-

Commercial real estate lending and mortgages are banks' main source of hope to beat lukewarm expectations for the earnings season that begins Tuesday.

July 10 -

Regional banks are reporting strong commercial loan growth as they have for so many quarters. Yet this time it looks like more of the growth is coming from existing clients, and there are also some early warnings about credit challenges.

July 21 -

An Office of the Comptroller of the Currency emerging risk report said underwriting for indirect auto and leveraged loans is cause for concern.

June 25 -

The agency's Semiannual Risk Perspective pinpointed compliance and operational risk as potential problems for big banks while it outlined a different set of challenges for midsize and community banks.

June 30

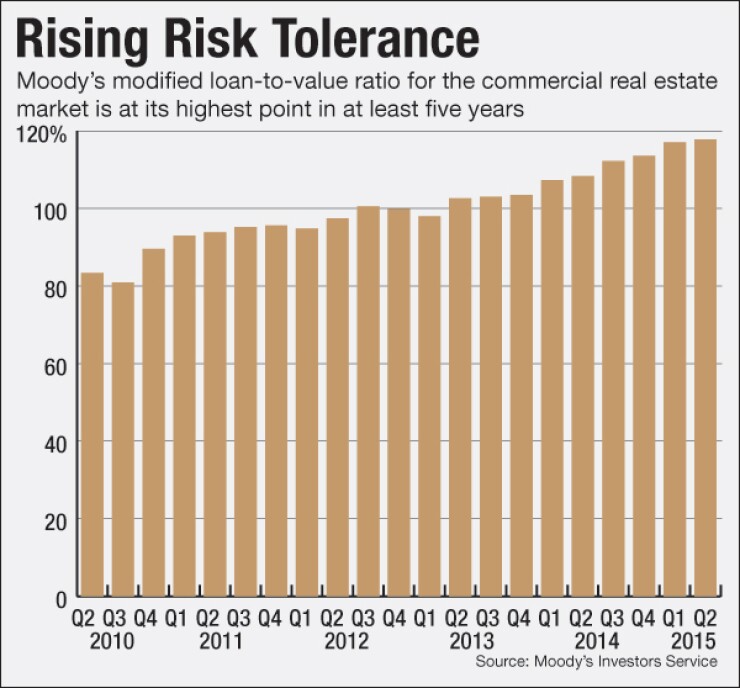

It may be time to start worrying about commercial real estate lending again.

Banks are now as overextended on CRE properties as they were on the eve of the financial crisis, according to a new report from Moody's Investors Service.

The ratings agency's calculation of the marketwide loan-to-value ratio --adjusted for normalized, historical rates of return — has exceeded 100% for two years and reached nearly 118% in the second quarter, Moody's said. The latest figure is a touch higher than the late-2007 peak, which was, of course, quickly followed by a market crash.

Moody's analyst Joseph Pucella called the results a "warning sign" but acknowledged that there is no indication yet that banks' CRE books are deteriorating. And there are now buffers that make a repeat of the last crisis unlikely, he said.

"It's a concern, but there are differences between the current and prior cycles with CRE," he said. "Higher debt-service-coverage ratios should alleviate some of the concern."

Pucella's note of cautious optimism is struck throughout the Moody's report on the banking sector, released Thursday. Credit indicators continued to improve in the second quarter, and some are even better than before the financial crisis.

That is the case with CRE loans: 0.7% of them were nonperforming at midyear, compared with nearly 10% at the beginning of 2010, Moody's said.

This contrast between benign current results and ominous future indicators is nothing new. For years since the recession, regulators and others who study the numbers periodically have issued grave

Yet quarter after quarter, warnings or no warnings, bank balance sheets across the industry show declining delinquency rates and chargeoffs.

But what Pucella calls "leading indicators" — canaries in the coal mine, essentially — are starting to chirp, and banks need to pay attention. Along with CRE overleveraging, the Moody's report expresses concern about the above-average loan growth in C&I — although, as with CRE, losses have not shown up yet.

The canaries may not have died yet, in other words, but they are starting to get woozy. And as the last crisis showed, it is too late to act once losses start to mount, Pucella said.

"Asset quality can deteriorate very quickly," he said. "We look to these leading indicators for some sign of stress coming, but they don't typically give you much warning sign."

Losses are manageable for the time being, though low oil prices put pressure on some types of loans in the second quarter. More than 90% of banks had declines in their nonperforming assets in the second quarter. Regional and community banks had lower average NPAs (1.9%) than the four largest banks (3.2%).

Nonperforming loans declined in all major asset categories — CRE, residential mortgages, credit cards and auto — but C&I, where NPAs rose 6 basis points because of weakness in the energy sector. But the rate was still a very low 66 basis points, Moody's said.

Trends in loan growth — especially C&I — also fit into the "fine for now, but bears watching" category.

C&I continued to be robust; after slowing for several quarters, it grew 10% year over year in the second quarter. Auto loans grew at 8%, down from quarterly averages in the teens to 20% over the past few years.

The 10% quarterly growth rate in multifamily was in line with the past few years, though Moody's analysts wrote that Fannie Mae and Freddie Mac's decision to reduce their multifamily lending could leave the field open for banks to expand their lending.

There is even a comeback in land and construction lending, where banks have been extremely gun-shy since the crisis. After pulling back rapidly, banks slowly started to increase their construction lending last year, and it has taken off this year, with growth rates of 24% in the first quarter and 17% in the second.

Those numbers look more striking than they are, though, because they show the rate of improvement from a time when banks had drastically pulled back their construction lending. The uptick happening now "goes right in line with the real estate market improving," said Pucella.

"The growth in construction lending is a concern , but it is still off a low base today," he said.

This sharp loan growth, along with the ever-climbing loan-to-value ratio in CRE, are the most worrisome signs Moody's saw in the second quarter.

"The key takeaway is that asset quality remained stable and improving in the second quarter," Pucella said. "But above-average loan growth remains a concern going forward."