-

Hanmi Financial has gone public with efforts to merge with BBCN Bancorp in a move the Los Angeles company hopes will scuttle another rumored pairing.

November 23 -

Several Korean-American banks are entering markets and businesses designed to target mainstream clients and other ethnic groups. Such moves are viewed as a way to improve the bottom line as revenue growth proves daunting.

February 18 -

A wave of management changes at Korean-American banks highlights the difficulties of filling key posts in a niche banking industry.

October 8

Executives at Hanmi Financial in Los Angeles realize that their latest M&A gambit is an all-or-nothing proposal.

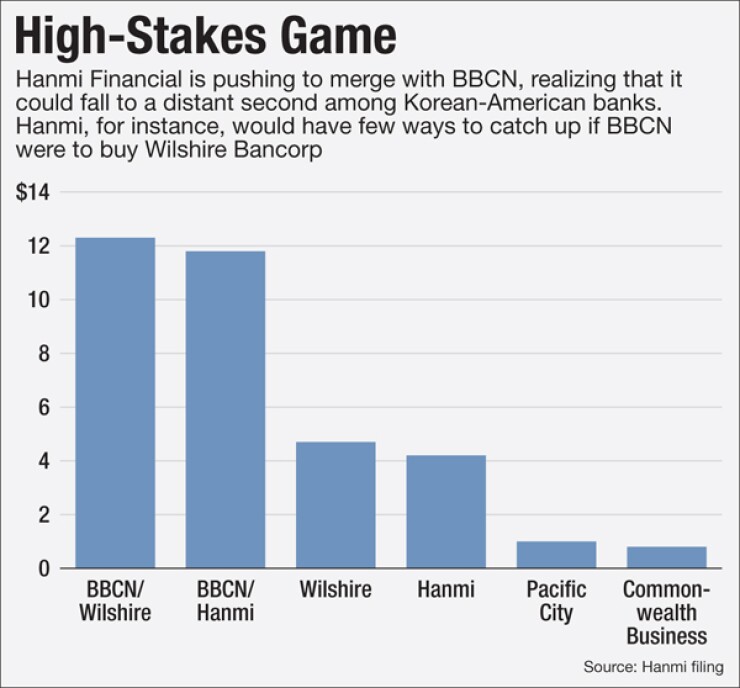

The $4.2 billion-asset Hanmi, by making a public overture to merge with BBCN Bancorp, is doing all it can to make sure that — when the dust settles — it is part of the nation's biggest Korean-American bank.

The move is bold and fraught with risk, but Hanmi viewed it as necessary given speculation that the $7.6 billion-asset BBCN is looking to buy the $4.7 billion-asset Wilshire Bancorp. The gutsy play also shows just how challenging it could be for ethnic banks to gain scale while sticking to traditional client niches.

Merging with BBCN "would position us to continue to grow in the Korean-American community, but also in other immigrant communities," C. G. Kum, Hanmi's president and chief executive, said in an interview. "Obviously, you want to participate in these types of situations. The combination … is very significant and very compelling. That's our preferred course of action."

The notion of a BBCN-Hanmi merger has circulated for several years, Kum said. This summer, some BBCN directors quietly expressed an interest in a deal, Kum said. Based on those views, Hanmi "made several overtures" to BBCN's management, though Kum said each was politely declined.

Kum and his team decided to make its interest public after a Korean-language publication reported that BBCN was in advanced talks to merge with Wilshire.

Hanmi released a

BBCN, which confirmed receipt of the letter, said it is evaluating the offer. A representative for Wilshire declined to comment.

The move "is audacious," said Timothy Coffey, an analyst at FIG Partners. "It could backfire, but [Kum] isn't going to find out unless he does something like this."

The Korean-American banking sector is ripe for consolidation because it serves a "niche market that isn't a huge banking opportunity relative to the number of participants," said Aaron Deer, an analyst at Sandler O'Neill. "I think most folks would say it is overbanked, and I think that's partly why you see some of the antagonism amongst the individual banks."

Some consolidation has already taken place. BBCN, for instance,

A combination of BBCN with either Wilshire or Hanmi would create a company with more than $11 billion in assets, crossing over a regulatory threshold where banks face stress testing and caps on interchange fees. The new BBCN would also have significant economies of scale that would allow it to loom large over other Korean-American banks, industry observers said.

"If you're three times the size of the next largest player … you have the ability to transact larger business from a balance sheet capacity," said Gary Tenner, an analyst at D.A. Davidson. A bigger bank may also face less pressure to be competitive with deposit rates, he added.

"It's tough to say what happens to that third bank," Bob Ramsey, an analyst at FBR Capital Markets, said. "Politics is always an issue in these sorts of things and everyone wants to have the succeeding management team."

A BBCN-Hanmi merger makes sense because the institutions have similar deposit strategies, geographies, loan mixes and product offerings, Ramsey said. Hanmi, meanwhile, has diversified its commercial business.

BBCN and Wilshire also make sense on paper; each bank has been trying to broaden its reach in recent years. BBCN has introduced new products to try and deepen ties to existing clients, while Wilshire recently bought a mortgage platform.

It would be difficult for either Hanmi or Wilshire to catch up to BBCN if it reaches a deal to cross $10 billion in assets. No other Korean-American bank has more than $1 billion in assets, making it challenging to build scale via acquisitions. It is also possible, though, that BBCN could eventually end up with both Hanmi and Wilshire at some point, industry experts said.

Hanmi, if unable to secure a deal with BBCN, still has the ability to grow independently. The company could also look to buy Korean-American, Asian-American or mainstream banks that fit its existing operations, Kum said.

The "aggressive" decision to go public with its quest to merge with BBCN could make future deals more challenging by spooking a target's board or management, said James Kaplan, a partner in the business law practice at Quarles & Brady.

Still, Kum's decision to go public makes sense, Coffey said.

Kum "has big ideas and is not afraid to take risks," Coffey said. "It's in his DNA."

Kum, who has experience with such tactics, said he is unconcerned that his strategy could hamper his ability to do future deals. His previous bank, First California Financial Group,

"It didn't stop PacWest," Kum said.