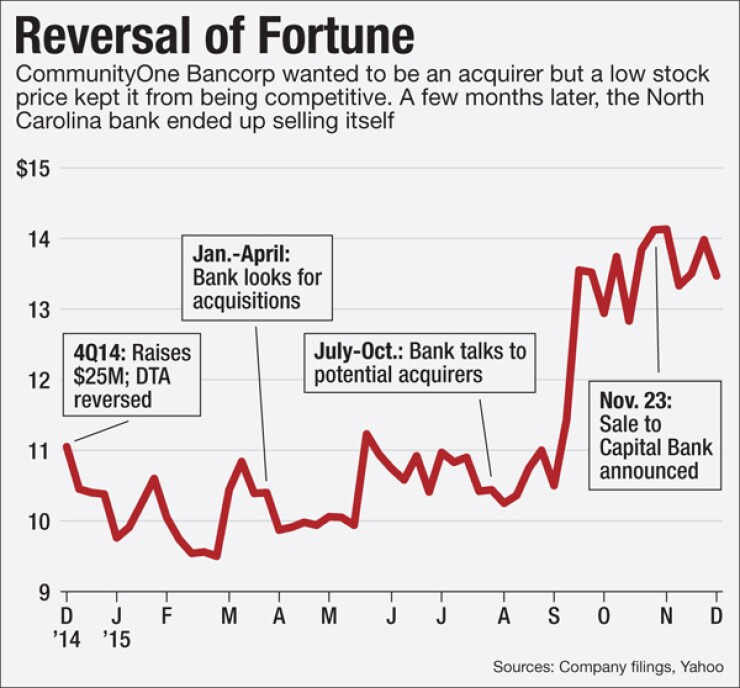

Buyers can quickly become sellers.

That's the story of CommunityOne Bancorp – and bank M&A in general.

The Charlotte, N.C., company whiffed on several acquisition attempts, including talks about a merger of equals, before agreeing to sell itself to a local rival, Capital Bank Financial. The $7.3 billion-asset Capital

-

There were doubts that CommunityOne could survive in 2011, even with the help of private equity and cooperation from regulators. Four years later, the North Carolina company is again profitable and healthy enough to consider acquisitions.

September 11 -

CommunityOne Bancorp in Charlotte, N.C., has agreed to buy a branch in Lenoir, N.C., from CertusBank.

March 31 -

Capital Bank CEO Eugene Taylor took a three-year break from acquisitions until agreeing to buy CommunityOne earlier this year. Taylor hopes the deal provides evidence that his team is a buyer not a seller in the year ahead.

December 30 -

Capital Bank Financial in Coral Gables, Fla., has agreed to buy CommunityOne Bancorp in Charlotte, N.C.

November 23 -

On the sidelines for three years, the once-aggressive acquirer jumps back in the game with a deal for CommunityOne Bancorp in Charlotte. It's also looking to bulk up in Tennessee and Florida, though any opportunity would bring tough decisions on whether to cross the $10 billion-asset mark.

November 23

CommunityOne, fresh off of

CommunityOne concluded that its low stock price "would not be competitive in any of those situations," the filing said.

The company went as far as to sign a nondisclosure agreement in January 2015 with an unnamed banking company to have "meaningful discussions" about a merger of equals. CommunityOne also tried to buy a nonbank that was involved in Small Business Administration lending before giving up last August.

CommunityOne began having discussions last May with the investment banks Sandler O'Neill and UBS about options that included independence, acquisitions, a merger of equals or selling to a larger company. CommunityOne considered its markets and growth potential as strengths, while its stock price and limited trading volume were viewed as weaknesses. The potential benefits of a $142.5 million deferred-tax asset that the company reclaimed at the end of 2014 were an important factor, too.

CommunityOne's first choice was a merger of equals, based on a belief that such a deal would preserve the company's DTA and allow its shareholders "to continue to hold a larger stake in the pro forma combined company," the filing said. Sandler and UBS approached three companies last summer, but two were said to have declined because of "other strategic priorities."

The investment banks also reached out to seven companies, including Capital, about buying CommunityOne. Four of the companies signed nondisclosure agreements to pave the way for due diligence, but Capital was the only one that decided to continue discussions past an October deadline for submitting nonbinding expressions of interest.

Only Capital and the unnamed company that had previously discussed a merger of equals remained in the running in mid-October. Capital's initial offer of $13 a share was about 13% higher than that of the other bank, the filing said. The companies were pressed to raise their offers, and CommunityOne insisted on "management participation" at the unnamed institution due to "the larger percentage ownership that CommunityOne shareholders would have in the pro forma company."

At different times in October, the chief executives for Capital and the unnamed company met with Carlyle Group and Oak Hill Partners, which owned a combined 47.6% of CommunityOne. The unnamed institution asked for exclusive negotiations but was denied.

Capital's second offer of $14 a share, given in mid-November, trumped the other institution's second proposal by nearly 10%, the filing said. CommunityOne's board decided to work toward finalizing an agreement with Capital.

CommunityOne's board, excluding members with ties to the big private-equity firms, met on Nov. 17 to discuss the pros and cons of selling the company to Capital. Positive factors included merging with a larger institution, a complementary branch network, the business model and the share of board representation.

Risks included the impact of Capital's crossing over $10 billion in assets, where it would face mandatory stress testing and caps on interchange fees. Capital is set to have more than $9.6 billion in assets when the deal is completed.

CommunityOne's investment banks eventually persuaded Capital to raise its offer to $14.25 a share, and an agreement was