JPMorgan Chase’s third-quarter performance offers a road map to profit and loan growth amid lower rates and emerging weaknesses in credit quality. The question is whether most other banks can follow it.

That its net income rose 8% year over year to $9.1 billion was a feat given “slowing [gross domestic product] growth, weakening business sentiment and a challenging interest rate environment,” Jason Goldberg, an analyst at Barclays, wrote Tuesday in a research note to clients.

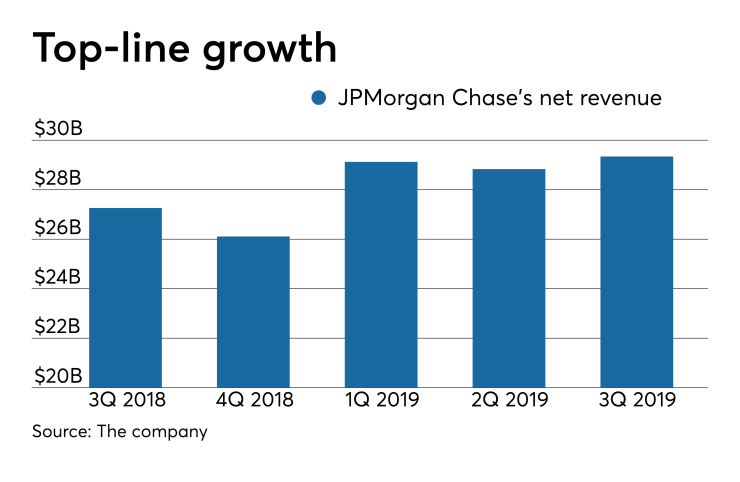

Top-line contributions from multiple lines were a big factor. Total net revenue climbed 8% to $29.3 billion thanks to higher fees from investment banking, increased volume of credit card transactions and growth in wealth assets under management.

The bank also squeezed out a 2% increase in net interest income to $14.2 billion. That was the result of loan growth and managing deposit costs, said Eric Hagemann, an analyst at Pzena Investment Management in New York, which owns about 2.5 million JPMorgan shares.

Average total loans, excluding residential mortgages sold on the secondary market, rose 3% from a year earlier. Interest expense fell 4% to $6.9 billion since the second quarter.

“JPMorgan is demonstrating that banks can still grow earnings,” Hagemann said in an interview.

Still, two hurdles were evident in JPMorgan’s earnings report that could trip up less powerful banks with fewer options at their disposal.

The average yield on total interest-earning assets dropped 17 basis points from the second quarter to 3.56% in the latest quarter as the Federal Reserve’s rate cuts on July 31 and Sept. 18 led to lower yields on floating-rate loans and investment securities.

Meanwhile, credit quality issues emerged in some business segments. Third-quarter charge-offs rose 33% from a year earlier to $1.4 billion, with upticks in consumer and community banking, commercial banking and wealth management.

The higher levels of charge-offs should not raise industrywide concerns that higher delinquency rates are on the immediate horizon, Hagemann said.

“The tick-up in credit costs was a function of them coming off a base of nearly zero,” Hagemann said. “As long as jobless claims and the unemployment rate remain benign, we’re unlikely to see a sharp turn in those trends.”

Charge-offs in the quarter, as well as a $150 million increase in loan-loss reserves, were in line with the company’s expectations, Jennifer Piepszak, chief financial officer, said during the conference call.

If anything, investors are undervaluing how strong most banks are performing and may be too concerned about a recession, Hagemann said. The KBW Nasdaq Bank Index has been virtually unchanged in the past year. But banks are in a solid position, even if the economy sours, he said.

“The market has underappreciated the impact of loan growth, efficiency projects, the return of excess capital to shareholders and strong liquidity positions” at large banks, Hagemann said.

Also during Tuesday’s earnings report, Chairman and CEO Jamie Dimon addressed the question of whether banks are doing their part to help address society’s ills.

In response to an analyst’s question during the earnings call about the potential for tax increases on the wealthy, Dimon said banks should take a leading role in helping struggling communities. JPMorgan has financed countless projects at below-market rates, forgoing a profit, to do its part.

“We’re trying to do a tremendous amount to try to help communities, because there have been people left behind,” Dimon said.

Mike Mayo, an analyst at Wells Fargo Securities, said he heard discussion of potential tax increases at a conference in New York last week.

“Politicians talk about the wealth tax, a transaction tax, a change in corporate tax, personal tax, basically flattening the pyramid,” Mayo said. “And it seems like a lot of people point their fingers at the banks.”

Dimon said JPMorgan is active in providing low-interest loans and other types of financing to community projects in Detroit and elsewhere.

“Infrastructure is not failing because of banks. We can help build infrastructure, help people get work skills ... we could lift up society,” Dimon responded. “When society does better, everyone does better. If you don’t believe me, look at Venezuela, Argentina, Cuba, North Korea, etc.”