-

Citigroup Inc. and JPMorgan Chase & Co. were among the 33 banking companies to sign an expanded version of the three-year-old environmental policy known as the Equator Principles.

July 7 -

The FICO score, and the predictive analytics behind it, revolutionized credit decisioning not long after it was unveiled by Fair Isaac in 1989. In the same vein, Diane Baum hopes that her automated environmental assessment, dubbed "Enviroscore," will simplify commercial lenders' decision-making process when it comes to evaluating the environmental risk of a proposed transaction, and significantly reduce the amount they spend on the compulsory "Phase 1" environmental assessment of a property.

August 1

Some potential corporate customers of the nation's largest banks have recently received surprising responses to their loan applications: come back to us later when you've cleaned up your act.

It is the new wave of green-washing at American banks, even at the expense of adding new business during a time of

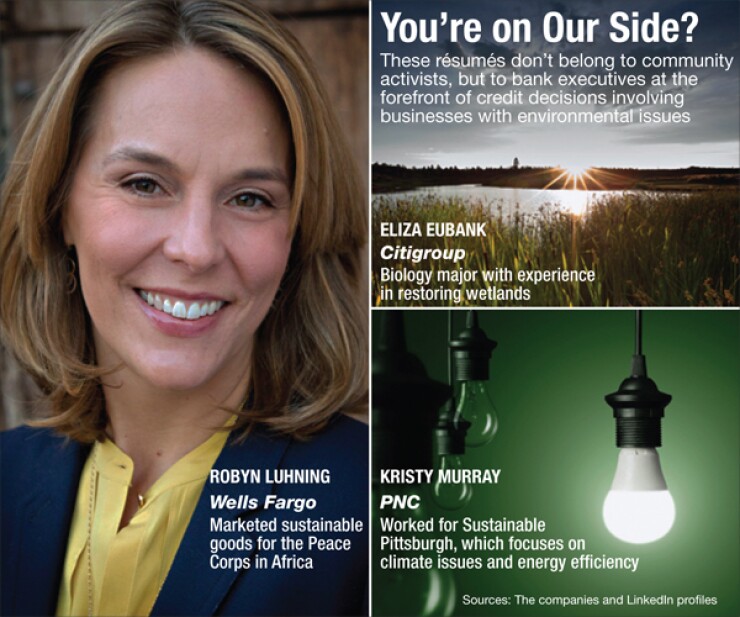

"We think that engaging with customers with poor environmental-risk practices could result in risk to Wells Fargo," said Robyn Luhning, a senior vice president and Wells' environmental and social risk manager.

Citigroup is willing to walk away from a deal if it does not meet the company's environmental standards, said Eliza Eubank, senior vice president of environmental and social risk management.

"Companies that are better at managing environmental issues are better at managing other issues," Eubank said.

Banks like

There is also peer pressure as companies like

Banks certainly seek some public-relations glory by touting their environmental standards, but there is more to it now, said Todd Glass, an energy and infrastructure finance attorney with Wilson Sonsini Goodrich & Rosati. Environmental principles also have an effect on banks' bottom lines.

"Theoretically, yes, they are leaving money on the table" if they reject a loan applicant because of its environmental risks, said Glass, whose clients include investment banks and utilities.

"But look at it from another direction: this is an economic necessity," Glass said. "What banks are starting to see is that this is not just a wacky environmental agenda. This is really fundamental to leading companies."

Luhning and Eubank, both senior members of their banks' offices of environmental and social risk management, represent the point where a bank's public image meets head-on with credit analytics and risk management. It is the place within a bank where the green of the outdoors can clash with the green color of money. Yet in these executives' eyes, the two are financially compatible, if not essential.

Both Luhning and Eubank possess education and professional experience far outside the world of banking. Luhning majored in environmental management as an undergraduate and worked in Africa for the Peace Corps, marketing sustainable goods. Eubank majored in biology and started her career as a naturalist at an outdoor ecological education center, and working for a nonprofit group in the restoration of wetlands.

PNC Financial Services Group has also added its own environmental expert. The Pittsburgh company in January hired Kristy Murray as its first environmental and social risk officer, shortly before the bank acceded to environmental groups' demands that it pull back from

Two other banks that also maintain environmental and social risk management divisions, Bank of America and MUFG Union Bank, declined to make the executives who work in those units available for comment. B of A this month said it would

An Evolving Job

To be sure, banks for decades have employed risk managers to assess whether environmental issues could interfere with certain borrowers' ability to repay their loans. Many regional banks and community banks employ such professionals, including Bank of the West, BB&T and Comerica, according to the Environmental Bankers Association

One of those folks is Jan Sheinson, an environmental risk manager at BMO Harris in Chicago.

"My primary role is to provide a technical opinion on environmental risks, and translate it for underwriters into bankers' terms," Sheinson said.

But his job has a narrower scope than the new breed of executives such as Eubank, Luhning and Murray, who also seek to determine whether a borrower's operations could hurt the environment or public health -- and damage their banks' image public image in the process.

"It's two different disciplines, two different skill sets," Sheinson said in comparing his job to the others'.

Citigroup's division of environmental and social risk management encompasses both roles, Eubank said. Her department reports through the risk management department to the chief executive's office.

"We're often asked how many deals we turn down," Eubank said. "That's not the right way to think about it. Our job is not to say 'no,' but to explain the conditions under which we can get to 'yes.' It's up to the client to decide if they want to take those steps to get Citi to finance their project."

If a client does agree to implement Citi's recommendations, the bank will hold the client's feet to the fire.

"We don't just shake hands on it up front and then move on," Eubank said. "We put a legally binding covenant in the loan agreement that commits the clients to adhere to these standards."

Any Downside?

Although it would seem that banks are voluntarily imposing restrictions on their business, it does not appear to present an immediate threat to banks' financial growth, said Christopher Whalen, senior managing director at Kroll Bond Rating Agency. It is unlikely that Kroll would cut a bank's debt rating based on it having a department of environmental and social risk management, he said.

However, if a bank repeatedly turned down business because of environmental factors, Kroll might need to revisit the issue, he said.

"If an institution Is missing a lot of opportunities and it ripples through and affects their financial results, that could become a factor," Whalen said.

The issue would probably be more pertinent to smaller banks that have limited business opportunities, he said. Large banks have such large loan portfolios that it probably is not financially material for them to reject a few loans for environmental reasons.

"Banks like PNC have other choices," Whalen said. "These things aren't going to be that significant in the grand scheme. The pressure groups are going to go after large banks like PNC or, even more likely, a bank like JPMorgan [Chase]. They want to create a ruckus. They're looking for publicity."

Ultimately, some bankers have decided that a client's ability to manage its own risk factors that involve the environment or other hot-button issues has a direct bearing on the risks that a bank assumes by providing a financing arrangement, Luhning said.

"Our experience has shown that a deeper understanding of these issues improves our credit decisions," she said. "I bring environmental and social issues to the table, and that's combined with people who understand balance sheets and cash flow. It's one more piece of information to give ourselves a full picture of the client."