Hanmi Financial in Los Angeles is dealing with a large problem loan that overshadowed efforts to grow its balance sheet.

The $5.5 billion-asset company reported on Tuesday that it recorded a $6.9 million specific loan-loss provision in the fourth quarter tied to a deteriorating credit. The overall provision more than tripled that of a year earlier, totaling $10.8 million.

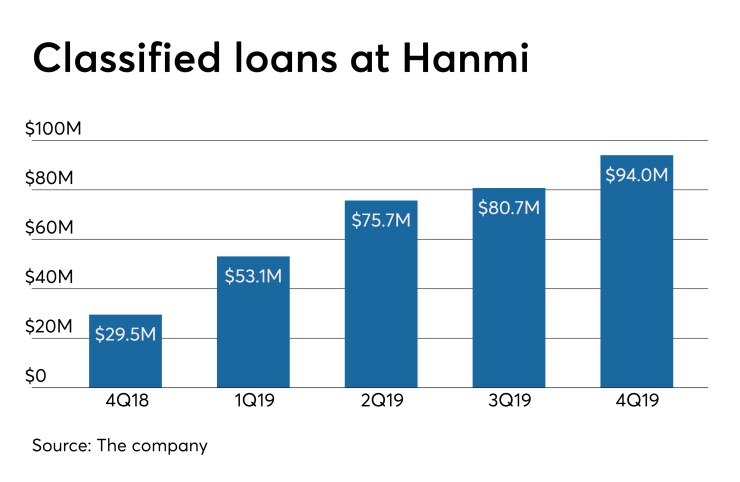

Classified loans were also triple those of a year earlier, at $94 million, and the company aborbed a $1.7 million impairment charge on a bank building it intends to sell.

Those items took a bite out of the bottom line.

Fourth-quarter profit fell by 73%, to $3.1 million.

Hanmi’s difficulties with the problem relationship — comprised of a $27.2 million land loan and a $12.5 commercial line of credit — surfaced this summer. The problem forced Hanmi to

Hanmi had already begun building a significant specific reserve, which now totals $22.6 million, for the loans. The company decided to set aside more money after receiving an updated appraisal of the loans' underlying collateral.

To date, there have been no charge-offs, and CEO Bonnie Lee promised during a quarterly earnings call “to work closely with the borrower to achieve a positive resolution." At the same time, Lee acknowledged the loans matured at the end of 2019.

Timothy Coffey, an analyst at Janney Montgomery Scott, wrote in a Wednesday note to clients that he “anticipates sizable chargeoffs in 2020.”

Kroll Bond Rating Agency also noted Hanmi’s difficulties, though it ultimately reaffirmed the company’s ratings. The agency said in its note that it “believes this credit exposure is an outlier and not indicative of a broader trend.”

Nonperforming loans were $63.8 million, or 1.38% of total loans, on Dec. 31.

Despite solid fourth-quarter loan originations totaling $381.4 million, Lee said she is taking a cautious approach to 2020. She forecast “low- to mid-single-digit growth” in loans

Coffey predicted that loan growth will end up "at the low end of management guidance.”