KS Bancorp in Smithfield, N.C., seems conflicted over an aggressive buyout offer from a much larger in-state rival.

The $34 billion-asset First Citizens recently went public with

KS Bancorp said in a press release Monday that it had no interest in selling.

The initial offer “did not rise to a level of pricing” to persuade the board to sell, Harold Keen, KS Bancorp’s president and CEO, said in the release. The hostile takeover is “evidence that First Citizens’ corporate culture is not in line with KS Bank’s community banking values,” he added.

Keen appeared to walk the statement back a day later, telling S&P Global Market Intelligence that the board would evaluate the improved offer. “We’re working with the professionals to evaluate it, and I don’t know what else to say,” he said.

Efforts to reach Keen on Wednesday were unsuccessful.

First Citizens' specific rationale for pursuing a bank that is a fraction of its size remains unclear.

A First Citizens spokeswoman pointed to a unique opportunity — KS Bancorp is looking at becoming an S corporation, a move that might require it to buy out several existing shareholders — to acquire a bank with a common culture and customer base.

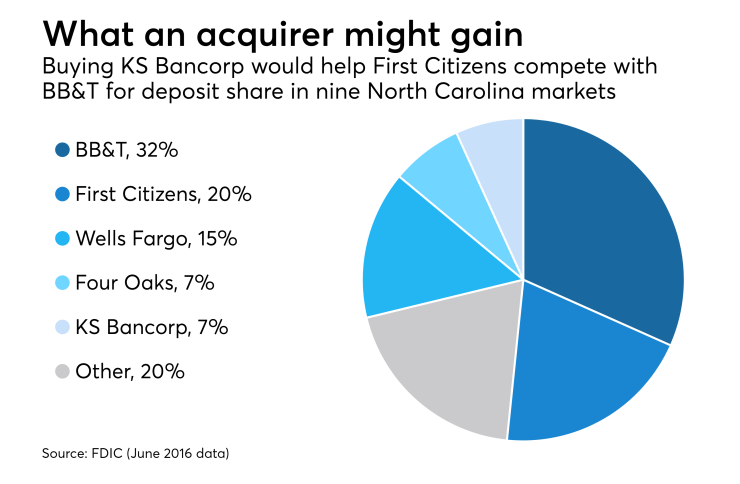

The deal would also help First Citizens compete more effectively with BB&T in nine North Carolina markets — Clayton, Four Oaks, Garner, Goldsboro, Kenly, Selma, Smithfield, Wendell and Wilson — where KS Bancorp has branches.

BB&T had a commanding 32% deposit market share in those markets in mid-2016, based on the latest data from the Federal Deposit Insurance Corp. First Citizens could increase its market share to 27% from 20% if it were to successfully buy and integrate KS Bancorp.

KS Bancorp, for its part, said it understands its importance to the communities it serves.

“As the only locally owned and operated bank left in Johnston County, we provide a level of service and customer satisfaction that other banks in our market cannot,” Keen said in the release.