- Minnesota

U.S. Bancorp has been hit with a consent order regarding deficiencies in its anti-money laundering compliance program.

November 6 -

The Treasury Department is still struggling to understand whether some businesses are losing access to the banking system because of heightened enforcement of anti-money laundering requirements and concerns about high risk activities, a top official said Wednesday.

November 4 -

A lack of access to financial services, particularly the inability to transfer funds overseas, can prevent lifesaving work from being carried out and has touched the refugee crisis in Europe, where many aid groups are delivering assistance.

November 4

-

The number of startup companies opting out of the State of New York more than a dozen since the financial services department's BitLicense regulation was finalized is troublesome.

November 4

-

There is a time, a place and a customer base for pseudonymous cryptocurrency. For regulated financial institutions, other types of shared ledgers those whose validators are legally accountable for certain terms of service may provide unique utility.

November 3

-

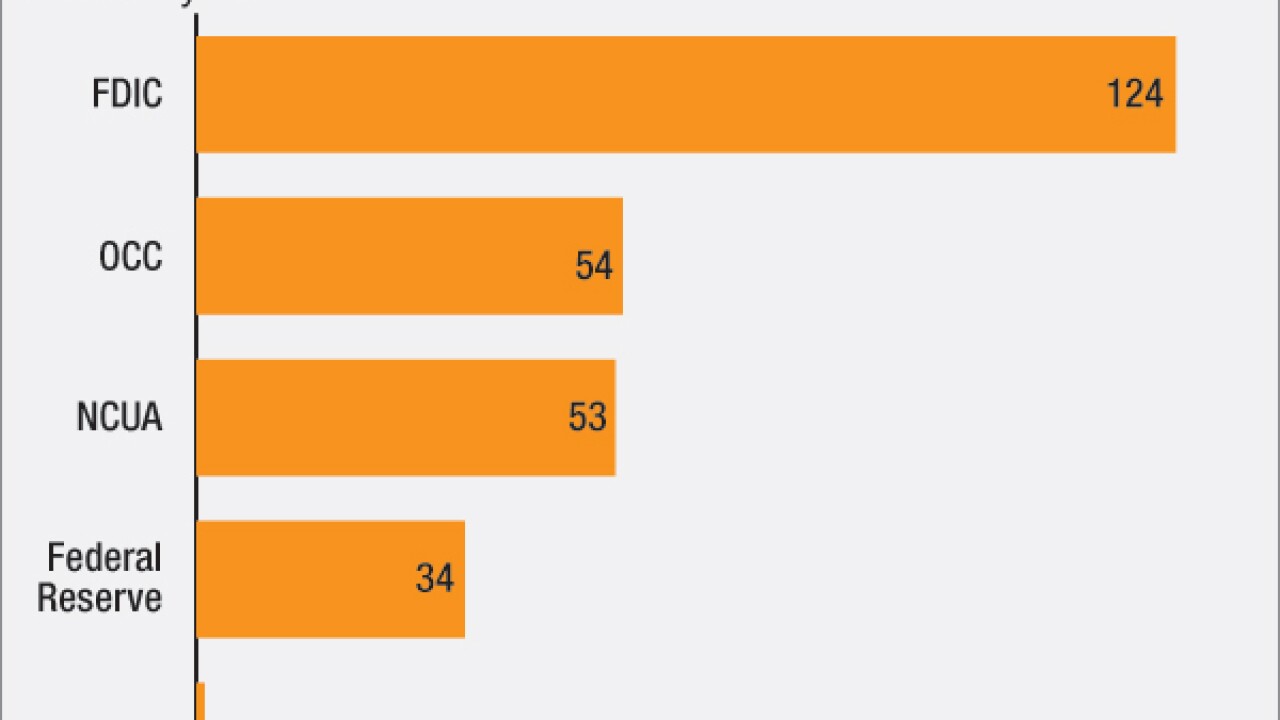

Banking regulators have been coy about whether they approve serving marijuana businesses, but lately one regional Fed bank has taken a strong position against the practice. But there are nearly three dozen Fed-supervised banks serving pot companies one of many seeming inconsistencies in an opaque and confusing regulatory policy.

November 3 -

For "suspicious activity reports" to help combat crime, banks need to be able to disclose reports to their foreign branches and affiliates.

November 2

-

Led by a team of financial services and regulatory veterans and young techies, Privacy.com represents the first mainstream attempt to build a business explicitly around transactional privacy in the era of Edward Snowden and Ashley Madison.

October 27 -

Credit Agricole agreed to pay $787 million to U.S. regulators and enter into a deferred prosecution agreement with the Justice Department to resolve allegations the French bank violated sanctions aimed at Iran and Sudan.

October 20 -

Even if Operation Choke Point officially ended, U.S. regulators have continued to apply the policy of threatening investigations and ruinous fines against banks that service "high-risk" customers in disfavored industries.

October 19

-

BofI Holding in San Diego is poised to end a tumultuous week, after a lawsuit accusing it of lax controls sent investors scurrying.

October 16 -

To identify fintech startups deserving of special recognition this year as part of the FinTech Forward program, a team of American Banker editors, BAI staff and industry members debated the merits of self-nominees and companies we know.

October 12 -

Outside experts have been left wondering what kinds of controls firms that offer daily fantasy sports contests are putting in place to prevent them from becoming money laundering hubs and how careful banks should be when doing business with them.

October 9 -

Swift CEO Gottfried Leibbrandt talks about how the global messaging network is looking to stay relevant to its bank members; the potential and limitations of blockchain technology; and his views on the startups looking to disrupt banking.

October 5 -

The long-delayed approval of the merger of M&T and Hudson City should have been a bright spot in postcrisis M&A, but a small footnote from the Fed quickly reminded bankers that dealmaking will remain a demanding process.

October 1 -

A survey due to be released Wednesday reveals a wish list for anti-money-laundering specialists to help ease their process of assessing customer risk.

September 30 -

One of the top anti-money-laundering regulators warned credit unions Tuesday that many do not appear to be properly following reporting requirements.

September 15 -

The digital currency industry reacted warily to a model framework for regulating such firms released Tuesday by the Conference of State Bank Supervisors, arguing the language is too vague and treats digital assets like normal money.

September 15 -

K2 Intelligence, an adviser on compliance and cybersecurity, has hired a former FBI cryptocurrency expert and a former regulator who worked on New York's digital currency regulations.

August 31 -

A foreign bank that sued the U.S. Treasury's Financial Crimes Enforcement Network won a preliminary injunction suspending an action that would have cut off the bank's access to dollar funding.

August 28