Congress is considering the first significant increase in years to a staple affordable housing program. For banks, that would mean more opportunities to put money to work and to fulfill regulatory requirements.

If passed, the Senate bill would expand the Low Income Housing Tax Credit program by 50%, helping to create or preserve an additional 400,000 affordable units beyond the 900,000 the program is already expected to provide over the next decade.

By helping to defray the high construction costs that so often make affordable-housing projects economically infeasible for developers, the LIHTC expansion could unleash a boomlet in development aimed at low- and moderate-income renters.

-

Ten banks have invested a total of $25 million in the fund, which buys up mortgage-backed securities tied to loans made for the development or rehabilitation of affordable single- and multifamily homes.

June 24 -

The agency's insurance-rate cut could spur the rehab of thousands of affordable units, but it's far from a total solution, housing advocates say.

April 4 -

In a political season teeming with tension around income inequality, racial economic disparities and animus toward the banking industry, reforming the Community Reinvestment Act seems like it should be a cornerstone of the debate. Yet the law has been almost entirely absent from the discussion. Here's why.

August 2 -

Steps to improve credit access, evangelize for down payment programs and offer borrower counseling can stop and even reverse the decline in homeownership.

June 21

As a result, banks would have more projects to invest in. Such investments are crucial to meeting their obligations under the Community Reinvestment Act—obligations that a dearth of affordable housing has at times made tough to meet.

"We are here, we are available, we have the capital available," said Robert Likes, the head of community development lending and investing at Cleveland-based KeyBank, a subsidiary of KeyCorp.

"One of the constraints is, there just aren't enough projects." He called the proposed legislation a "huge" boon to struggling families.

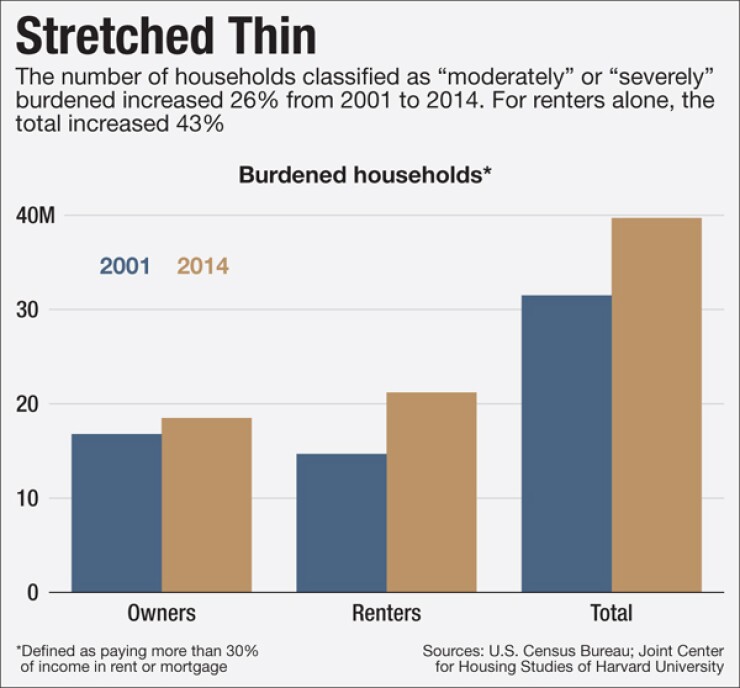

The bill, introduced in May by Democratic Sen. Maria Cantwell and Republican Sen. Orrin Hatch, with additional features added in mid-July, has strong bipartisan support in Congress. It would be the first major expansion of the LIHTC program since 2001.

The affordable-housing shortage has gotten so bad that government assistance for community development projects, once a Democratic hobbyhorse, is now favored on both sides of the aisle. Hatch is the chairman of the Senate Finance Committee, which oversees tax credit legislation; Sen. Ron Wyden is the committee's ranking Democrat and Cantwell is a member of the panel.

In a statement, Sen. Cantwell said that she wanted "to expand this proven economic development tool and job creation engine to provide even more affordable housing that America desperately needs."

There is no guarantee that the bill will pass, nor even that it will soon come up for a vote, despite historic lows in the homeownership rate. Much of the legislative agenda could remain on hold until after the presidential election and the ensuing lame-duck session have passed. In an era of extreme political polarization and congressional deadlock, however, the apparent bipartisan support for LIHTC stands out as a bright spot.

"If you would have told me in the '90s that Orrin Hatch was sponsoring an affordable housing bill, I would have said, 'Yeah, right. I don't think so. You're living in some Pokémon Go virtual world,' " said Ken Thomas, president of the Miami-based Community Development Fund Advisors. "But here it is."

Even the proposed LIHTC expansion, which would increase its cost to about $11 billion annually, will not be enough. According to the Department of Housing and Urban Development, the United States is losing more than 300,000 affordable units each year.

"Clearly by '12, '13 we really should have had it," Thomas said of the bill. "Better late than never."

Nowadays, if a bank can show it is doing everything it can to meet the needs of its local community, it will also receive CRA credit for community investment projects in other parts of the country. That is why KeyBank was free last year to provide nearly $1 billion in debt and equity financing to affordable-housing developments, more than double the amount it provided in 2014. The $101 billion-asset bank now seeks out projects in all 50 states rather than financing only those it finds in the 14 states where it has a retail presence.

The Cantwell-Hatch bill, if passed, should provide more investment opportunities in banks' local areas.

"It takes away the excuse that there are no qualifying investments out there," Thomas said.

Since its creation in 1986, the LIHTC has financed nearly 2.9 million homes nationwide. But 3.9 million extremely low-income families, according to a report released by Sen. Cantwell's office this year, still lack access to affordable housing. As it stands, said Likes, only one out of every three or four applications for an LIHTC is approved.

While some have criticized the LIHTC program, arguing that it is not very effective at meeting its goals and serves mainly to benefit developers and their investors, Thomas said his decades of experience studying the CRA and fair lending practices have taught him that government subsidies are necessary for affordable housing—and he thinks the tax credit will continue to be supported no matter who wins the White House in November.

Donald Trump is "not going to be out there waving the CRA flag like Hillary [Clinton] would be," said Thomas, "but he's not going to discourage any of it. He's made all these claims about helping people of different income levels, so how could he go against it?"

KeyBank seems to be making a similar bet. In January 2017, the bank will launch a five-year initiative committing $8.8 billion to community development lending and investment. That capital will almost certainly need to be paired with federal dollars.

"This is why we have the federal government," Thomas said. "It's not that the private sector doesn't want to do it, but they're just not able to do it."