Regions Financial executives warned Friday that the road to making their bank more efficient might get rockier as the Federal Reserve is expected to cut interest rates.

The $127.5 billion-asset company is six months into a plan to lower its efficiency ratio to 55% by 2021. Regions reported the key measure was 59.4% in the second quarter, which was down from 62.7% a year earlier.

The average efficiency ratio for the industry was 55.8% during the first three months of the year, according to the latest data from the Federal Deposit Insurance Corp.

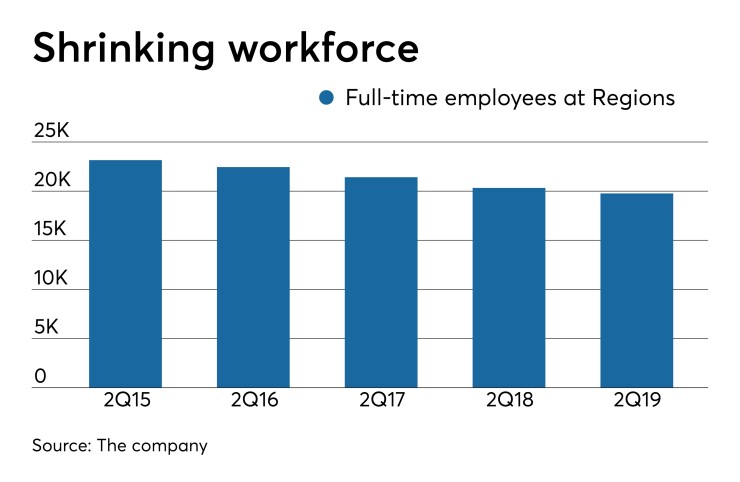

Regions, of Birmingham, Ala., has been trying to get its costs under control primarily by trimming staff and selling off office space.

But its revenues are now expected to take a hit when the Fed cuts interest rates, potentially twice in the back half of the year. Regions' plan could be complicated further if the central bank decides to keep rates low for an extended period in order to prolong the economy’s growth.

“With this rate environment persisting the entire time, it would be pretty tough,” Regions Chief Financial Officer David Turner said on a call with analysts Friday.

The company is trying to strike a balance between reducing its headcount overall, while still recruiting bankers with client relationships in key markets. On net, Regions reduced staff by 291 over the past three months and by 561 since last summer, according to its financials.

“If we’re really going to control our expenses we really have to have an intense focus on our top three categories, salaries and benefits being No. 1,” Turner said.

The company has also sold or is in the process of selling 400,000 square feet of office space, and executives said they are looking at controlling purchases from vendors.

While headcount is being reduced, Regions is updating its technology to cut the cost of running its banking operation. The company saw a 53% increase in new digital checking account openings over the past year, executives said Friday.

Regions reported a 3% increase in profits from a year earlier to $374 million for the second quarter. Total revenue was about flat at around $1.4 billion.

Executives had previously said they would increase revenue by 2% to 4% for the year and on Friday indicated that it would likely be on the lower end of that range.

“In this type of challenging revenue environment and a commitment to positive operating leverage you just have to pull every string you can in terms of controlling expenses,” Turner said.