest financialinstitutions.

September 1

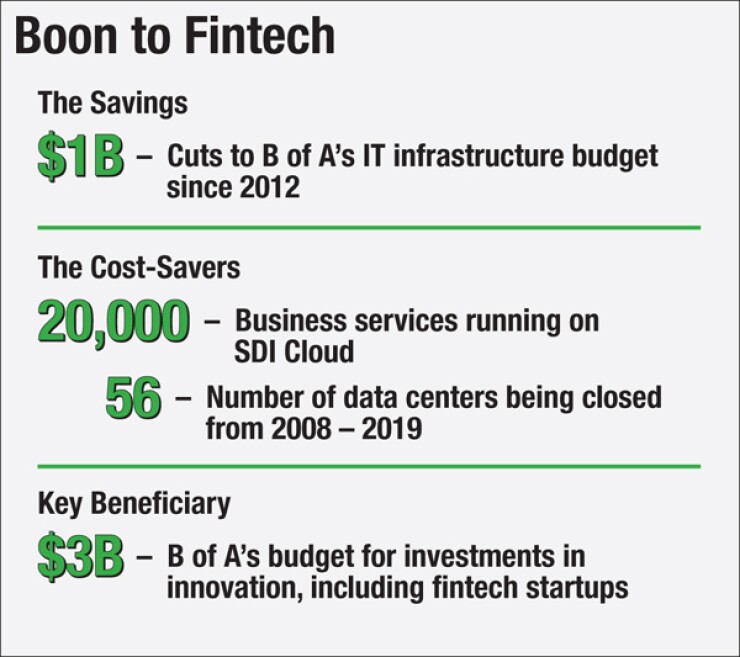

The bank's budget for technology and operations in 2016 is $17 billion. The IT infrastructure part of that, which Reilly oversees, is down $1 billion since 2012, he said. The bank also has a $3 billion innovation budget. There isn't a one-to-one correlation between tech savings and growth in innovation spending, but the cost-cutting efforts help.

Reilly's team uses Gartner benchmarks to track what its peers spend on infrastructure assets (networks, servers, storage, desktops, etc.) and to figure out where to make changes.

"I compare all that addressable expense to my competitors at a level of granularity that shows me, maybe in the server space my problem is depreciation," he said. "Maybe in the network space it's staff cost. Maybe in the data center it's real estate cost. I get precision around which component of the cost is too expensive."

Layoffs have not been a big factor, Reilly said, because people represent only 25% of these infrastructure costs. Labor is "not enough of the addressable expense to make the kind of headway we've made," he said. "We have to go after what are traditionally called fixed costs."

One means of saving has been the bank's growing use of

Efficiencies from the use of SDI will help the bank shut down three more data centers this year. As part of a

The bank is also turning to containers — not only

As a result, the bank's internal cost per workload is lower than what's offered by Amazon, Rackspace or Microsoft Azure, Reilly said. Lower-cost infrastructure allows the IT organization to consider developing and buying more innovative technology.

"Doing what we do with new and emerging companies takes resources, money and investment," Reilly said. "If we weren't driving down the day-to-day running costs of the place, we wouldn't be able to put some of that money back to the bottom line and some of that money toward directed innovation."

Investing in Fintech Startups

Reilly mentored two of the eight fintech startups that participated in this year's New York FinTech Innovation Lab, a 12-week incubator run by Accenture, the Partnership Fund for New York City and senior executives from 16 large banks.

"What this program does for large organizations like us and our peers is it helps to get direct access to innovators in a much faster way," Reilly said. "It's easier to get tech solutions to the right executives. It helps us ensure that we're disrupting our own thought patterns and our own ideas about where technology solutions fit in the bank."

Bank of America also runs its own innovation summit every October, through which it has worked with 1,500 fintech startups, 18% of which have gone on to become vendors for the bank, he said.

One of the companies B of A officials worked with at the innovation lab, Quarule, applies artificial intelligence software to banks' regulatory compliance tasks.

"As rules change, you have to change the business processes to become compliant," Reilly noted. "I had always assumed you needed an army of compliance executives to do that."

The software can also be used to model the impact of new rules on systems and parts of the organization.

It will take a certain amount of effort to integrate Quarule with the bank's existing software and teach it about the bank's processes, Reilly acknowledged. "If you're willing to take that on, that's when you get the automation. Perfect? No. But it raises the red flags [to show] where should I be looking."

The other startup Reilly mentored, T-Rex, provides risk and pricing analytics tools for financial assets, starting with renewable energy assets like solar energy.

"The renewables market has been a very illiquid one," Reilly pointed out. "The promise of this technology is that the analytics would make it a more liquid market. You're going to see customers want to have more of their portfolio assigned to those types of investments, so it's a market that has to mature quickly."

The other six fintech startups, in brief, were:

- Untapt, which was one of American Banker and BAI's

20 Fintech Companies to Watch in 2015, uses mathematical algorithms to analyze software developers' aptitudes against recruiting managers' needs and produce matches. "The No. 1 pain point we face is shared across the industry — why is it so difficult to hire software engineers?" said Ed Donner, the company's co-founder and CEO.

- AlphaPoint has blockchain-enabled technology to create "golden ledgers" meant to reduce the cost and complexity of handling data reconciliation across data silos. "Institutions that have grown organically and through acquisitions have dozens of systems involved in just one workflow," said Igor Telyatnikov, the chief operating officer of AlphaPoint. "And the data between these systems often gets out of sync and causes errors and delays and is costing these institutions hundreds of millions of dollars in manual reconcilement costs."

- Syndicated Loan Direct converts unstructured loan data into metrics that make loan portfolios easier to analyze. The product could be used by banks, private-equity firms and regulators to analyze syndicated loans, which totaled $2 trillion last year. The startup has already completed a proof-of-concept with Barclays and has others underway with other banks.

- Cambridge Blockchain has built an identity-management platform for multinational banks that is based on blockchain technology. "This puts control of identity data back in the hands of users," said Matthew Commons, the startup's chief executive. The goals are stopping fraud and protecting privacy, he said.

- ForwardLane is designed to help financial advisers provide services to a greater number of young wealth management clients. "Financial advisers typically spend less than 50% of their day on the client," said ForwardLane CEO Nathan Stevenson. The company's artificial intelligence software could help financial advisers improve their client coverage, sales and satisfaction, he said. It provides synopses of news of interest to the client and analysis and portfolio recommendations for the advisor. It works with IBM Watson.

- 51maps provides secure containers for the apps employees run on mobile devices. The apps are encrypted in motion and at rest. A global audit log lets companies track activity among all their users.

These are just eight of a vast universe of perhaps 10,000 fintech startups. With their focus on solving rising challenges for banks and the time they have spent with bankers honing their offerings, they are worth a look by B of A and its peers.

Editor at Large Penny Crosman welcomes feedback at