After enduring a nightmarish week in which its chief executive was ousted, its funding began drying up and the Justice Department served it with a subpoena, Lending Club now finds itself contemplating emergency maneuvers that would have been unimaginable at the start of the month.

The world's biggest marketplace lender, whose business model depends on it quickly selling its loans to investors so it can originate new ones, disclosed in a regulatory filing late Monday that it is now considering using more of its own capital to fund loans.

Over the past week, Goldman Sachs, Jefferies and other investors have reportedly stopped buying its loans, at least temporarily. "It is possible that these investors may not resume investing through our platform," Lending Club warned in the Securities and Exchange Commission filing.

-

The abrupt resignation of the firm's founder and CEO, under a cloud, seems likely to fan investors' growing fears about the marketplace lending sector. It could also hasten regulatory scrutiny.

May 9 -

Some buyers are hanging in there, but as OnDeck Capital's disappointing first-quarter results show, investors who acquire and securitize marketplace loans are heading for hills. Among the reasons: fear of defaults, unfavorable pricing and shrinking loan yields.

May 3 -

Suddenly, online lenders are struggling, or paying higher prices, to attract the institutional money that has fueled their rapid rise.

April 13

The company also stated that it may need to offer "significant inducements" to loan buyers in order to lure them back to its platform. Those sweeteners could include offers of equity in Lending Club, which would dilute existing shareholders, the company stated.

It remains to be seen whether those steps will be enough to assuage loan buyers who were rattled by the May 9 ouster of founder and CEO Renaud Laplanche, as well as the company's disclosure that it discovered changes to loan data in order to fit a buyer's specifications.

The most recent disclosures show how precarious Lending Club's position is today. Lending Club acknowledged Monday that it may not be able to reach agreements with its skittish institutional loan buyers. And even if it does, the agreements will assuredly be on terms that are less favorable to Lending Club.

For years, industry critics have been arguing that a heavy reliance on continuing loan growth is a key flaw in marketplace lenders' business model. But few expected Lending Club, which was long the industry's undisputed leader, to be among the first companies to expose it.

Until quite recently, the idea of funding loans on its own was anathema at Lending Club, which long argued that its marketplace lending model is more efficient than balance-sheet lending. "We are a technology company that happens to provide a financial service," Laplanche told American Banker last year.

But Lending Club is now in survival mode. And in order to meet the meet the demand from borrowers, who often use personal loans from Lending Club to consolidate credit card debt, the company may have no choice but to turn to its own balance sheet.

As of March 31, Lending Club had $868 million in cash, cash equivalents and securities available for sale. That compared to $2.75 billion in loan originations during the first quarter.

Another potential option for Lending Club is to raise the interest rates it charges borrowers. That would suppress loan demand and while providing higher margins for investors. Lending Club has already raised its rates three times since December.

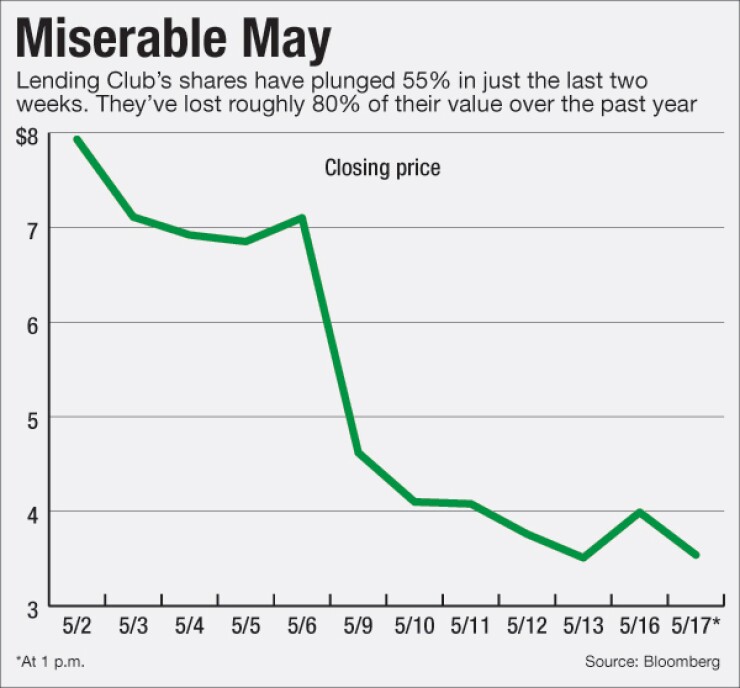

The recent events have battered Lending Club's shares, which plunged 51% last week and were down another 9% Tuesday after the firm revealed that it received a grand jury subpoena from the Department of Justice. The stock was trading at around $3.50 late Tuesday; it went public at $15 in December 2014 and was trading at close to $20 less than a year ago.

Analysts at Compass Point Research & Trading, who already had a "sell" rating on Lending Club, cut their price target Tuesday for the stock from $4 to $3.

"We could become more constructive on shares if the company was able to secure a stable source of funding assuming no significant dilution to equity holders," Compass Point wrote in a research note.

James Friedman, an analyst at Susquehanna Financial Group who has a "neutral" rating on Lending Club, said that he expects investors to continue searching for strong risk-adjusted returns.

"And if that's something that Lending Club can continue to offer, I do think that investors will come back, though maybe not to the same degree," he said.

In addition to jittery investors, Lending Club is coping with a number of other headaches. Its to-do list includes dealing with regulators, lawsuits and the salary demands of its own employees.

After Lending Club received the DOJ subpoena on May 9, the company contacted the Securities and Exchange Commission. Lending Club stated Monday that it intends to cooperate with both agencies.

With storm clouds hanging overhead, Lending Club is also an attractive target for litigation. Four lawsuits seeking class-action status, alleging violations of securities laws, were brought against Lending Club during the first quarter, according to the company. Lending Club also said Monday that it may be subject to litigation related to the events surrounding Laplanche's exit, and it expects to incur significant legal expenses.

In light of what transpired over the last week, Lending Club may also have a harder time holding onto its employees.

The firm said Monday that it has offered retention packages to employees. Acting CEO Scott Sanborn was granted $5 million in restricted stock, in addition to a salary increase. Chief Financial Officer Carrie Dolan got $3.5 million in restricted stock, plus a $500,000 cash award.

Meanwhile, members of the company's board raised the pay of Executive Chairman Hans Morris to $250,000 a year, up from $40,000 a year in 2015, and awarded him $1 million in stock options. Morris, who was previously a director, took on additional duties just prior to Laplanche's departure.

Finally, Lending Club disclosed Monday that given the challenges the company now faces, it may be forced to reduce its loan origination volume.

In the fourth quarter of 2015, Lending Club's loan origination volume grew by 68% compared with the same period a year earlier. During the four previous quarters, loan originations grew by 82% to 107%.

The possibility of lower loan originations could further undermine investor confidence since Lending Club's business plan — and indeed the plans of the entire marketplace lending sector — has been predicated on rapid growth over the next several years.

Between January and March, Lending Club earned 82% of its total operating revenue from what are essentially loan origination fees. That amounts to a heavy reliance on new loans. And it means that if loan originations slow, the company's staffing will likely have to be reduced as well.