Some of the biggest banks in the country curtailed financing to fossil fuel companies during the past year, but that didn’t stop the banking industry’s total backing of such firms from rising slightly.

Thirty-three global banks have provided $1.9 trillion to fossil fuel companies over the past three years, according to a report released Wednesday by Rainforest Action Network and backed by 160 activist organizations including BankTrack. This included an overall increase of $9 billion, or 1.4%, from 2017 to 2018, even while banks like Barclays and JPMorgan Chase decreased their financing in this sector by $5 billion.

Still, it marked a significant slowdown from 2016 to 2017, when support for such firms by banks surged by $36.8 billion, or 6%.

The report, Banking on Climate Change 2019, is the 10th of its kind. It calculates lending and underwriting of bonds and share issuances to 1,800 companies in the coal, oil and gas industries. U.S. banks account for 37% of all global fossil fuel financing.

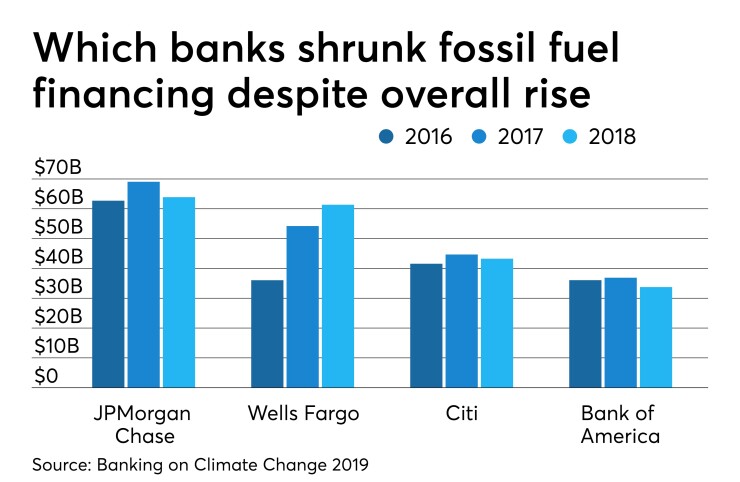

JPMorgan is the largest financier in the field, with $63.9 billion in fossil fuel financing. That was a $5.1 billion drop from 2017 but an increase from $62.7 billion in 2016. Wells Fargo’s financing to fossil fuel companies increased by $7.1 billion year over year to $61.3 billion in 2018.

Citigroup and Bank of America decreased their financing in the sector by $1.4 billion and $3.1 billion, respectively, from 2017 to 2018. Barclays, which has reduced this kind of financing since 2016, also decreased its support by $5.1 billion.

“We’re faced with ever worsening climate change impacts worldwide, and the latest IPCC report provides a stark 2030 deadline for the deep cuts in global CO2 emissions needed to avoid full climate breakdown,” Johan Frijns, director of BankTrack, said in a press release. BankTrack follows the operations and investments of commercial banks.

“Yet banks continue to throw their billions at the fossil fuel industry, while announcing minor policy tweaks here and endorsements of the latest toothless ‘responsible finance’ initiative there," Frijns continued. "One wonders what on earth it will take for banks to finally change course and fully abandon the fossil fuel sector. Campaigners will be demanding exactly this at this year’s upcoming bank AGMs, armed with this report’s shocking new findings.”