His title may be changing, but Ray Davis' goal of altering the banking landscape remains the same.

Davis, who is

Pivotus is "going to create a new digital banking platform," Davis said in a recent interview, shedding some light on a division that Umpqua has been

- Oregon

Umpqua Holdings in Portland, Ore., will have a new chief executive in 2017. The company said Monday that Ray Davis, 67, will step down as president and CEO, effective Jan. 1. Davis, who will become executive chairman, will be succeeded by Cort O'Haver, who was named president of Umpqua Bank in April.

June 20 -

Umpqua Holdings in Oregon has promoted a business-banking executive to president of its bank unit.

April 27 - Washington

Umpqua Holdings in Portland, Ore., plans to close 26 branches in Oregon, California, Idaho and Washington state in an effort to cut costs.

March 17 -

Umpqua Holdings in Portland, Ore., has created a unit dedicated to disrupting the banking industry.

December 3

"How do we transfer the same customer experience that Umpqua's so well known for in our stores to the digital world?" Davis said, adding that Pivotus is already working on a number of prototypes. "If we're successful — and we think we will be — I think we can get pretty close to ensuring the future of our organization."

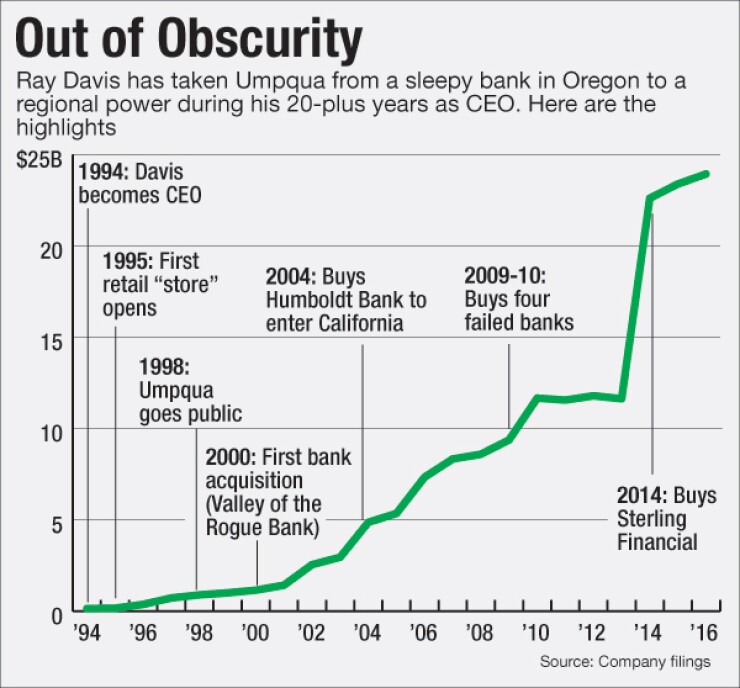

Davis has a magic touch with banking, taking Umpqua from a $150 million-asset bank to a $24 billion-asset regional power in the Pacific Northwest during his 20-plus years at the helm. Much of that growth has come from acquisitions, including four failed banks and the 2014 purchase of the $10 billion-asset Sterling Financial.

His legacy will also be defined by efforts to

Still, Umpqua, like other banks, has been facing the reality that branch traffic is declining. For instance, it is closing 26 branches, or nearly 7% of its overall network, a move that should help control costs.

In contrast, the objective for Pivotus is to "add incremental and creative revenue to the top line of our organization while we continue to differentiate the bank," Davis said.

While Davis intends to shake things up with technology in his new role as Umpqua's executive chairman, his successor as CEO has no immediate plan to throw out the playbook when it comes to traditional banking. There is, however, excitement about the prospect of eventually integrating some of Pivotus' products.

Pivotus has "some pretty cool ideas," said Cort O'Haver, who will become CEO on Jan. 1. He declined to discuss any specific product or concept.

"I'm kind of a fanatic for providing good service in our store environment," O'Haver said. Umpqua's approach "is really our leading edge, and how we morph that experience with the use of technology and service is really something we're going to concentrate on now and into the future."

O'Haver, a former regional executive for U.S. Bancorp who joined Umpqua in 2010, was recently

"I have a pretty balanced approach," he said, noting that it has been 15 years since he directly originated a commercial loan. "I think clearly we need deposits to generate the loan growth we need — whether it's consumer or commercial."

O'Haver said that acquisitions, a key to Umpqua's explosive growth in recent years, are possible, but that he doesn't want to force a deal. The company is "still digesting" Sterling and will be picky; O'Haver said he doesn't want to buy a bank with a heavy focus on commercial real estate lending.

"If someone called and wanted us to look at something, we'd look," O'Haver said. "We do have opportunities that come in occasionally. … We're pretty selective about what we're looking at right now based on where we're at in the … makeup of our balance sheet and how we want to invest."

Concentrating on improving performance after years of deals makes sense, said Aaron James Deer, an analyst at Sandler O'Neill. "The main focus over the coming year is just going to be on execution and making sure that the company's operating as best it can," he said.

With the integration of Sterling "more or less complete," Umpqua "can kind of get back to the business of running its business so to speak," Deer added. "I think you're going to see them focused on organic growth and operating efficiency, and hopefully that will result in better profitability metrics."

The succession plan also "weakens the thesis" that Umpqua will look to sell itself anytime soon, Jacquelynne Chimera, an analyst at Keefe, Bruyette & Woods, wrote in a recent note to clients.

While the banking industry continues to struggle with regulation and low interest rates, O'Haver said he doesn't see any company-specific challenges for Umpqua. "There's probably more opportunities post-Sterling than there are any headwinds," he said.