Battle lines are being drawn over pricing as the banking industry continues its slow and steady rollout of faster payments.

U.S. Bancorp Chief Executive Richard Davis offered an impassioned defense of his company's decision Wednesday to charge a $6.95 fee for real-time transfers.

The $429 billion-asset company launched real-time payments last month — and is one of only two companies to offer the service through the industry-backed clearXchange network, which lets each bank control its pricing strategy. Bank of America is the other participant in the network, but it does not charge customers for the service — a decision that has raised questions about the competitiveness of U.S. Bancorp's product, especially if other banks follow B of A's lead.

-

Add U.S. Bank to the list of companies allowing its customers to access its mobile app through their thumbprint.

April 1 -

The real-time, person-to-person payments service launched last week by U.S. Bank and Bank of America with clearXchange will service as a litmus test for whether, and how much, consumers are willing to pay for quick money transfers.

March 15 -

The plan calls for the implementation of two new same-day settlement windows by March 2018. Fees that banks and credit unions will pay each other to cover the cost of the upgrades have been decreased.

May 19

Yet as more banks begin offering real-time payments, they have a responsibility to charge a fee, Davis argued during a conference call with analysts. Banks have made big investments in technology — and charging a fee for the service will help recover some of those costs, he said.

But there is also a bigger issue at play: Charging a fee for real-time payments will prevent banks from becoming a "utility" to clients, Davis argued.

"We have to make sure that the business of banking doesn't become a utility in the minds of consumers, where they expect everything to come without a value price to it," Davis said.

To illustrate his point, Davis pointed to Amazon Prime as an example of how banks should model the business. Amazon customers receive free shipping for two-day shipments — but pay extra when they want their packages to arrive faster.

A similar logic should apply to real-time payments, Davis said. Offering real-time payments will help banks to acquire customers and compete with nonbank providers, such as Venmo.

But providing an easy-to-use service is expensive.

"This will become ubiquitous over time, which at the end of the day is OK, as long as the industry finds the right value proposition," Davis said. "We continue to evaluate pricing as we think about competitors. So I think to extent that there are more in the marketplace at different price levels, that will influence our pricing strategy."

Chief Operating Officer Andy Cecere echoed the idea that U.S. Bancorp might adjust its prices as it surveys the field. "It is a comparison and a look across different competitors," he said in an interview after the call.

Research suggests that consumers are willing to pay for faster payments. Nearly one third of consumers and three-fourths of businesses want real-time payments and are willing to pay a fee, Esther George, president of the Federal Reserve Bank of Kansas City,

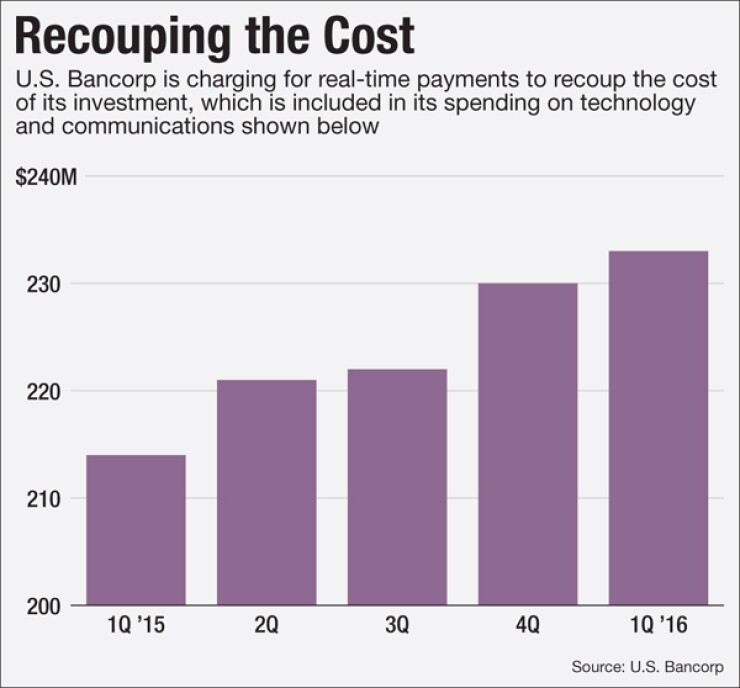

However, the scrutiny over pricing comes as U.S. Bancorp — like many of its peers — has made ambitious investments in technology during a period of limited revenue growth.

Technology-related expenses at the Minneapolis company jumped 9% in the first quarter, to $233 million. It attributed the increase to conversion costs associated with its recent acquisition a $1.6 billion credit card portfolio.

But tech expenses have crept up steadily all year as U.S. Bancorp — which describes itself as a "leader in the rapidly changing landscape of banking technology" — has released new digital products, such as a cutting-edge mobile app.

During the call, analysts pressed U.S. Bancorp executives on the uptick in costs. In total noninterest expenses edged up 3%, to $2.7 billion. The company — which is well known for its disciplined approach to cost management — also expects costs to increase in the second quarter.

Higher costs weighed on profits, which dipped 3% from a year earlier, to $1.4 billion.

During the call, Davis reiterated that, despite the recent "discord" over pricing strategies for real-time payments, the industry remains united in its effort to compete with nonbank lenders.

Controlling the payment system has historically been a boon to the industry, he said. Building out real-time payment capabilities will help the banks adapt to a changing world.

"We haven't lost our position, we haven't given it up," Davis said. "We're not going to sit idly by while nonbanks come over and take our position."

Still, it is unclear whether banks will be able to

In the coming year, U.S. Bancorp will release additional features to its real-time offerings. It currently only provides the service to consumers — but, in the coming months, it will expand the service to commercial clients, Cecere said.

Davis also emphasized that the industry is working well together on separate efforts to speed up the payment system.

For instance, banks have begun preparing for same-day electronic payments, which will be required by Nacha starting in October. The industry-backed group oversees the ACH network.

"I am happy to report we are all working and playing well together, so that we don't create confusion or price disintermediation on what would otherwise be something we want to keep simple for the customers," Davis said.