-

With an agreement in hand to buy Bank of Commerce Holdings in Sacramento, the Washington company will prioritize filling in a 200-mile gap between the seller's footprint and its own.

June 25 -

The combined institution will hold assets of more than $335 million and serve over 20,000 members across eight counties in Oregon.

February 9 -

The Eugene-based institution joined a small but growing number of credit unions that have raised their entry-level pay in recent years.

January 22 -

Even as the bank’s sales practices faced intense government scrutiny following the Wells Fargo scandal, senior leaders in Oregon were fostering a culture that valued credit-card sales above all else, according to several former employees.

August 27 -

Even as the bank’s sales practices faced intense government scrutiny following the Wells Fargo scandal, senior leaders in Oregon were fostering a culture that valued credit-card sales above all else, according to several former employees.

August 27 -

Mark Turnham is set to retire from the Portland, Ore.-based credit union, having worked there since 1980.

August 3 -

Members at Malheur Federal Credit Union will vote later this year on whether to join Medford, Ore.-based Rogue.

June 12 -

The Oregon company tapped Tory Nixon to serve as president of its bank.

June 11 -

The Oregon-based institution is the latest to offer bonus pay for branch staff facing additional risks by coming to work.

April 3 -

Unlike other regions of the country, the western U.S. has seen very few large bank mergers in recent years. Here's why Pacific Premier's acquisition of Opus Bank could change that.

February 3 -

President and CEO Bob Corwin plans to retire by this summer, having led the Clackamas, Ore.-based credit union for seven years.

January 24 -

Justin Olson will take the helm from CEO Jim Lumpkin, who led the $90 billion-asset USAgencies for more than two decades.

January 17 -

Incoming CEO Clint Stein said the Tacoma, Wash., company is ready to revisit deals after spending three years updating its digital platforms.

December 26 -

Member business lending growth has fluctuated in recent years but growth overall is slowing even as balances continue to rise. The long run of success could prove to be a problem when the economy finally turns south.

November 14 -

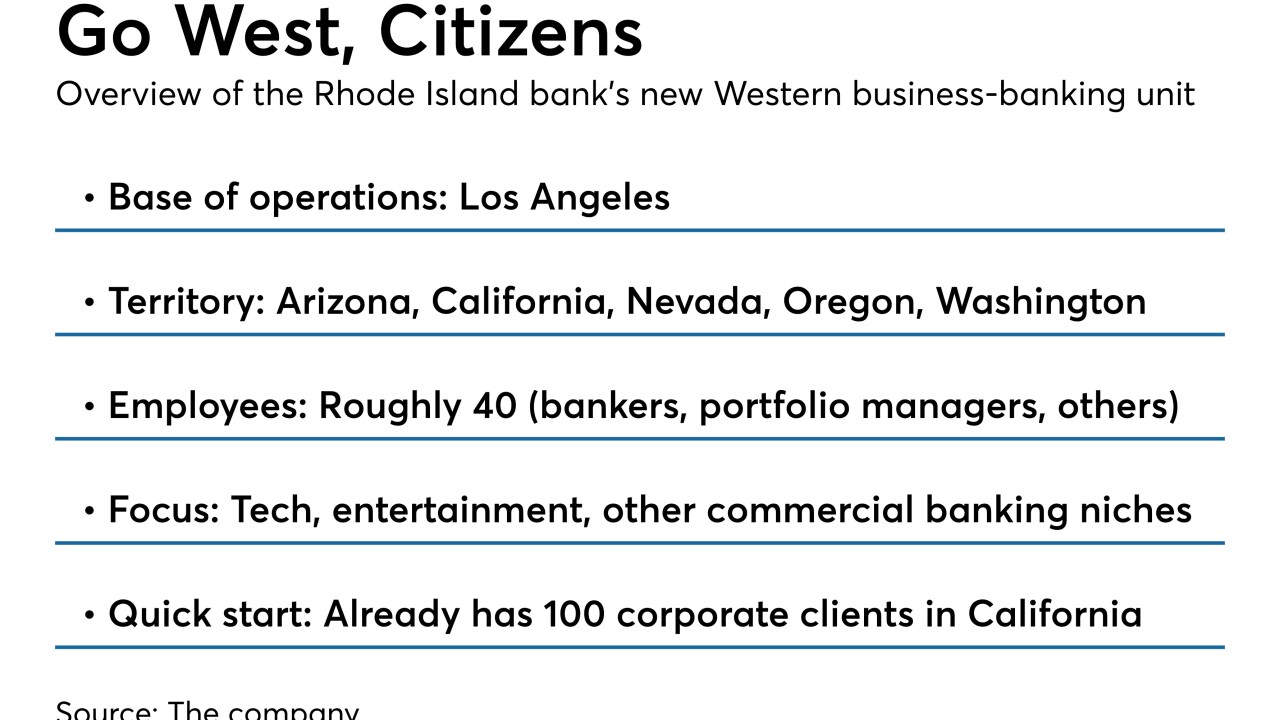

The Providence, R.I., bank recently installed a new regional head in California to oversee a commercial banking expansion into five western states. The bank says it’s trying to craft a successful growth strategy while reassuring investors it isn’t overreaching.

October 9 -

JWTT, created by former Wedbush Securities bankers, says it will use its connections to court business from other investment banks that were recently sold.

September 19 -

The industry has taken some steps to lower barriers to affordable housing, but some observers say that more can be done.

September 5 -

Jim Lumpkin, president and CEO of the Portland, Ore.-based institution, is planning to retire in the first quarter of 2020.

July 11 -

Seed, a San Francisco startup, has developed a platform that lets small businesses quickly open accounts online. That's an important feature for Cross River as it courts more fintech clients.

June 24 -

Columbia Banking CEO Hadley Robbins says he's confident the bank can grow on its own as the number of buyout targets in the Pacific Northwest dwindles.

April 22