There are good reasons so few companies are in the in-school student lending market, at least according to David Green, chief product officer at the fintech lender Earnest.

"The market is big, but it’s not as big as the student refinancing market," Green says. "It’s challenging from a loan-size perspective because you’re looking at an average loan of $10,000 versus $70,000 when you refinance a post-graduation loan. You have to be very efficient with serving them and getting to those users."

The San Francisco-based fintech says it is confident, however, that it can handle those issues, jumping into in-school student lending for the first time as more private lenders seek to service what can be a risky part of the market.

This week Earnest officially launched its product, which was partly created based on feedback from students, loan co-signers and financial aid offices.

“We’re trying to make sure the process for students is as clear and transparent as possible,” Earnest CEO Susan Ehrlich said in an interview in March when she confirmed the product’s pending launch.

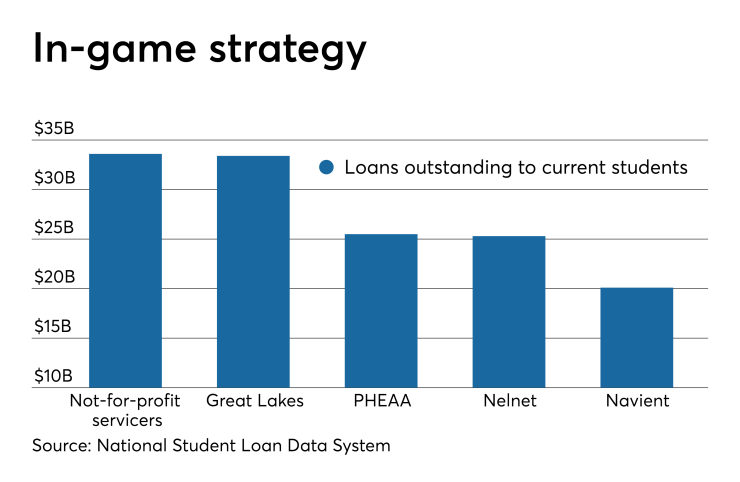

Navient, which owns Earnest, first mentioned the fintech’s intention to offer in-school student lending during an earnings call. Navient CEO Jack Remondi said the company expects to originate roughly $300 million worth of loans to current students this year. Earnest joins companies such as CommonBond, Sallie Mae and LendKey that also offer in-school lending options. Sallie Mae, Navient's former parent, originated $5.7 billion in private education loans last year.

The general idea behind the private student lending is that such companies can provide better interest rates than federal student loans.

“While government provisions of loans guarantees that nearly everyone is eligible for some financial underwriting of their education, the interest rates of those loans are at an absurd 5% to 8%,” said Lex Sokolin, a fintech entrepreneur and former global director of fintech strategy at Autonomous Research.

Sokolin added such rates make sense when risks are spread out across the entire population of students, where the best performers subsidize the worst performers. “However, it also creates an opportunity for private lenders to provide better rates more in line with the market for some of the students,” he said.

In-school student lending isn’t without some risks, Sokolin warned.

“Lending to students still in school means getting to that borrower earlier, with less of an adult track record in place,” he said. “As a result, you have to rely much more on broader types of data and credit history.”

Earnest said it has refinanced over $4 billion in student loans, saving borrowers some $500 million in interest, according to a press release.

The fintech said it will focus on loan transparency in a few ways, particularly through a two-minute eligibility check as well as a checkout process designed to provide a loan summary before a consumer agrees to the funding. Green said the checkout process also is designed to help borrowers assess the best repayment options, which include a $25 fixed monthly payment, interest-only payments, and principal and interest payments as well as deferred payments.

“At the end of the day, the borrower is going to know exactly what they’re signing up for, and that should help them make better decisions” for repayment, Green said.

Earnest expects the majority of in-school lending candidates will need to rely on a co-signer to gain loan approval. Green said that’s the case for about 90% of undergraduate loans across the industry. To that end, Earnest said it is also making it simpler to involve a co-signer in the process and give borrowers the ability to share an application through the mobile app.

The fintech will give borrowers a nine-month grace period to begin repaying the loan upon graduation, which is three months more than the industry standard.

Earnest also announced it has hired Pamela Rice as chief technology officer and vice president of engineering. Rice was most recently at Capital One, where she led the company’s emerging technology labs, development operations and technology commercialization programs. She also served as the chief technology officer for OnDeck Capital, and was with BillMeLater when PayPal purchased the company in 2008.