Signature Bank has hired a dozen new commercial loan officers across the country, as the New York bank continues to shift away from its historic reliance on multifamily lending.

The $48.6 billion-asset bank recruited bankers away from Wells Fargo, PacWest Bancorp, Comerica and Western Alliance Bancorp., according to a Tuesday news release. The new executives will focus on originating loans to private equity and venture capital funds.

The hirings continue Signature’s expansion into new business-lending markets, such as loans to venture capital firms. Signature formed its venture capital group in April when it hired a 24-person team, also from PacWest's Square 1 Bank division, led by Ken Fugate.

“We believe the venture capital and private equity arenas are rapidly growing sectors which will prove beneficial to our growth,” CEO Joseph DePaolo said in the release.

In Signature’s private-equity group, the bank named two new managing directors, both from Wells Fargo. Charlie Owens will be based in Charlotte, N.C., and Brad Boland will be based in San Francisco.

For its venture capital division, Signature hired eight bankers from the Square 1 unit of PacWest and two additional bankers from Comerica and Western Alliance’s Bridge Bank division. The new Signature bankers will be based in Atlanta, Chicago, Denver, Los Angeles and Durham, N.C. The officers’ experience is primarily focused on the life sciences and technology sectors.

Signature has been on a hiring spree in recent years,

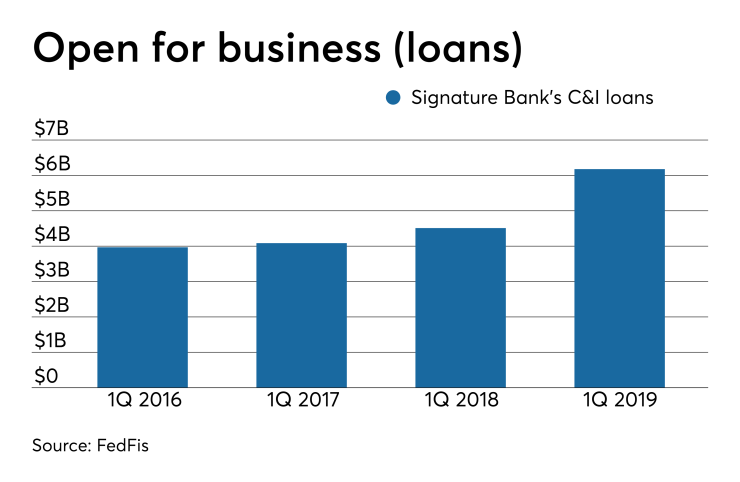

Signature’s multifamily book fell to 33% of total assets at March 31, compared with 36% three years ago. Its C&I loan book climbed to 13% from 11% in the same period. Signature’s move to C&I loans would be more pronounced, but for its recent write-down of the value of most of its

The shift comes as the New York state Legislature this month approved sweeping changes to rent-control laws, which may impact bank lending to apartment-building landlords. Keefe, Bruyette & Woods analysts wrote in a June 12 research note that the new rent-control laws will “meaningfully limit the growth and appreciating value” of multifamily loans.