Few banks have

The question now is how far — and how quickly — can the $22 billion-asset bank bounce back?

Shares in the Little Rock, Ark., bank fell 56% this year, including a 28% plunge in October. A big reason for investor skepticism is Bank OZK's exposure to commercial real estate, which prompted the bank to write off nearly $46 million in loans during the third quarter.

Bank OZK shares still trade below $30, and analysts believe they will languish for the foreseeable future.

"There’s almost nothing they can do to get the stock to reverse,” said Stephen Scouten, an analyst at Sandler O'Neill. “I don’t know if it’s fair," but "they lost whatever credibility they had. It’s going to take some time to earn back.”

George Gleason, Bank OZK's chairman and CEO, will be in the spotlight in 2019 as he looks to contain the bank's CRE exposure and win back anxious investors. For those reasons, he is one of American Banker's community bankers to watch in the new year.

Efforts to reach Gleason were unsuccessful.

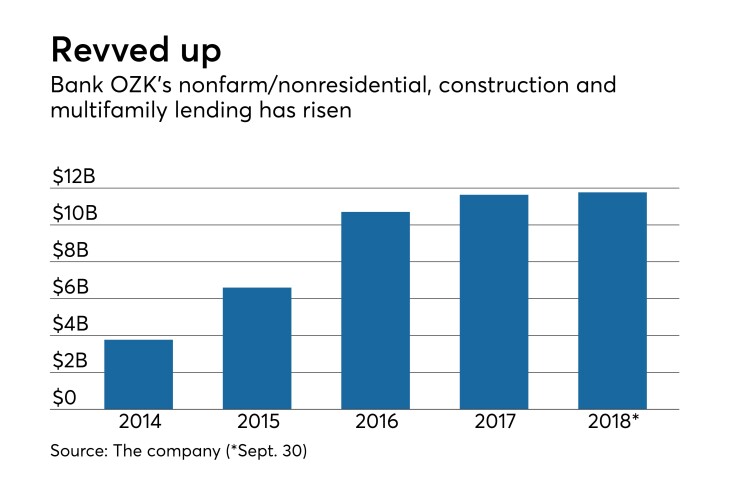

Bank OZK’s real estate specialties group, which focuses on large CRE deals around the country, had more than $8.6 billion in loans at Sept. 30, so the recent charge-offs were relatively modest. Nevertheless, the bank's 0.71% charge-off ratio, while manageable, is its highest since the financial crisis.

Bank OZK,

Net income remains on track to surpass the $422 million the bank earned in 2017.

Still, for investors accustomed to a virtually unbroken track record of success, news of even modest charge-offs came as an unpleasant shock. It’s timing, amid ongoing concerns over the banking industry's high CRE concentrations and growing fears of an economic slowdown, only heightened concerns.

“You have to look at what the market thinks, and it’s not positive,” said Ken Thomas, president of Community Development Fund Advisors in Miami. “Rising rates suggest a slowing economy, which leads to the 'R' word. Everyone’s afraid of a recession.”

To regain investor confidence, Gleason must report several consecutive quarters of unblemished results, Scouten said.

In recent investor presentations, Bank OZK has laid out a case that the October hiccup was an outlier, the real estate specialties group portfolio is fundamentally sound and its 2019 prospects remain bright.

The bank has stated that the charged off credits were the only substandard loans in the real estate specialties group portfolio, which has an overall loan-to-value ratio of 42.1%. Nonperforming assets at Bank OZK totaled $51 million on Sept. 30, or 0.23% of total assets.

Given those strong metrics and its solid capital ratios, Scouten said Bank OZK seems well positioned as it enters 2019 — even if the economy slows.

“It’s hard to see how they would need incremental capital,” he said.

Matthew Utesch, a financial analyst at Umpqua Holdings, said he has seen no signs that Bank OZK is departing from traditionally conservative CRE underwriting standards.

Utesch said he worries more about the bank’s growing portfolio of indirect recreational vehicle and marine loans. That portfolio has increased by 320% since the bank entered the business in mid-2016, to $1.6 billion in loans. Though the average FICO store for those credits is 790, "these are the first types of loans to go bad in a downturn,” he said.

A combination of CRE with recreational lending makes Bank OZK “more recession-prone than other banks,” Thomas said. At the same time, he expressed concerns over a small regional bank's ability to manage a large nationwide CRE book.

“We call it the friction of distance,” Thomas said. “How can they be experts in all these different markets?"

While he agreed that there is room for doubt, Scouten said he remains confident in Bank OZK's ability to navigate through a challenging economy.

“They’re making a big bet on themselves,” Scouten said. “I’m not one to bet against George Gleason. I think he’s as smart as they come.”